Key Insights:

- Tether 2025 experienced a reduction in profits despite its growth in assets and reserves.

- The treasury exposure increased to all time highs and sustained annual profits.

- The USDT supply increased drastically due to the demand in the non-banking sphere.

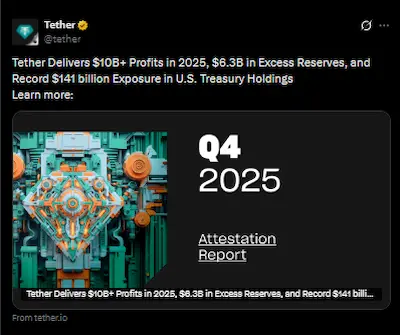

Tether 2025 profits declined year over year even as the issuer of USDt reported record exposure to U.S. Treasury securities, according to a financial report prepared by accounting firm BDO and published on Friday. The report shows that Tether generated more than $10 billion in net profits in 2025, down about 23% from the $13 billion reported in 2024, while simultaneously expanding its balance sheet and strengthening reserve composition.

Tether Closes 2025 with Assets of $192.9B and Excess Reserves of $6.3B.

In the report prepared by BDO, Tether reported that it ended up with total assets of $192,877,729,144 at the end of the financial year ending on December 31, 2025.

Source: Tether

The total liabilities were 186,539,895,593, 593, which created excess reserves at an amount of about 6.3 billion. The liabilities reported, most of them, i.e., USDt issued, and exceeding 186,450,610,920, were connected with digital tokens.

According to the assurance report, assets exceeded liabilities by more than $6.3 billion at year-end, despite the decline in annual net income. While Tether 2025 profits were lower than the prior year, the company ended the year with a larger balance sheet and higher reserve levels.

Treasury Exposure Reaches New High

A central feature of Tether’s 2025 financial profile was its increased exposure to U.S. Treasuries.

The report shows that direct U.S. Treasury holdings exceeded $122 billion by the end of the year, which the company described as the highest level ever recorded. Including indirect exposure, Tether reported total treasury exposure of approximately $141 billion.

According to management, the growing allocation to Treasuries reflects a shift toward highly liquid, low-risk assets.

Treasury exposure has also been cited as one of the biggest contributors to profits, and it contributed a major share of the over $10 billion net profits reported in the year. Although total profit was less than it was in 2024, Tether’s 2025 profits were one of the highest recorded by a privately-traded company within the digital asset industry.

USDT Accommodation and Network Operation

According to the company, most of this issuance had taken place on the Tron blockchain, as over $30 billion of new tokens were issued in the second half of the year. The supply growth was accompanied by a long-term demand for dollar-bound digital tokens globally.

Chief executive Paolo Ardoino stated that demand for USDt continued to be driven by users seeking access to U.S. dollars outside traditional banking systems, particularly in regions where financial infrastructure is limited or slow.

According to the report, USDt remained embedded in global payments, trading activity, and savings use cases throughout the year.

According to CoinMarketCap data, USDT was the largest cryptocurrency by market value, placing it in third behind Bitcoin and Ether, at the end of the year, with a market capitalization of about $185.5 billion.

The market players were still tracking the profits and reserve releases of Tether 2025 with much attention, since the USDT is a robust and efficient currency in the crypto market as a liquidity and settlement tool.

Investment Portfolio and Sector Exposure

In addition to the issuance of stablecoins and treasury deposits, Tether also declared that it was still actively growing its own investment portfolio.

According to management, the portfolio exceeded $20 billion in value by the end of 2025. Investments were spread across multiple sectors, including artificial intelligence, energy, media, fintech, precious metals, agriculture, crypto treasury companies, and land.

In addition to the issuance of stablecoins and treasury deposits, Tether also declared that it was still actively growing its own investment portfolio.

Such investments were made under the Tether Global Investment Fund and were viewed as a diversification move as the stablecoin issuance market became more competitive.

According to Ardoino, the performance of the company in 2025 was determined by the structure of its growth and not its size.

The exposure of gold and precious metals

The BDO report also reported on the continued exposure of Tether to precious metals. By September 2025, the firm had about $12 billion in gold exposure in support of its XAUt stablecoin.

This included more than 520,000 troy ounces of gold held specifically for XAUt.

Moreover, Tether possessed an extended gold stock worth about 130 metric tons, which is estimatebout $22 billion in terms of the current market value.

The report did not indicate changes to gold holdings later in the year, but confirmed that precious metals remained part of the company’s diversified reserve structure alongside Treasuries and other assets.

Separately, Tether confirmed the launch of USAT, a federally regulated, dollar-backed stablecoin designed for the U.S. market under the GENIUS Act framework.

The token is issued by the Anchorage Digital Bank and is an indication of the entry of Tether into the new federal regime of stablecoins in the United States.