Key Insights

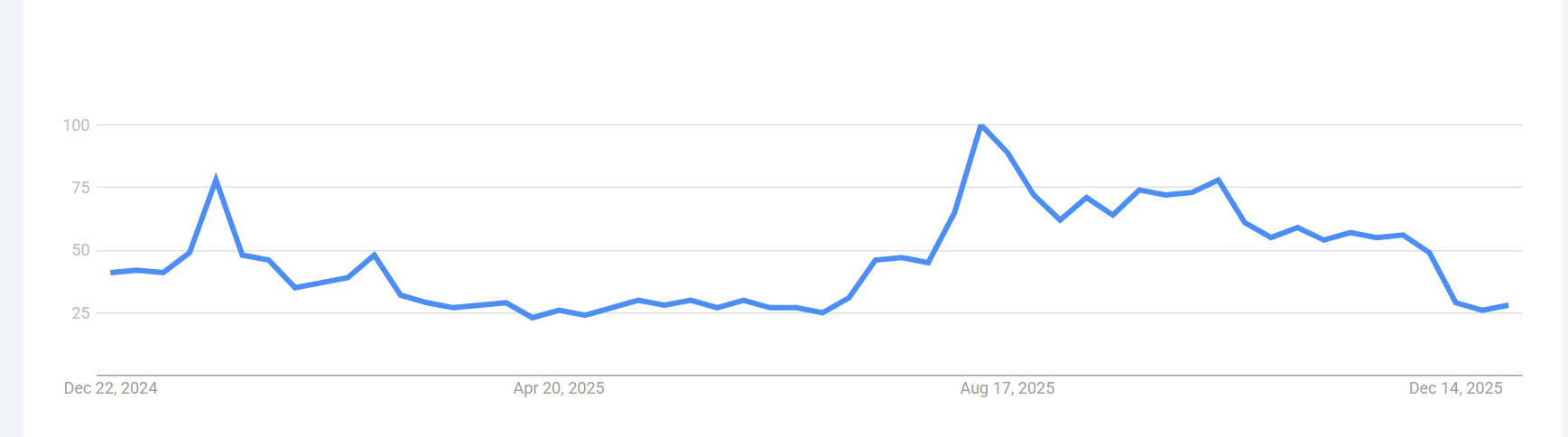

- International search interest in crypto remains at or near annual lows, and this reflects a decreased retail presence in crypto markets in early 2025 trading.

- Ethereum TVL projections suggest that stablecoins, tokenized assets, and institutional settlement solutions will influence the future use of the Ethereum network.

- Data from ETH derivatives reflects declining Open Interest from peaks, which indicates market deleveraging and less volatile prices.

ETH Price Prediction as Retail Searches Slide, TVL Hopes Rise

With the end of 2025 nearing, there seem to be contradictory indicators of attention within the crypto markets. The search interest is fading worldwide, but there are projections of an increasing number of on-chain activities, institutional investments, and derivatives patterns influencing today’s ETH price forecast scenarios, which revolve around Ethereum.

Falling Search Interest Reflects Retail Absence

As measured by Google Trends, the number of worldwide searches for “cryptocurrency” has recently hit an all-time low globally, with a worldwide score of just 26. In the US specifically, the level of interest in cryptocurrency has decreased further and dropped to the lowest level within the past 12 months.

https://trends.google.com/trends/explore?q=Crypto&hl=en

This trend indicates very few retail investors engaged in cryptocurrency this month versus earlier in the year, with the same degree of enthusiasm.

There was a sharp drop in search volume for cryptocurrencies following the announcement of President Donald Trump’s tariff policies, which contributed to a plunge in the price of Bitcoin and many other cryptocurrencies. Since that time, there has been little recovery in interest.

Periods of low retail interest are typically associated with periods of less volatility associated with cryptocurrencies. When low volume from retail investors exists, it tends to limit the amount of speculative buying pressure on the market, which is usually driven by short-term investors.

Source: Google Trends

Source: Google Trends

Ethereum TVL Growth Projections Gain Attention

The outlook for Ethereum’s total value locked has been renewed, as industry executives are discussing potential expansions of the network. According to SharpLink Co-CEO Joseph Chalom, the company expects Ethereum to experience tremendous growth through 2026.

Chalom stated, “We believe that over the next 5 years, Ethereum’s Total Value Locked (TVL) will increase by 10X,” in a post he wrote in December of 2023. He attributed the growth to increased stablecoin adoption and an increasing demand for institutional settlement.

He further predicted that stablecoin usage will reach $500 billion next year, citing that Ethereum is the “go-to” settlement network for global transactions.

Another area of interest to Chalom is tokenizing real-world assets. He stated that he anticipates the creation of approximately $300 billion in value from tokenized assets likely to arise from a combination of on-chain fund, equity and bond transactions.

These estimates have also served as important benchmarks for predicting the long-term price of Ethereum among those who have been tracking the development of the network’s activity over an extended period.

Institutional Signals and ETH Positioning

Institutional investment has also become more visible. Max Crypto reported that Tom Lee’s BitMine has started staking $1 billion worth of ETH.

Disclosures like these are a sign of the increasing belief in Ethereum’s ability to provide a platform for emerging systems of digital finance.

Chalom stated that sovereign wealth funds could hold five to ten times the amount of ETH than they hold now. He connected this interest with Ethereum’s role in securing finance in an on-chain environment.

With these new developments in mind, the price forecasts for ETH are starting to shift from retail-focused momentum to those based on capital flows.

Source: x

Derivatives Data Shows Market Cooling Phase

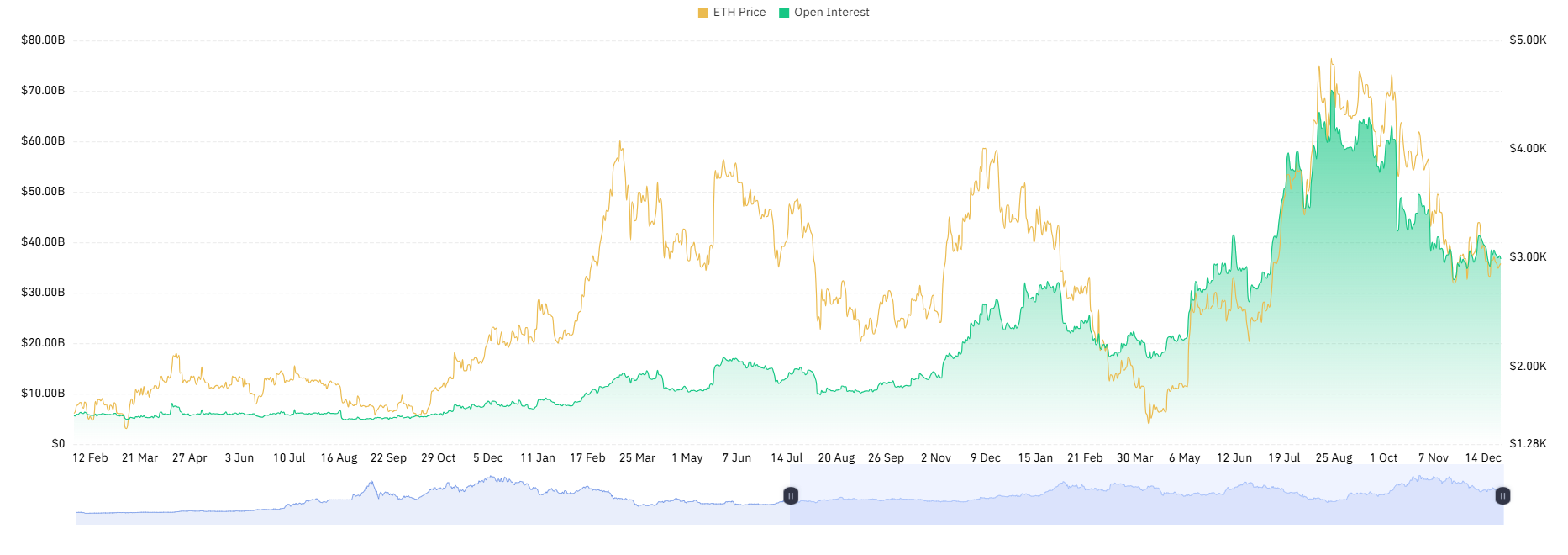

The price action for ETH and the corresponding open interest displays a fundamental change. ETH has consistently shown growth in both its price and level of leverage during periods of strong rallying activity—this indicates a strong conviction by traders.

As opposed to periods of high conviction, where open interest experienced rapid increases signalling relatively low liquidation risk across the entire derivatives market. Recent corrections have seen diminishing amounts of open interest along with falling prices; therefore, they signal both a closure of positions and diminished risk appetite for investors.

Price pattern analysis indicates that there is a “stabilizing” of the current price, but the prior highs have not been reclaimed as of yet. The gradual recovery of ETH’s open interest from both its correction and stabilization phases is an important requirement for the ETH price prediction.

Source: Coinglass

Source: Coinglass

Final Thoughts

At present, ETH predictions reflect retail interest at a low level while institutional dynamics are shifting. The Search Data reflected the sentiment of caution toward future opportunities, whereas Total Value Locked and Stake pricing projections demonstrated longer-term interest in Ethereum.

Market participants are adjusting their positions based on derivatives after reaching peak leverage points. Each of the aforementioned data leads to the conclusion that the direction of Ethereum will be determined by prudent and managed trading activity and not speculative excess.