Key Insights

- The PORTAL price continues to squeeze within the range of $0.020 and $0.024 due to the reduced volatility.

- Maintaining levels above $0.020 indicates decreased pressure to sell off, despite the October breakdown.

- There is still a steady increase in market cap, indicating that there is renewed participation rather than short-term speculation

PORTAL Price Holds Key Support as Daily Breakout Zone Narrows

PORTAL price analysis shows growing market attention as price compresses near long-term resistance on the daily chart. Recent trading reflects stabilizing structure, rising liquidity, and renewed interest following technical compression and supportive on-chain data.

Daily Chart Structure Shows Compression Near Resistance

According to ZAYK Charts, a market update stating that the daily chart has developed a falling wedge structure, which, since resistances have been tested many times, more volume as it comes into the market creates increased probabilities for breakouts.

PORTAL price analysis in the daily timeframe indicates that there has been a prolonged downtrend that started in late 2024. And at that time price was defined by making lower highs and lower lows until October, when the price saw strong selling and yet was met with apparent buyer support.

Since then, the price has been trading within a tightening range spanning between $0.0200 and $0.0240. Therefore, as this has been following a tightening pattern, we have a reduction of volatility through less selling strength as the individual candles move closer to where the descending channel apex lies.

The technical structure now displays that the price is still holding above the lower channel support of $0.0200, as long as this level fails to be broken on the downside, sellers are losing control of the price, and buyers continue to support through providing demand at lower zones.

PORTAL consolidates at descending channel support, signaling potential trend reversal with a 300% breakout projection ahead. (Source: X)

PORTAL consolidates at descending channel support, signaling potential trend reversal with a 300% breakout projection ahead. (Source: X)

Support, Resistance, and Measured Price Levels

The level of $0.0200 – $0.0210 is the primary support according to PORTAL price analysis, since this region has withstood several attempts to sell that point over the course of multiple days without experiencing a confirming daily close below it.

The level of $0.0150 – $0.0160 is a major invalidation zone associated with the wick of the capitulation from October. If the price breaks down below this zone, it would reset current recovery expectations.

Currently, there is immediate resistance between the levels of $0.0240 and $0.0250, which establishes the trend line pressure that is in decline. If PORTAL closes daily above this range, it will indicate a structural change.

There are higher resistance zones located at $0.0300 and $0.0380. These are regions that have been sold off during earlier phases of price action in the market.

RELATED: NEAR Price Analysis Shows Breakout Toward $2.10 Target

Indicators Reflect Reduced Volatility and Early Stability

Using the Bollinger Bands, PORTAL’s price analysis shows that the recent price action has been tightening together. The price is currently balancing around the middle band, approximately $0.0222.

Bollinger Bands have a “neutral” character that indicates that prices have been stable within the bands, but are likely to expand. Therefore, the band contraction adds to the compelling evidence of a strong trend materializing.

The short-term moving averages have been flattening out, with the current price trading slightly above both moving average lines. This indicates that prices are becoming less bearish and more neutral, but not yet confirming a trend reversal.

In the support area, the frequent long lower wicks demonstrate that there are buyers absorbing the lower prices. Sellers are still testing the lower price levels, but they are failing to follow through on their trades.

PORTAL consolidates the above key moving averages as Bollinger Bands tighten, signaling potential volatility expansion and early trend shift. (TradingView)

PORTAL consolidates the above key moving averages as Bollinger Bands tighten, signaling potential volatility expansion and early trend shift. (TradingView)

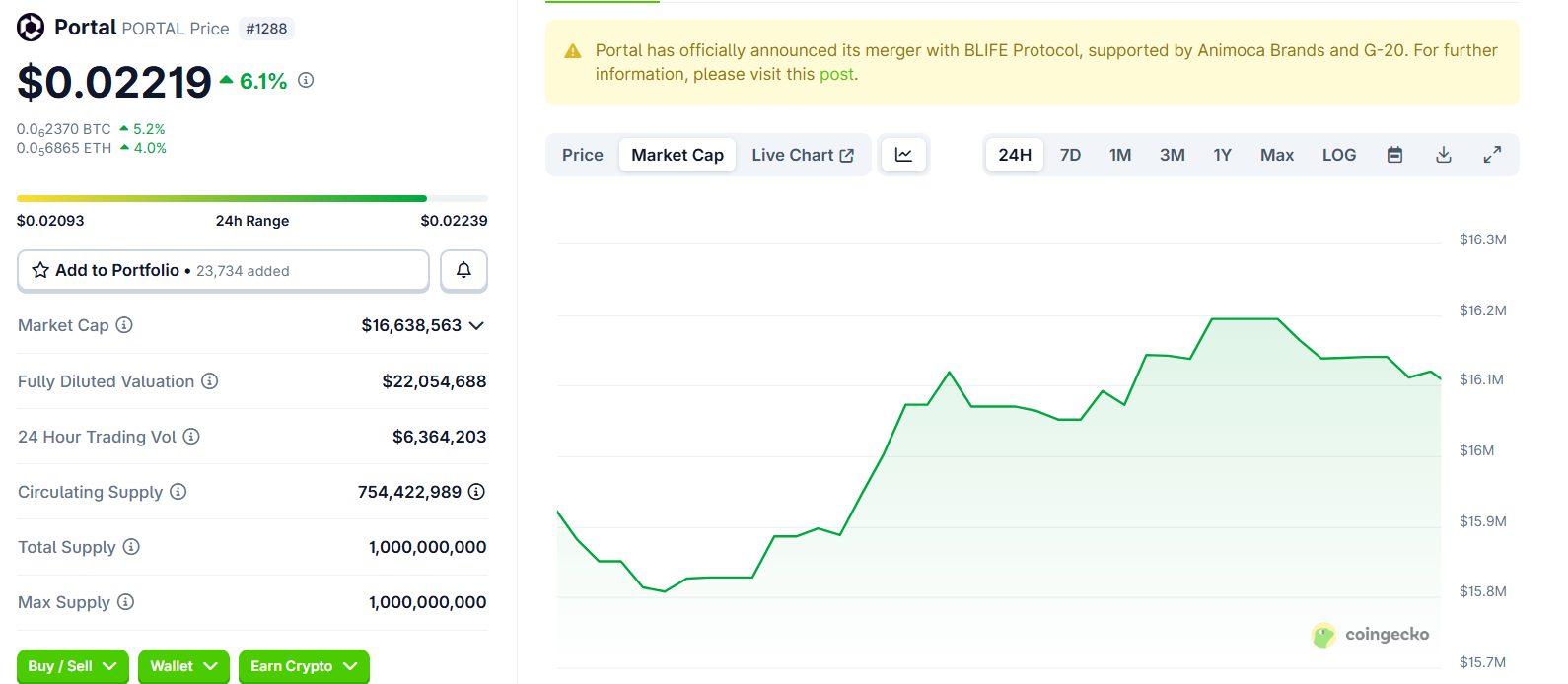

PORTAL price analysis uses a context of increasing liquidity and stable volume to understand the market. As a result of daily trading volumes averaging $6.3 million, PORTAL will maintain its price stability at greater than $0.022.

In addition, the market capitalisation for PORTAL has increased during daily trading hours to approximately $16.6 million, indicating that funds are being rotated around PORTAL rather than having been sent specifically to it for the purpose of increasing the price.

PORTAL price and market cap rise sharply as strong volume and merger news fuel renewed bullish momentum. (Coingecko)

Data about the supply indicates that nearly 75% of tokens are currently in circulation. The Fully Diluted Valuation (FDV) is nearly equal to the current Market Capitalization, thus limiting concerns about dilution.

The merger news between BLIFE Protocol and other entities, as described in market updates, provided additional narrative to support the announcement and was coincident with volume spikes and higher relative strength.