Key Insights

- XRP ledger velocity drop to near zero is signalling the start of a quieter phase after months of volatile on-chain movement.

- XRP ETF inflows hit the $845 million mark, as institutional interest strengthened and spot market outflows ease to calmer levels after earlier spikes.

- Traders monitor the $2.28 resistance level, where a breakout may clear the path toward $2.75 as XRP technical indicators move toward a potential shift.

XRP is entering a seemingly crucial phase. Recent market data shows that the network activity is slowing and trader behavior is shifting as investment inflows rise. These changes are shaping a bullish outlook for the asset as the year winds up.

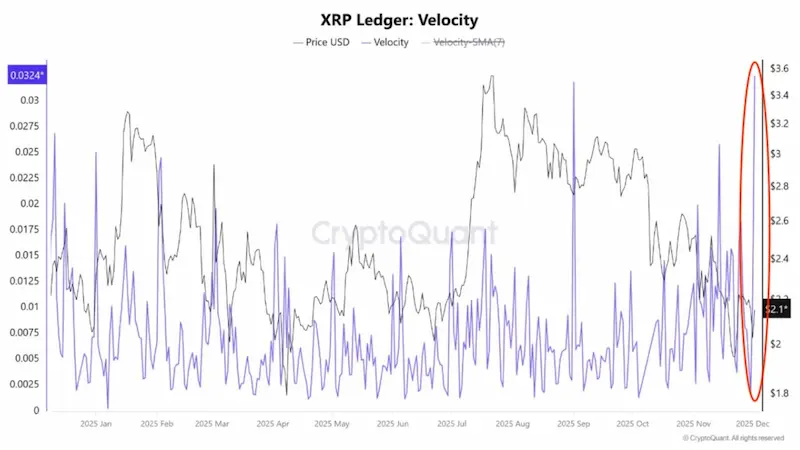

XRP Network Activity Cools as Ledger Velocity Drops

Coin Bureau shared Crypto Quant data showing a sharp drop in XRP Ledger velocity. This measure tracks how often XRP moves between wallets. It stayed volatile for most of 2025, with frequent spikes during major price swings.

XRP velocity shifted alongside price moves and intensified during the strong rally that peaked in late summer. Notably, the drop that followed matched the uneven on-chain activity seen during the pullback.

XRP Ledger / Source: X

XRP Ledger / Source: X

Traders appeared to shift positions quickly with each move. However, the sharp slowdown now signals a calmer market phase, where transfer activity has faded even as the price keeps drifting lower.

This combination reflects a period of reduced participation, with fewer traders moving large amounts of XRP across the network.

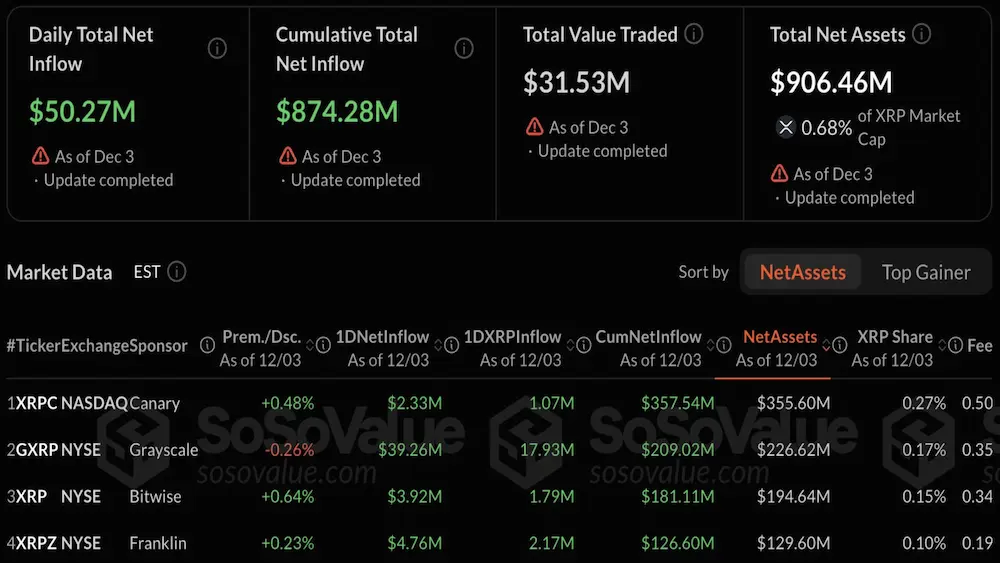

Spot Market Outflows Ease as ETFs See Rising Demand

Market watcher Kamran Asghar reported that XRP spot outflows dropped to $11.7 million on December 4. While outflows continued, the pace was far lighter than the larger spikes earlier in the year.

Liquidity levels held steady offering a setting for short-term price movement. Analyst Asghar shared a multi-year view of XRP’s Spot Taker CVD. The referenced chart is showing aggressive buyer and seller activity intensifying through 2025.

XRP ETF Performance Dashboard / Source: X

XRP ETF Performance Dashboard / Source: X

According to the analysis, the breakout above $1 brought strong demand. Consequently, the demand was followed by volatile swings toward the $3 range. Seller pressure grew more noticeable through the summer and autumn as XRP pulled back from its earlier peak.

During the same period, XRP ETFs attracted $845 million in inflows, moving ahead of Ethereum and Solana. Total institutional demand continued to build, pushing cumulative inflows to $874.28 million.

Grayscale led the day with more than $39 million, while ETF products listed on NYSE and NASDAQ steadily widened access for larger investors.

Key Technical Level at $2.28 as Breakout Opportunity

A developing setup on the 3-day MACD shows the indicator moving toward a possible bullish cross. The lines have moved closer after months of downward movement.

Price structure has formed smaller candles near the $2.17 area, pointing to slower momentum during the pullback. This zone that acted as a demand area during the current consolidation.

A volume increase will confirm the move as the indicator approaches a potential shift. The structure is showing the same conditions seen during earlier phases when XRP prepared for larger moves.

Crypto market analyst Ali ,noted $2.28 as the next major level to watch. This area lines up with the 0.618 Fibonacci retracement, the upper boundary of the descending channel which is a previous supply zone. A break above this resistance could give XRP a path toward $2.75, where the next major barrier sits.