Key Insights

- Solana integrates with X, enabling trading, tipping, NFTs, and DeFi directly on a 600 million-user platform.

- SOL price holds above $139 after an intraday breakout, reaching $143.55 while maintaining bullish momentum and support.

- Spot ETFs for Solana see strong inflows, with Bitwise and Fidelity funds adding over $33 million combined.

By integrating with X, Solana now offers the ability to trade, tips, create NFTs, and use DeFi functions directly from your account. As a result of this integration, 600 million users will now have access to a fully operational crypto ecosystem. In addition, this step expands the capabilities of X to operationalize many of the blockchain’s benefits.

X Integration and Smart Cashtags

As stated by CryptosRus, the integration will allow posts to have buttons embedded in them that will enable users to initiate operations about tokens, NFTs, and DeFi directly from their social feeds; moreover, through browser wallet extensions, users will convert static links into interactive transaction windows.

Solana confirmed through an official tweet that, beyond the offering integration, X will also be launching Smart Cashtags.

Through Smart Cashtags, users will be able to post their tokens, view charts, and see related news without ever leaving the application.

Therefore, the fusion of these two features effectively takes the social aspects found in Web2 and merges them with the technology found within Web3.

Solana News Today: Price and Market Behavior

According to data from Cointelegraph, Solana is currently trading near $139 as it continues to face resistance, with the number of weekly wallets created dropping from 30.2 million in November 2024 down to 7.3 million.

SOL’s price movement is highly aligned with open interest. After the market saw periods of low participation, there would often be large price increases; this resulted in a series of ascending price movements.

The open interest has historically peaked towards the end of these rallies, typically preceding a large correction. At this time, after experiencing a large number of liquidations, the current price level has stabilized.

The market appears to be waiting for the next catalyst to determine which future direction SOL will take. Price recoveries will be driven by steady and managed growth in leverage, rather than cyclical bursts of speculative trading.

Source: X

Source: X

Solana News Today: Intraday Price Movements

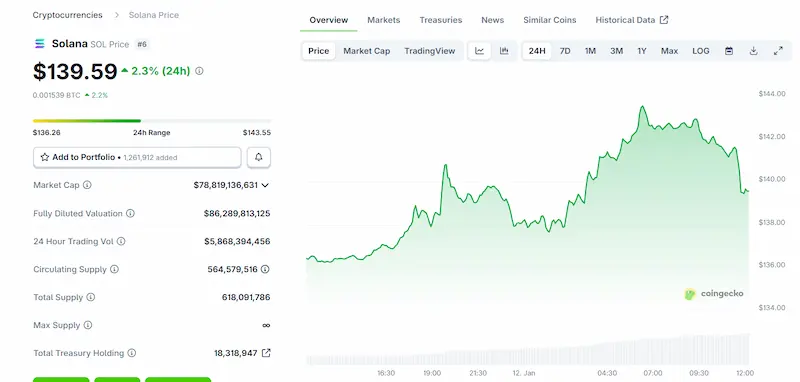

SOL (Solana) did an uptrend of 2.3% according to CoinGecko’s 24 Hour Chart, with a last recorded value of $139.59 for the day of trading.

A 24 Hour Candle Chart is a snapshot of the most recent 24 hours of trading activity. The highest price for SOL during the trading session was $143.55, and the lowest was approximately $136.26.

As the price continued to rise, the volume of traded SOL increased, indicating there was continued interest and strong buying from investors.

The current weakest areas of support are found near the $139 level, while the strongest area of resistance is at $143.55.

Additionally, when there has been a pullback from the highs back down to $139, the pullbacks have been relatively small, which suggests to me that this is a controlled price correction and not a major price drop.

Based on the analysis, if we continue to see high buying volume come into the SOL market, I expect the price to retest the $145 area again soon.

Source: Coingecko

Source: Coingecko

Solana Spot ETFs and Investment Activity

According to Binance, Solana spot ETFs demonstrate a very significant increase in inflow. Last week alone, the Bitwise Solana Spot ETF realized an increase of $22.22 million in net inflow, increasing its net asset total historically to $648 million.

Fidelity’s SOL ETF saw combined inflows of $11 million last week, increasing historical inflows to $131 million. The total net asset value of both SOL spot ETFs is now $1.09 billion. i.e.1.43% of the market value of Bitcoin.

Analysts state that these inflow numbers represent an increasingly strong manifestation of institutional interest toward Solana and may provide a very stable platform for future SOL market activity.

Today, multiple sources indicate that Solana has yet to capitalize on the rapid adoption of crypto functionality in relation to social platforms, and is experiencing an increase in intraday trading prices, and the continued development of institutional investment strategies toward the SOL market.

Users now have direct access to trading, DeFi, and NFTs on X, and the overall continued inflow of investment in both price and ETF products represents a continuing interest and confidence within the market for SOL.