Key Insights

- New Ethereum wallets showed a sharp rise and were active during the last month.

- Daily transactions and active addresses increased, suggesting increased network use.

- Staking was high, and the market price eased in the next 24 hours.

Ethernet network activity has risen drastically in the last month, with the number of first-time users increasing alongside a steady rise in new addresses, as indicated by Glassnode’s data. The on-chain analytics firm reported that “activity retention,” a metric tracking whether users remain active over time, nearly doubled month over month.

Ethereum network activity shows a structural shift in users

Glassnode reported that its month-over-month activity retention has been on a steep rise, with first-time-interacting addresses soaring in the recent 30 days.

Moreover, the firm noted that this trend indicated the influx of new wallets interacting with Ethereum, rather than growth being driven by older accounts with more frequent transactions.

New activity retention, which represents newly active network addresses, rose from just over 4 million to around 8 million during the month. Recent data suggests that Ethereum’s network composition has changed significantly, according to Glassnode.

Additionally, new addresses are entering the ecosystem and staying active because they do not need to account for the majority of activity, unlike wallets.

This development comes as transaction execution increasingly shifts toward scaling solutions, while Ethereum’s base layer continues to handle settlement.

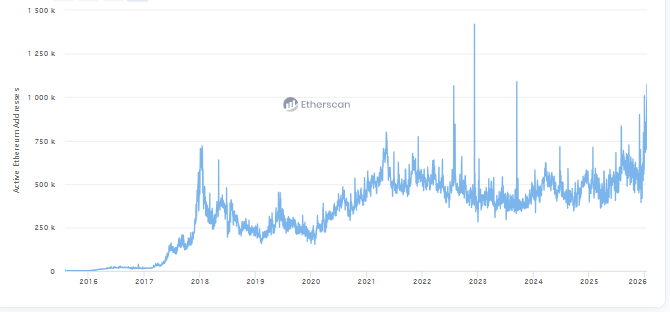

Over the past year, the number of active Ethereum addresses has increased by more than two-fold. According to figures from Etherscan, the number of active addresses rose above 1 million on January 15, up from approximately 410,000 at the same time the previous year.

Source: Etherscan

The increase is driven by increased daily interactions across transfers, smart contract interactions, and transactions in decentralized finance, all captured on the network.

The same has been true of transaction throughput. Recently, daily transactions increased to about 2.8 million, which is more than 125 percent higher than the previous year.

The rise in transactions, combined with the growing number of active addresses, suggests increased involvement of the network as a whole rather than temporary spikes driven by a narrow set of events.

The use of stablecoins and lower transaction fees boosts transaction growth.

The growth in the activity of the Ethereum network has also been attributed by market commentary to changes in the way transactions are processed.

According to the Macroeconomics outlet Milk Road, the increased activity was accompanied by a dramatic surge in the use of stablecoins on Ethereum and falling transaction costs.

Outlet reported that the trend indicated Ethereum was moving execution to layer-2 networks while leaving settlement on the base layer.

On-chain metrics align with institutional flows

Justin d’Anethan, head of research at Arctic Digital, said recent data shows improving sentiment around Ethereum.

He noted that indicators that had previously entered oversold territory have turned higher, alongside renewed capital inflows into exchange-traded funds, stablecoins, and native crypto protocols.

Additional network information suggests increased involvement through staking. According to Nick Ruck, director of LVRG Research, the current staking level is almost 36 million ETH, and daily transactions exceed 2 million.

He stated that the combination of consistent ETF inflows, scaling upgrades, and rising transaction volumes indicates strengthening on-chain fundamentals.

Context and new market levels

Michaël van de Poppe, founder of MN Fund, stated that Ethereum has entered a period of price compression that often precedes larger moves. His comments followed the recent consolidation after Ether’s advance toward $3,400.

Ether traded recently to a two-month high of around $3,400 before falling to approximately $3,300, as market participants weighed both hardening net underlying fundamentals and short-term headwinds.

Market observers stated that the price action was driven by tighter liquidity conditions, citing reduced supply in circulation and high institutional participation.

Ethereum was trading at $3,308.54 at the time of press, 0.89% lower than its opening price in the last 24 hours, as general market forces pushed prices down.

According to CoinMarketCap, Ethereum’s market capitalization is currently $399.32 billion, suggesting the market decline is worsening each day.

The volume-to-market ratio was 6.31, and liquidity was moderate in valuations. The total and circulating supply of Ethereum were approximately 120.69 million ETH, indicating the supply did not change during the course.