Key Insights

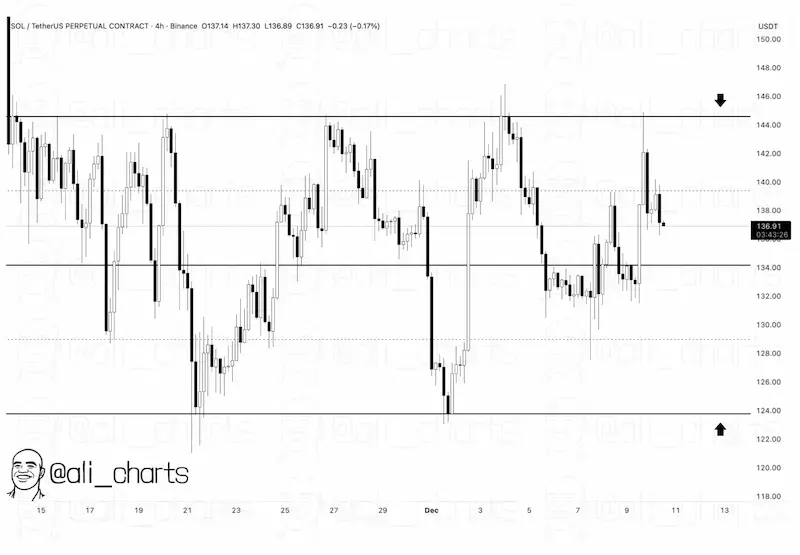

- Solana $SOL has consistently tested resistance near $145 as support around $124–125 triggered sharp recoveries within the defined trading range.

- Elliott Wave analysis suggests that Solana $SOL may form a final low before the start of its renewed momentum on the price patterns.

- Daily volume of $3.93 billion confirms the ongoing market dominance, which is supported by high throughput, low fees, and ecosystem adoption growth.

Solana $SOL trades at $136.06, with a 24-hour volume of $6.97 billion. The price fell 2.9% today and dropped 3.5% over the past week. Market activity remains strong as SOL moves within key support and resistance levels. Traders are closely watching $124 support and $145 resistance for possible breakout opportunities.

Solana $SOL Consolidates Within Critical Price Zones

Solana’s coin $SOL has repeatedly tested its resistance near $145, but has faced strong rejections there each time. Heavy profit-taking appeared evident due to the liquidity pockets above the previous highs attracting stop orders.

Charts have marked these as key zones for traders entry. Support is strong around $124–125 and has consistently defended the market and prompted sharp recoveries. V-shaped bounces from this point demonstrates a robust demand at lower levels.

SOLUSDT 4Hour Chart / Source: X

These movements happened as buyers responded to temporary liquidity sweeps. Therefore these movements will help define the horizontal range that traders are currently monitoring.

Notably, within this structure, the mid-range near $134 operates as a pivot. Price failed to break $140–142 and has since struggled to break resistance. This move is reinforcing a mildly bearish tilt which could dominate until a sustained breakout occurs. In the meantime, traders remain in a cautious state as they evaluate these levels.

Elliott Wave Analysis Shows Potential Solana $SOL Downside

A separate market analysis remarked that the asset may face further declines before the start of a durable reversal. The Elliott Wave framework suggests a possible final low between $81 and $90.

The analysts compared this move with patterns seen in Bitcoin corrections. In addition, recent recoveries have not displayed any impulsive characteristics, and this implies that a deeper dip remains in the bigger picture.

Solana SOL 1Week Price Chart / Source: X

Early rebound attempts showed limited conviction which are leaving room for continued downside pressure before buyers fully reasserts them self. The white scenario analysis suggests a B-wave that could finish at current support levels.

If this comes true, bulls may attempt to revisit previous highs. The lack of impulsive structure has continued to maintain a cautious outlook for traders that are watching for entry points in the near-term price moves.

Market Capitalization and Volume Dynamics

Solana $SOL is boasting a $3.93 billion daily volume. This massive volume has helped it surpass other similar ecosystems. Its week-long market cap view shows an initial decline near $73–74B, followed by sideways consolidation then a surge toward $81B.

The session then ended with an immediate recovery reflecting the presence of a strong underlying demand and growing inflows. Such sudden vertical pushes often correspond with technical triggers and renewed investor interest.

Therefore , the Mid-week consolidation suggests that market participants are attentive to catalysts influencing momentum. Furthermore, technological advantages and ecosystem growth still underpin market activity.

This is because of high throughput, low fees, and increasing adoption in DeFi platforms and consumer applications that support robust trading volume. Retail and developer engagement continues to expand, reinforcing Solana’s central role in the market.

All these factors and the much anticipated FOMC rate cuts meeting on 10 December 2025 could influence movement in the next trading sessions.