Key Insights

- The price of Ethereum compressed against a long-term descending trendline, but the breakout is still alive around $3000.

- Ethereum traded sideways within the $2950-$3120 range, with short-term indicators showing neutral momentum.

- According to derivatives data, the long positions of leading traders remain strong, but balanced liquidations imply that leverage levels have recently been reset.

Current Ethereum prices are hovering around $3000, indicating a drop in volatility. There is evidence of positive price action tightening along with balanced moving average indicators. While also indicating a bullish sentiment in derivatives markets, and thus, traders are concentrated on the short-term direction until further proof in the form of volume and structure occurs.

Ethereum Price Structure Near Long-Term Resistance

According to a recent analysis by ZAYK charts, Ethereum (ETH) has been testing against a long-term declining trend line, with numerous unsuccessful attempts at breaking through this barrier since October.

The price has tracked lower toward the bottom of this trend line. and currently sits just under $3,050.

The current prediction for ETH is built upon this analysis. The repetition of tests against this resistance level likely indicates that sellers will be less active during future tests, given the amount of resistance already experienced at this price point.

Therefore, if ETH can establish a sustained breakout above this level, we could see another up move to around the $3,800 area.

If resistance is not broken, we will have to remain cautious regarding the overall market sentiment towards ETH.

A rejection from the declining trend line will likely result in ETH returning to near $2,700, where there is clearly identified structural support.

ETHUSDT compresses under long-term downtrend resistance, signaling potential breakout

ETHUSDT compresses under long-term downtrend resistance, signaling potential breakout

with 27% upside toward 3,800 USDT.Source: X

Short-Term Momentum and Range Conditions

The Ethereum price is currently consolidating on the 4-hour timeframe between $2950 and $3120. However, the price is currently trading slightly above the 9 EMA, indicating short-term strength but a lack of trend confirmation.

The MACD readings are mostly flat, meaning that buyers and sellers are evenly matched and that there is an equilibrium between the two sides.

This situation is generally conducive to an eventual explosive move out of the consolidation range, so the range boundaries are critical in determining where ETH will go in the future.

If ETH closes above $3120, it will likely have a lot of steam behind it, and we can expect further upward movement towards $3250 and $3300.

If ETH closes below $2900, it will likely find support at the $2850 area.

ETH consolidates near $3,000 as momentum flattens, signaling potential breakout or rejection

ETH consolidates near $3,000 as momentum flattens, signaling potential breakout or rejection

from the key resistance zone. (TradingView)

Derivatives Sentiment and Positioning Data

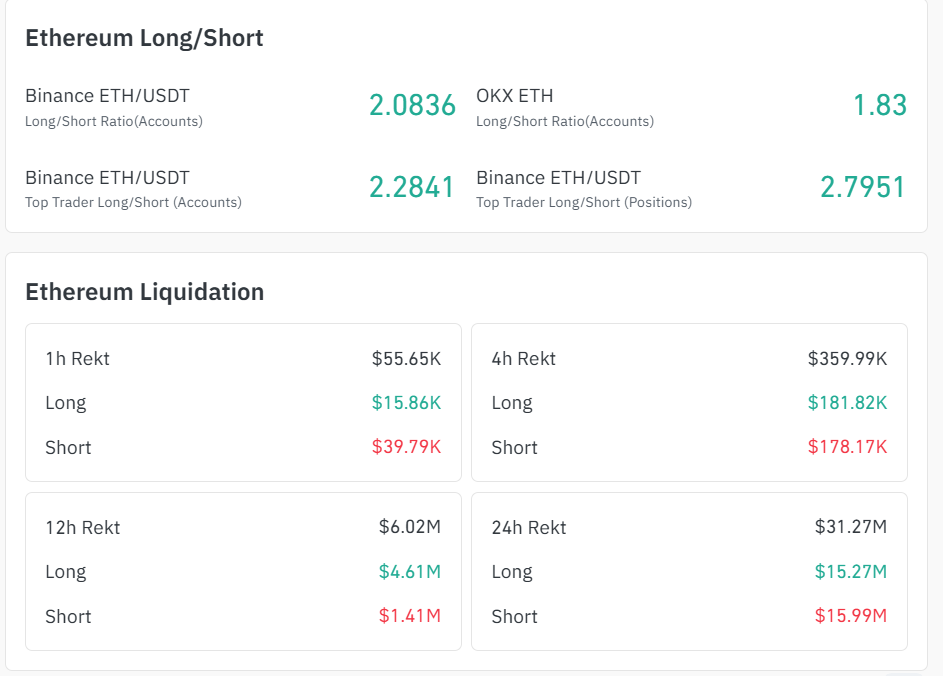

According to derivatives data collected from various exchanges, traders seem to be taking a bullish outlook on Ethereum (ETH). Long-to-short ratios for Binance and OKX, two of the largest exchanges, continue to stay over 1.8.

Additionally, there are many large traders who clearly have significant amounts invested long into ETH.

The fact that traders are positioned this way gives support to the current price target of ETH, but it also creates potential for downside risk if prices stall out before hitting our projected target.

The fact that liquidations occurred evenly over the last 24-hour period seems to indicate that excess leverage has been eliminated.

Ethereum sentiment leans bullish as top traders hold strong longs, while balanced liquidations

Ethereum sentiment leans bullish as top traders hold strong longs, while balanced liquidations

signal a leverage reset phase. (Coinglass)

Short-term liquidations are supportive to shorts, bringing upward pressure initially; however, price levels can only remain higher if they are supported by continued spot demand and increasing volumes.

At the moment, Ethereum is trading around a critical technical area. The ETH price prediction relies mostly on the ability for buyers to establish a new structural change or to be denied again.