Key Insights:

- Vitalik Buterin’s ETH sale was a small swap of 2961 Ether to minimize market impact.

- The sale of ETH was associated with criticism of EVM chains with slow optimistic bridge withdrawals.

- Butterin noted that, with Ethereum’s base-layer scaling, loosely integrated chains are no longer needed.

Vitalik Buterin’s ETH sale activity drew market attention this week after the Ethereum co-founder sold roughly 2,961 Ether worth about $6.6 million over three days, according to on-chain data. While the sales were modest relative to his total holdings, the timing aligned with renewed debate over scaling models, application-specific chains, and the degree to which new networks are integrated with Ethereum’s base layer.

Vitalik Buterin’s ETH Sale Implemented in CoW.

Blockchain analytics firm Lookonchain reported in a Thursday post on X that the ETH was sold at an average price of approximately $2,228 per token. Ethereum’s native cryptocurrency was trading near $2,130 at the time of writing, down more than 5% over the previous 24 hours, according to CoinMarketCap data.

According to Arkham Intelligence data, the sale of Vitalik Buterin’s ETH was routed via CoW Protocol, a decentralized trading system that aggregates orders and trades them in batches.

Moreover, Arkham notes that this form of execution is usually used to minimize market impact and limit slippage, as opposed to block trades executed in a single transaction.

The routing decision aligns with common practices in on-chain liquidity management and is not a sign of an attempt to exit the market altogether. Buterin remains one of the largest individual holders of Ether, with most of his portfolio still denominated in ETH following the recent sales.

EVM Chain Proliferation Criticism and Bridge Design Criticism.

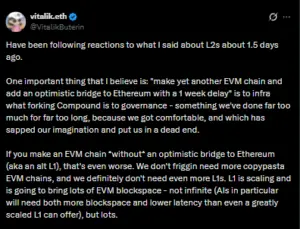

Buterin also posted commentary alongside the observed ETH sales, criticizing the growing number of EVM-compatible chains that use optimistic bridges to connect to Ethereum. He particularly noted the prevalence of week-long withdrawal delays, which undermine the user experience and technical cohesion.

Source: Vitalik Buterin

According to Butterin, the trend resembles earlier phases in the history of decentralized finance, when teams repeatedly forked protocols such as Compound to pursue governance. He indicated that the strategy seemed to be initially fruitful but eventually limited innovation.

In his view, launching additional EVM chains that closely mirror existing architectures has led to repetition rather than meaningful differentiation.

He also stated that creating an EVM chain without an optimistic bridge to Ethereum is “even worse,” adding that the ecosystem does not require additional “copypasta” EVM chains or new layer-1 networks that offer limited technical novelty.

Ethereum Base Layer Capacity and Scaling Outlook

Buterin noted that Ethereum’s base layer is already scaling and is expected to deliver substantially more EVM blockspace over time.

While he acknowledged that blockspace will remain finite, particularly as AI-driven applications demand lower latency and higher throughput, he said Ethereum can still support a broad range of use cases without fragmenting activity across numerous independent layer-1 networks.

Buterin stated that scalability at the base layer is enhanced to minimize loosely connected chains that do not deeply integrate with the system, thereby adding needless complexity.

Invest in New Capabilities and not Cloning.

Instead of copying what had already been implemented, Buterin encouraged developers to work on systems that add new functionality in a truly novel way. He identified privacy-preserving architectures, application-specific execution environments, and ultra-low-latency systems as areas where innovation can meaningfully enhance blockchain capabilities.

He further expressed his concern that the focus of infrastructure development has shifted more towards quick, familiar deployment than towards long-term technical advancement.

Buterin argues that incremental improvements can only maximize existing systems, but that more fundamental structural and design constraints would be resolved.

Allocation of ETH for Long-Term Funding

Last week, Buterin disclosed that he has set aside 16,384 ETH, valued at about $45 million at the time of the announcement, to support privacy-preserving technologies, open hardware, and secure, verifiable software.

He stated that the funds would be deployed gradually over several years as the Ethereum Foundation enters what he described as a period of “mild austerity.”

Buterin added that he is personally assuming responsibilities that might otherwise fall under specialized foundation initiatives. His stated focus is on developing an open, secure, and verifiable technology stack that spans both software and hardware.