Key Insights

- Crypto market volatility surged after Trump tariffs and EU retaliation news reshaped investor positions worldwide.

- Legal uncertainty over Trump tariffs by the Supreme Court could alter market pricing and risk dynamics.

- Capital shifted from cryptocurrencies to gold as traders responded to macroeconomic stress from trade policy.

Trump tariffs are creating crypto market volatility as new trade measures and an upcoming Supreme Court ruling converge. Digital assets and traditional markets could experience sudden swings, with investors bracing for rapid changes in prices across stocks, currencies, and cryptocurrencies.

How Will New Tariffs Affect Markets?

Crypto Rover highlighted that Trump tariffs could shake the entire market next week. A fresh 10% tariff on European goods, announced over the weekend, marks the first major escalation in months. Could this move trigger one of the most volatile weeks in financial history?

According to historical patterns, past tariff shocks caused steep drops in both U.S. equities and crypto.

When the S&P 500 fell on October 10, Bitcoin experienced its largest crash in five years.

Traders note that Trump tariffs could similarly influence portfolios, with both digital and traditional assets facing heavy pressure.

What Could the Supreme Court Ruling Mean for Traders?

As the Supreme Court considers the legality of the tariffs imposed by President Trump, traders are closely monitoring the outcome of the decision.

Crypto Rover has cautioned that if the court rules against the tariffs, it could lead to a loss of confidence in the stability of policy and could result in massive sell-offs that could be violent.

However, if the court rules in favor of the administration, traders will have to account for the impact of those tariffs on the overall economy. How should traders prepare for both possibilities?

This illustrates how much ambiguity the crypto space is dealing with when it comes to volatile markets.

If traders are mispriced on those risks, the leverage they have taken out will be unwound within a short timeframe, thus exacerbating the disruption across the entire market.

Therefore, tracking what happens legally with the tariffs is just as important as tracking tariff announcements.

Could Geopolitical Tensions Push Crypto Lower?

Wise Advice Sumit reported that the recent price dump in Bitcoin and other cryptocurrencies was not random.

The EU is preparing $100 billion in retaliation against the U.S., prompted by Trump tariffs linked to Greenland.

Futures opened red, wiping $546 million in long positions and erasing $130 billion from total crypto market capitalization within 90 minutes. Could further geopolitical tension push crypto markets even lower?

If the EU negotiates alternative trade deals with countries also under U.S. sanctions, the U.S. risks losing access to key global trade routes.

Such scenarios put downward pressure on the dollar, investor confidence, and risk assets, reinforcing the connection between trade policies and crypto market volatility.

Source: X

Source: X

Why Are Investors Moving From Crypto to Gold?

According to Jacob King, gold has risen in value to new heights, while Bitcoin’s value has dropped dramatically.

As they are moving in opposite directions, more investors view cryptocurrencies as speculative investments and turn to gold for protection against inflation, trade wars, and global uncertainty.

Will capital continue to leave the crypto market for established, traditional safe havens?

This pattern indicates that crypto market volatility is influenced by macroeconomic stress and investor psychology.

As Trump tariffs raise concerns about growth and trade, some investors are reallocating their portfolios toward assets that historically preserve value, reducing exposure to digital currencies during uncertainty.

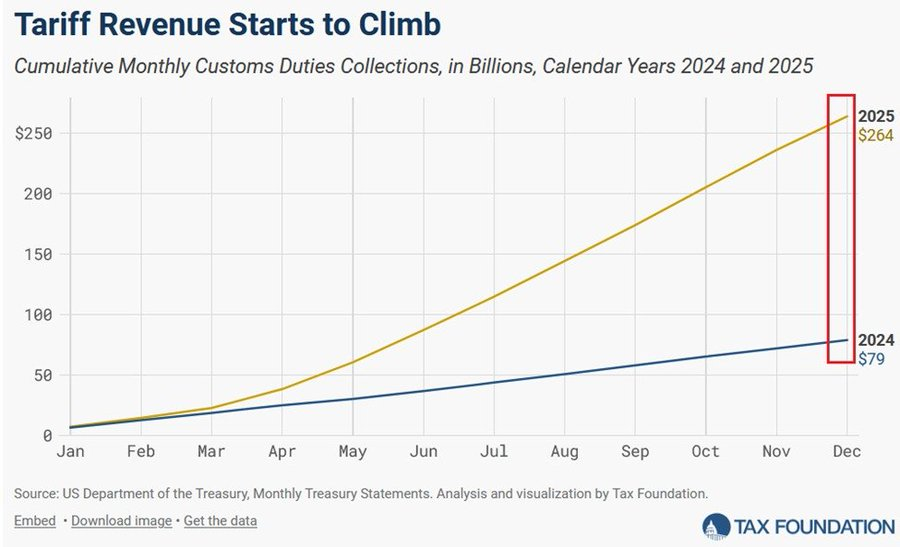

How Does Tariff Revenue Growth Influence Markets?

According to the Kobeissi Letter, U.S. tariff revenue increased dramatically in 2025, up 234% from the previous year and reaching $264 billion.

As an example of this spike, in December alone, tariffs accounted for $28 billion in revenue, averaging $30 billion per month in the second half of 2025.

Overall, this spike represents a continuation of the effects of Trump tariffs on American economic activity. However, will continued collections of tariffs lead to increased levels of volatility for the stock market?

A boost in tariff revenues creates a new source of revenue for the government; however, they also indicate that the country is implementing additional restrictions on trade, which may limit economic growth for decades to come.

Traders and crypto investors will be closely watching these developments as high levels of tariffs could continue to affect how and where capital moves throughout both traditional and digital asset markets.

How Does Leverage Amplify Crypto Volatility?

Stockifi describes the relationship between large leveraged positions in cryptocurrency and macro events, such as Trump tariffs.

When policy changes occur, many leveraged traders liquidate their positions rapidly, just as we saw with BTC $546m on the recent liquidation of Bitcoin leveraged positions.

Will we see a similar event after the Supreme Court ruling?

These types of events illustrate how macroeconomic data (like tariffs) impacts cryptocurrency volatility as well as trader behaviour.

Crypto market participant reactions to trade shocks can cause significant spikes in crypto volatility and pose considerable risk or opportunity depending on the timing and awareness of ongoing legal and economic developments.

Final Thoughts

Market volatility in Crypto related to Trump tariffs and further layers of uncertainty from legal rulings and retaliation from the European Union (EU). Traders currently have their eyes on leveraged positions, capital rotations and macro developments.

The crypto market will be under great stress, whether it shows a rapid recovery or continues its volatility, showing resilience. Investors should remain vigilant, as potential changes in regulations or geopolitical events may impact not only their digital investment but also traditional financial investments.