Key Insights

- Bitcoin trading volume expanded steadily and structural support has held indicating that market participation is pushing the asset towards key resistance levels.

- Ethereum’s continued whale accumulation and volume increase reinforced sustained bulls look to push past current price zones and move upward this week.

- Solana, XRP, and HYPE led the altcoins in market activity and engagement across the high-liquidity narrative-driven assets.

Trading Volume Surge has continued to shape market sentiment as major cryptocurrencies record sharp increases in activity and steady price advances. The broader market moved carefully at the start of the week, yet volume trends suggested strong participation across both institutional and retail traders.

Bitcoin Holds Structural Support as Trading Volume Expands

The Coin Bureau reported that Bitcoin posted a daily gain with 24-hour trading volume jumping more than 100 percent. This move brought a rise in long-side leverage even though funding levels remained stable.

Market participants are keenly monitoring the resistance zone because a decisive break here could push price toward the upper red band.At the same time, traders focused on the green support range, which continued to act as the main structural level.

https://x.com/coinbureau/status/1997973176010117533?s=20

As long as this zone held, the broader trend remained orderly. However, any failure at this point could introduce deeper bearish pressure. Analysts Ted noted that there is a CME gap between $89,400 and $89,800. Often this gap tends to be filled within the same week.

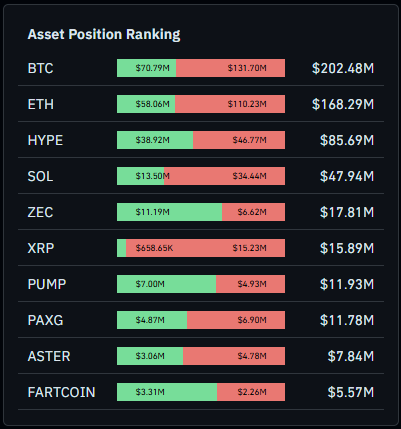

Open interest data placed Bitcoin’s appetite for exposure at more than $202 million. Such a long positioning suggested steady confidence. Consequently, short positions continued to serve as active hedging strategies across the volatile sessions.

Traders Positioning Per Asset / Source: X

Ethereum Trading Volume Gains Momentum as Whales Accumulate

Ethereum followed with a strong rise in daily activity and its 24-hour volume surged more than 112 percent. This massive move is mirroring renewed interest in the asset. Support at the $3,000 level held firmly, allowing price to move higher.

Large entities led by BlackRock and Bitmine are accumulating ETH, and reinforcing market attention. BlackRock transferred more than $78 million worth of ETH to Coinbase. Traders viewed the $3,300–$3,400 range as the next test.

A break above this zone could open room toward $3,700–$3,800, while failure might prompt a return to recent support. Whale-driven long positions continued to influence directional movement.

ETH open interest reached about $168 million. Market participants are tilted toward long exposure, supported by steady engagement within staking and Layer-2 ecosystems. The asset retained its role as a high-beta companion to Bitcoin during strong market phases.

Altcoins Record Strong Activity in Expanding Market

In addition, Solana saw its trading volume rise by more than 129 percent. Its market depth remained stable allowing the price to move steadily higher. Heightened activity in its ecosystem continues to draw traders, and open interest is around $48 million with both long and short positions active.

On the other hand XRP also saw a significant increase in trading volume. XRP’s established community stayed active during these market changes. Open interest is closing in on $16 million and is signalling steady engagement from both long and short traders.

HYPE had the highest percentage increase in volume among the tracked assets. Its open interest reached over $85 million due to its strong trading activity. DOGE and BNB also recorded notably high gains. This surge was supported by the consistent market participation and balanced trading conditions.