Key Insights:

- The USDF stablecoin is undergoing internal Coinbase testing and is not trading or withdrawing.

- Coinbase Custom Stablecoins lets firms issue USDC-collateralized branded tokens.

- Coinbase earned almost $247M in Stablecoins in Q4 as usage grew.

Coinbase has also started backend testing its USDF stablecoin on its exchange, a new milestone in its move to support company-issued, dollar-backed tokens through its Custom Stablecoins platform.

Coinbase Custom Stablecoins Program Enters Operational Testing Phase

The test is linked to Coinbase Custom Stablecoins, a framework introduced in December that allows companies to create branded stablecoins collateralized by Circle’s USDC.

Coinbase stated that the current phase is strictly internal, with no public trading, deposits, or withdrawals enabled, positioning the move as technical validation rather than a market launch.

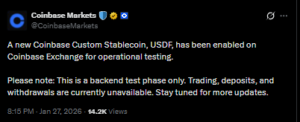

Coinbase disclosed the development in a post on X, stating that “a new Coinbase Custom Stablecoin, USDF, has been enabled on Coinbase Exchange for operational testing,” and clarifying that the process remains limited to backend systems.

Source: Coinbase Market

The company added that broader functionality will follow in later stages. The USDF stablecoin is being developed by crypto infrastructure firm Flipcash and is expected to launch publicly in early 2026, according to people familiar with the project.

Coinbase Custom Stablecoins Framework Expands

The test is directly tied to Coinbase Custom Stablecoins, a program that lets businesses create proprietary digital dollars collateralized by USDC.

The design enables member firms to exchange funds across Coinbase-supported blockchains, manage liquidity within their own systems, and earn rewards based on token activity.

Coinbase created the framework to accommodate enterprise applications where the banking rails are often slow or even expensive.

Applications identified as possible during the testing phase include payroll processing, business-to-business settlements, cross-border transfers, and internal liquidity management.

These functions are embedded in the infrastructure layer rather than consumer-facing products, reflecting a focus on operational finance rather than retail trading.

Flipcash is not the only participant in the Coinbase Custom Stablecoins initiative. Coinbase is also working with Solana-based self-custody wallet Solflare and decentralized finance platform R2 to develop branded stablecoin products using the same framework.

Additionally, the company has been actively participating in U.S. policy discussions, urging lawmakers to ensure that stablecoin reward structures are not restricted by upcoming crypto market structure legislation.

The market statistics indicate the size of the industry. Bloomberg data shows that the value of stablecoin transactions worldwide reached a record of more than $ 33 trillion in 2025.

The USDC recorded the best transaction volume of $18.3 trillion, with Tether USDT recording the best transaction volume of $13.3 trillion and market capitalization leadership of $187 billion.

Market Environment and Financial Results

Coinbase’s stablecoin push aligns with the company’s diversification beyond digital assets. The exchange also recently launched copper and platinum futures trading, adding to its already existing derivatives portfolio, which consists of gold and silver contracts.

However, Coinbase stocks fell during the trading session. The share fell 1.24 percent intra-day to its lowest point in May last year at $208 and ended at $210. Google Finance shows that after-hours trading was very low.

Coinbase shares have fallen over 10% year to date, about 46% since reaching an all-time high of $398 in July, and 9.9% in the last month.

Moreover, at the time of writing, Bitcoin was fairly stable at over $88,000, according to CoinGecko data, and a quarterly report by Coinbase Institutional and Glassnode showed that excess leverage had been eliminated from the system in the fourth quarter.

Implementation of Stablecoin in Platforms

The trend of expansive adoption is not limited to the Coinbase ecosystem. The adoption of stablecoins on the fintech platform Revolut grew faster in 2025, with payments projected to have increased 156% annually to about $10.5 billion, reflecting the broader role digital dollars have assumed in everyday payment processes.

The USDF stablecoin, in this regard, represents another piece of data in the shift toward enterprise-issued and enterprise-supported digital currencies.

The testing phase of Coinbase introduces the token into a managed, collateralized mechanism associated with USDF, helping the enterprise achieve its vision of building enterprise-grade stablecoin rails rather than consumer-centered tokenization.