Key Insights:

- Bitcoin dropped 22 percent, as the strategy’s net loss reached $12.4 billion in Q4 2025.

- The strategy reported a net loss of 17.4 billion due to an unrealized loss on Bitcoin under fair value.

- The net loss from strategies exceeded the 1.9% revenue growth, and cash and debt ratios remained constant.

Strategy net loss dominated the company’s fourth-quarter 2025 earnings after a sharp decline in Bitcoin prices pushed the firm deep into the red, underscoring how market volatility continues to shape the Bitcoin-focused company’s financial results.

Strategy Net Loss Driven by Digital Asset Revaluation

Strategy reported a net loss of $12.4 billion for the quarter ended Dec. 31, primarily reflecting the impact of Bitcoin’s 22% drop over the period. Losses were announced after Bitcoin declined 22% in the quarter, erasing earlier-year profits and putting continued strain on the firm’s balance sheet.

Although the loss is significant, Strategy noted a low revenue increase and presented liquidity and debt ratios indicating financial flexibility within the next few years.

Moreover, the Strategy net loss of $12.4 billion compared sharply with the $670.8 million loss reported in the same quarter a year earlier. On a per-share basis, the company reported a loss of $42.93 per diluted common share.

Source: Strategy

Strategy attributed the majority of the quarterly loss to an unrealized $17.4 billion decline in the fair value of its digital asset holdings, recorded under fair value accounting standards.

By the end of the quarter, the price had dropped below $88,500. Bitcoin has since declined further, falling to $64,500 so far this year, placing it below Strategy’s average acquisition cost of $76,052 per Bitcoin.

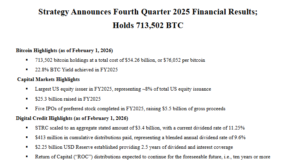

As of the end of the quarter, Strategy held 713,502 Bitcoin, acquired at a total cost of $54.26 billion. With Bitcoin trading at lower levels during the quarter’s close and into early 2026, the holdings were valued at $45.8 billion, resulting in an unrealized loss of nearly $8.50 billion.

Revenue Growth Offsets Losses Only Partially

Despite the headline Strategy net loss, the company reported revenue growth in the fourth quarter. Total revenues increased 1.9% year over year to $123.0 million.

Strategy stated that the increase was driven in part by performance in its business intelligence segment, which continues to generate recurring revenue independent of Bitcoin price movements.

However, the revenue gains were insufficient to offset the scale of losses from digital asset revaluation. The company has also recorded an operating loss of $17.4 billion, which was also the same unrealized loss accrued on its Bitcoin portfolio.

Phong Le, chief executive officer, reassured investors during the earnings call that the company is not experiencing liquidity stress and does not see itself compelled to sell its Bitcoin holdings to satisfy its financial commitments. Le also noted that the enterprise value of Strategy is still higher than the market value of its Bitcoin reserves.

Market Reaction and Stock Performance

The earnings release triggered a sharp market response. The strategy shares fell by 17% on Thursday, one of the largest single-day declines in years, to close at $107, a two-year low.

The data provided by Google Finance indicated that shares traded between an intraday high of $122 and a low of $104.16 during the trading session.

The volume of trading was 56 million shares, compared with the stock’s average volume of 21 million shares. After market hours, the stock declined an additional 0.97% to $105.95.

Strategy shares (MSTR) are now down 31.92% year to date and 68.22% over the past year, reflecting the broader crypto market downturn.

Additionally, Strategy’s enterprise value fell 12.82% to $49.95 billion following the sell-off. Canaccord Genuity maintained its buy rating on the stock but sharply reduced its price target, cutting it from $474 to $185 per share in its latest forecast.

Balance Sheet Position and Liquidity

While the Strategy net loss highlighted the financial impact of Bitcoin’s decline, the company reported measures aimed at strengthening its liquidity position. Strategy increased its cash holdings to $2.25 billion during the fourth quarter.

The company said this level of cash covers approximately 30 months of dividend payouts. Strategy also reported that it has no major debt maturities until 2027.

Phong Le, the chief executive officer, responded that there was nothing to fear in the immediate future about Strategy’s financial position or its bitcoin strategy during an investor call on earnings.

He noted that the company’s enterprise value remains above the value of its Bitcoin reserves and said its $8.2 billion in convertible debt represents about 13% net leverage.