Key Insights

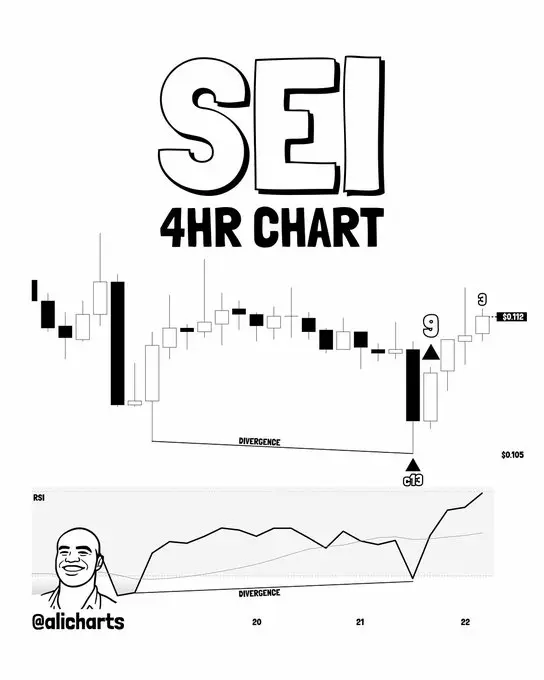

- SEI has created a higher low and higher high on the 4H chart, affirming a positive structure change after weeks in a phase of consolidation.

- Momentum indicators turned green as RSI divergence and a bullish MACD crossover encouraged price stabilization above the resistance level at 0.112.

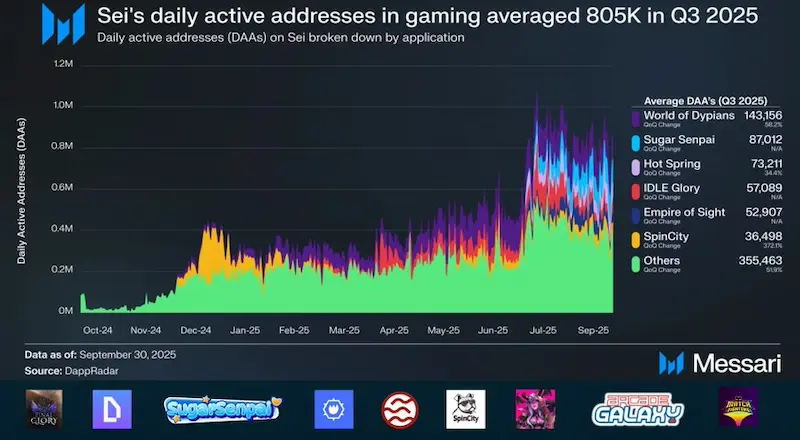

- Average Sei Network Gaming usage indicated steady growth in on-chain activity of various gaming platforms within the ecosystem.

SEI Price Shows Early Reversal as Technical Momentum and Gaming Activity Strengthen

After experiencing a long decline, SEI is beginning to demonstrate early signs of recovery with increasing signs of technical momentum and consistent on-chain gaming activity, and is supporting the creation of short-term expectations for SEI value based on the most recent patterns of activity and the utilization of SEI.

Technical Reversal Signals on the 4H Chart

Based on a recent analysis by Ali Charts, the 4HR timeframe for SEI shows signs of a possible long-term trend reversal. There have been multiple bullish TD buy signals and a divergence in the RSI, which indicates that the sellers are getting exhausted.

The price action has been moving upward recently, beginning around the 0.105 area, following a long period of consolidation. Subsequently, the recent very positive candlestick, which broke the previous downtrend, caused the SEI to create higher lows and also slightly higher highs.

This new upward price action places the 0.112 area in development as the most likely breakout zone. Any trades that take place above the 0.112 level will confirm that the next resumption of upward price movement is likely to stabilise or gradually continue moving higher.

Additionally, the bullish RSI divergences develop above the previous low as the current price action saw a small rebound off the previous low. Moreover, the price has rebounded with such a strong increase that the previous supply of sellers appears to have been depleted before this price increase.

Source: alicharts

Momentum Indicators Support Short-Term Price Stability

Currently, SEI is trading close to the value of 0.114 on the Binance market, having fallen from the 0.145 area. It appears that the past candles were of the type that moved sideways to slightly higher.

Bollinger Bands reveal that the price is bouncing from the lower edge at approximately 0.108 and reclaiming the 20-period average. The tightening of bands may signal that volatile periods are about to end.

The MACD indicators further accent the momentum change, where a bullish crossover has occurred, in addition to the positive histogram.

Important support rests between 0.108 and 0.110, while resistance is at about 0.115. Market performance at these levelsstill catalyzes short-term expectations of SEI prices.

Source; TradingView

Gaming Activity Provides Fundamental Support

In addition to charts, on-chain data also serves as context for how SEI’s price might perform. An example is an AltCryptoGems tweet, which linked to a Messari report highlighting that gaming activity on the Sei Network has been strong.

According to DappRadar, on average, more than 805,000 gaming addresses accessed Sei Network daily in the 3rd quarter of 2025. The users are not mere speculative traders. This is the actual use of the network.

https://x.com/AltCryptoGems/status/2003119591992558003?s=20

The rate of growth surged towards the end of 2024 and through the middle of 2025. This is because the daily gaming addresses kept reaching a peak of nearly 1 million. This showed that, though huge spikes had occurred, the volumes were still significantly high compared to the past.

The ecosystem is highly diversified, with games creating a considerable amount of activity in terms of numbers. World of Dypians and SpinCity demonstrated strong levels of quarterly growth, thus offering a diversified set of games in their business focus, instead of fully depending on one particular title.

Source: X

SEI Price Prediction Framed by Structure and Usage

SEI price direction could remain bullish with continued support above 0.112, which could lead to the continuation of consolidation and should allow for gains in price towards 0.120.

If buyers remain active at 0.108, a short-term retracement back to this low would not likely disrupt any potential for continued advances, as long as buyers maintain the 0.108 range. A sustained break below 0.105 would weaken any potential for further price gains in the near term.

Technical recovery attempts are supported by high levels of daily gaming activity, engaging users in games. Therefore, there is a strong demand for transactions on the blockchain network.

If momentum remains positive and adoption trends continue to build, SEI price action will likely build a solid foundation. Market participants continue to monitor volume and structure to provide confirmation of price action.

Final Thoughts

The current SEI price forecasts are the result of some positive developments to stabilize prices and the ongoing development of the network. The current bullish signals indicate stabilization in the very near future, while the ongoing gaming activity indicates strong underlying demand.

The SEI price is dependent on confirmation; however, the correlation between networks and user growth places SEI in a positive position for near-term price evaluations.