Key Insights

- The retail crypto focus remains low amid volatility, and the October flash crash has plagued activity.

- The search data demonstrates subdued action with Bitcoin trading within a tight range towards the end of the year.

- Sentiment indicators are low, irrespective of the stability of prices and long-term likelihoods.

Crypto Search Interest Slides Toward Yearly Lows as 2025 Nears Its End

The crypto search interest has dropped drastically as we head into the last week of 2025, and online search data indicates that the retail focus has continued on a downward trend across key markets.

Google Data show that queries related to cryptocurrency activity have dropped to some of the year’s lowest levels, a sign of reduced activity after months of extreme volatility and market turmoil.

Crypto Search Interest Weakens After Market Turbulence

Commentary from market observers has linked the decline in search volumes to a reduction in retail engagement. Crypto commentator Mario Nawfal stated on social media that retail participation has largely disappeared in recent months.

He attributed the shift to declining confidence following the collapse of several high-profile memecoins associated with the Trump family, many of which have lost more than 90% of their value from peak levels.

https://twitter.com/RoundtableSpace/status/2004986890869497968

Nawfal believes that a lower level of public interest can be observed not only in online indicators but also in anecdotal evidence of reduced discussion among non-professional investors.

While his remarks reflect sentiment shared online, the Google Trends figures independently show that crypto search interest has remained near its lowest range throughout the second half of the year.

The decline in search activity has also been accompanied by general market stress following a significant flash crash in October. That incident has been characterized as one of the worst single-day crashes ever recorded in the history of the cryptocurrency market, causing a substantial impact on leveraged trading and spot rates.

October Flash Crash has Long-term Implications.

According to market statistics, the crash in October recorded almost 20 billion leveraged liquidations in just one day of trading. Some of the altcoins fell by up to 99 per cent, highlighting the magnitude of the upheaval.

Moreover, Bitcoin was not an exception, as it turned around completely and dropped to around 80,000 in November after hitting an all-time high of more than $125,000.

After that fall, Bitcoin has been trading between $80,000 and $90,000. The extended consolidation has provided fewer catalysts for fresh retail involvement, a trend that aligns with consistently poor crypto search interest readings in December.

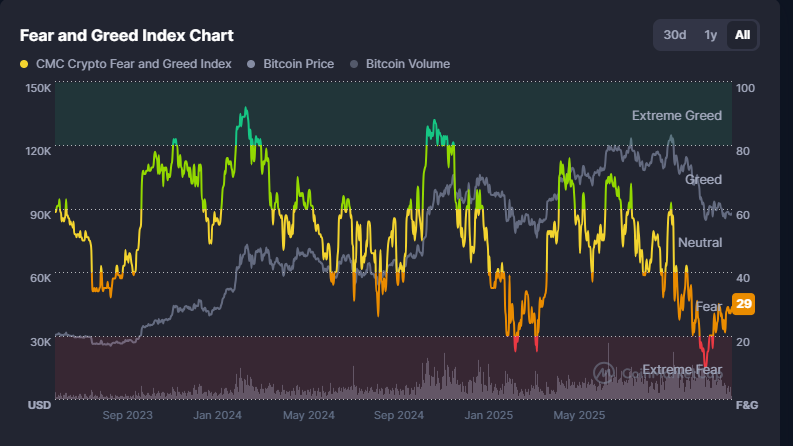

According to CoinMarketCap, the Crypto Fear and Greed Index reached an annual low of 10 in November, which is still considered an extreme level of fear. The index has since fluctuated between fear and extreme fear, with a current reading of 28.

Sentiment Indicators Are Low

Although the Fear and Greed index has recorded a moderate recovery since its low in November, it still conveys a warning to market participants. This aligns with the current stagnation in cryptocurrency search interest, which has not shown any significant recovery despite stable prices.

Public commentary from industry figures has presented divergent interpretations of the current cycle. Samson Mow, founder of Jan3, stated in posts on X that 2025 marked the beginning of a bear market, while also suggesting that Bitcoin could enter a prolonged bull phase extending into the next decade.

At the same time, several financial institutions have maintained higher long-term price projections. Some analysts, such as Geoff Kendrick of Standard Chartered and Gautam Chhugani of Bernstein, have estimated that by 2026, the price of bitcoin will reach $150,000.

Additionally, Hoskinon, the founder of Cardano, himself pointed to a potential price of around $ 250,000 in 2026 due to the supply and demand dynamics of institutions.

Forecasts Persist Despite Weak Retail Signals

Earlier in October, Arthur Hayes and Tom Lee suggested Bitcoin could still reach $250,000 before the end of the year. Those projections did not materialize. Instead, Bitcoin has declined by roughly 3% over the past 30 days, with market sentiment continuing to deteriorate through the end of December.

Additional market analysis from K33, released last week, indicated that prolonged sell-side pressure from long-term Bitcoin holders may be approaching its limits after years of steady distribution.