Key Insights:

- Metaplanet increased revenue projections amid rising Bitcoin revenue.

- The impairment of Bitcoin in non-cash was a cause of massive losses, even as operating performance increased.

- BTC holdings grew, and new purchases stopped in early 2026.

Bitcoin treasury operations and Metaplanet operations of the Tokyo-listed company began in 2026 under revised financial projections, following the company’s upward revisions to its 2025 revenue and operating income forecasts and a significant non-cash Bitcoin impairment loss related to end-of-year prices.

Revised 2025 Outlook and Impairment Impact

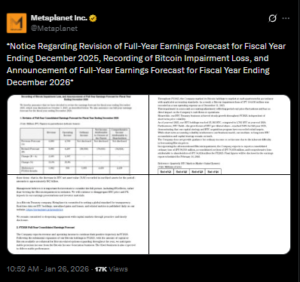

In a regulatory notice released Monday, Metaplanet said it now expects 2025 revenue of 8.905 billion Japanese yen, approximately $58 million, and operating income of about $40 million, reflecting stronger performance in its Bitcoin income generation business.

At the same time, the company warned that the accounting treatment of its Bitcoin holdings will drive a deep annual loss, despite improved underlying operating results.

The updated guidance places Metaplanet among a growing group of publicly listed firms whose financial statements are increasingly shaped by crypto-asset valuation rules rather than cash flow performance.

The updated forecast includes an ordinary loss of approximately $632 million and a net loss of about $491 million for 2025. The two figures are attributed to a charge for impairment of Bitcoins, estimated at between $680 and $700 million.

Source: Metaplanet

According to the company, the charge was a non-cash write-down of the value of the Bitcoin holdings at the year-end pricing, based on market volatility in December 2025.

Metaplanet affirmed that the impairment will have no direct impact on its Bitcoin holdings or daily operations, as it is an accounting adjustment rather than a cash expense.

In the 2025 financial review, the company recorded an impairment loss of $679 million, reflecting price movements in the last month of the year.

As a result, Metaplanet will incur a colossal loss per annum when it reports its full-year performance on February 16, although its operations performed better.

Bitcoin Treasury Growth Metrics

According to the firm, its Bitcoin assets grew by 1,762 BTC at the period-ends of 2024 to 35,102 BTC at the period-ends of 2025. Over the same period, BTC yield per diluted share reached 568% for the year. The company defines this metric as the growth in the amount of Bitcoin backing each diluted share, which it uses to track per-share BTC exposure.

Despite the growth in BTC holdings, the company has not reported any Bitcoin purchases so far this year. Shareholders approved additional BTC acquisitions in the prior year, but no new transactions have been disclosed since then.

The last reported Bitcoin purchase occurred in late December 2025, following a period earlier in the year when the firm acquired Bitcoin almost weekly.

Market Response and Share Activity

The downturn follows a period of volatility in the company’s share price, which saw sharp gains after Metaplanet announced a 75 million Japanese yen share buyback program. At that time, shares of 3350.T rose by more than 15%.

The recent fall has been accompanied by a lack of reported bitcoin purchases in 2026 and by the disclosure of a large non-cash impairment loss. The company said that nearly all projected revenue is expected to come from its Bitcoin income generation business.

Selling, general, and administrative expenses for the year are projected at about $29 million. Due to the difficulty of forecasting Bitcoin prices, the company stated that it will not provide guidance for ordinary income or net income for 2026.

Furthermore, the company also acquired Bitcoin.jp to strengthen its operational base in the Japanese market.

Partnerships and Long-Term BTC Targets

Metaplanet also disclosed a new partnership with Norges Bank, identified as the world’s largest investment fund, as part of its broader capital strategy.

The partnership was announced to support Metaplanet’s stock allocation and treasury framework. The company has previously stated a long-term objective of purchasing up to 100,000 BTC.

In the fiscal year 2025, the company increased its revenue and operating profit estimates to 8.9 billion and 6.3 billion yen, respectively.