Key Insights

- Pump.fun remakes creator fees following a review discovery that incentives were biased towards token launches rather than token trading.

- Superior Tools allow creators to distribute fees and retain claims at their disposal.

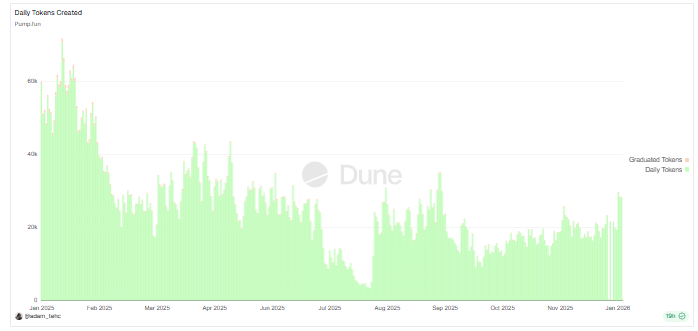

- The weekly volume was $6.6 billion, and the graduation rates remained less than 1%.

Pump.fun Overhauls Creator Fee System After Incentive Review

Pump.fun is restructuring its creator fee framework following an internal review that concluded the existing model was distorting incentives across the Solana-based memecoin launchpad.

The changes were disclosed by co-founder Alon Cohen, who said the platform’s Dynamic Fees V1 system increased activity but failed to support durable market behavior.

The announcement outlines structural updates aimed at rebalancing how fees are distributed and used following token launches, while keeping the platform’s broader mechanics unchanged.

https://twitter.com/a1lon9/status/2009677442064024063

According to Cohen, the earlier fee model prioritized token creation over trading activity. He said this outcome emerged despite initial gains in usage metrics after Dynamic Fees V1 was introduced several months ago.

While the system encouraged a higher volume of new tokens, it reduced incentives tied to trading, which the platform identifies as the primary source of liquidity and transaction volume.

Early Activity Gains Exposed Structural Limits

Cohen said the initial rollout of Dynamic Fees V1 coincided with a rapid increase in creator participation. New deployers launched tokens and livestreamed activity, contributing to what he described as some of the strongest on-chain conditions recorded by Pump.fun in 2025.

Data shared alongside his statements showed that bonding curve volumes more than doubled during this early phase.

However, the increase proved temporary. As activity normalized, the platform identified weaknesses in how creator fees functioned in practice.

Cohen said the system made token creation a comparatively low-risk activity while leaving trading exposed to downside risk without proportional incentives.

He described this imbalance as problematic because traders supply liquidity and drive volume, both of which are central to the platform’s operation.

The review also found that the fee structure did not significantly alter the behavior of the average memecoin deployer.

While activity increased, the mechanism increasingly rewarded the act of launching a token rather than sustaining market engagement after launch.

Pump. fun Introduces Fee-Sharing and Ownership Controls

In response, Pump.fun announced the first phase of changes, focusing on creator fee sharing and administrative flexibility.

Within the new framework, creators and community takeover (CTO) administrators will have the opportunity to distribute designated percentages of the creator fee to up to 10 wallets after the token launch.

The platform said this feature is designed to simplify how projects distribute fees among contributors.

Under the revised system, fee claims are synchronized across all assigned wallets, and unclaimed fees remain permanently available to their designated recipients.

Cohen stated that no member of the Pump.fun or Terminal team will accept creator fees. He described the updated structure as intended for participants active in the platform’s trading environment, rather than for internal stakeholders. Fees remain claimable at any time and are not forfeited if left unclaimed.

Both dynamic fees and market capitalization.

In the previous Dynamic Fees V1, smaller tokens paid higher fees compared to larger projects. Fees reached up to 0.95% per trade for tokens with market capitalizations ranging from approximately 420 SOL to 1,470 SOL.

As the number of tokens grew, fee rates declined gradually, reaching as low as 0.05% as projects approached valuations of nearly $20 million.

The structure successfully accelerated early-stage activity. Pump.fun reported that bonding curve volumes more than doubled during the period, supported in part by a streaming-led launch trend that attracted first-time crypto users.

Despite these gains, Cohen said the incentives did not sustain long-term participation patterns and ultimately concentrated rewards on token creation rather than trading.

Trading Activity and Concentration Measures.

The developments come as Pump.fun continues to report high usage. Within the past week, the platform has traded a record volume of 6.6 billion, marking the highest weekly volume to date.

The creator’s revenues are also not negligible. According to data monitored by Adamtec, creator fees exceeding $1.1 million were claimed in the last 24 hours, and nearly $ 7.9 million were claimed during the last seven days.

Source: Adamtec

Source: Adamtec

Meanwhile, the measure of token creation shows a high rate of concentration. Over 27,000 tokens were issued on one day, and less than 200 graduated. This maintained daily graduation rates under 1% implying that business is centered on a small group of successful tokens.

PUMP Token Action and Buyback Statistics.

The native token, PUMP, of Pump.fun has demonstrated reinvigorated short-term price action alongside updates on the platform.

As of press time, the token is selling at approximately $0.0024, representing a gain of about 10% over the past 24 hours, according to CoinMarketCap. It trades approximately $175 million every day. Although it has been increasing recently, PUMP remains over 70% below its all-time high.

Cohen said additional changes to the creator fee framework are planned, though no further details were disclosed. The platform reiterated that internal teams will not participate in creator fee allocations under any circumstances, maintaining separation between operational roles and market incentives.