Key Insights:

- Chainlink brought live 24/5 access to data from US stocks via their equivalency, opening the ability to get real-time data on-chain through Chainlink for Stocks and ETFs.

- Solana Mobile also launched its SKR token, which will be used for staking, governance, and curation in the Seeker’s ecosystem

- Grayscale announced it would be launching a Near Spot ETF, while Bitcoin and Ethereum ETFs saw very large outflows.

Crypto market news reflects a shifting landscape as blockchain infrastructure expands, new tokens launch, and institutional flows adjust. Developments from Chainlink, Solana Mobile, ETF markets, and Grayscale reveal how digital assets continue interacting with traditional finance frameworks.

Chainlink Launches 24/5 U.S. Equities Data Streams

Crypto market news on Coin Bureau update on X shows that Chainlink recently unveiled the launch of U.S. Equities Data Streams. This new service allows users to access U.S. stock and ETF price and volume data with sub-second latency.

These data streams are available 24/7, five days a week, encompassing all three types of U.S. equity trading sessions: regular market hours, after-hours trading, and overnight trading.

The U.S. Equity Data Stream’s new architecture supports over 40 different types of blockchain applications.

Some of the first applications that have integrated into the U.S. Equity Data Stream are Lighter, BitMEX, and ApeX Pro.

These applications leverage the data feed to implement pricing and risk management mechanisms for perpetual contracts and predictive markets that correlate with the price of equities.

The launch comes in response to increased demand for tokenized securities and access to longer durations of trading. In addition, it builds upon ongoing efforts throughout the industry to replicate the behaviour of traditional capital markets within a blockchain-based framework.

Solana Mobile Activates SKR Token for Seeker Users

Crypto market news highlighted that Solana Mobile announced the launch of the SKR token as part of its Seeker smartphone ecosystem. The announcement was made via the official Solana Mobile X (Twitter account).

SKR is intended to provide governance, staking, and application discovery for the mobile Ecosystem. Early staking rewards have been reported to be approximately 28% annually.

Device owners can claim the token using the Seed Vault Wallet app, and developers can claim SKR via the Solana Mobile Publishing Portal within 90 days of its launch date.

The first season of this project has shown that there are currently 265 DApps (Decentralized Applications), 9 million transactions, and a total volume of $2.6 billion. More than 60% of the total circulating supply has been staked already.

Bitcoin and Ethereum ETFs Record Combined $700M Outflows

The crypto markets news has also seen a lot of funds flowing out of the spot cryptocurrency ETF. According to Ash Crypto, they have reported a combined outflow of over $700 million from Bitcoin and Ethereum ETFs.

The total net outflow for 11 different Bitcoin ETFs was $479.7 million, with Grayscale’s GBTC leading with an outflow of $160.8 million and Fidelity’s FBTC with an outflow of $152.1 million.

Ethereum ETF net outflows totaled around $230 million. XRP-specific ETFs had $53 million worth of outflows, while Solana-specific ETFs had $3 million worth of inflows.

While Bitcoin ETF holders have faced a lot of selling pressure over the last few weeks, they still have over $35 billion worth of inflows combined. Those involved in the market believe this is evidence of a reallocation of assets due to the overall volatility of the markets.

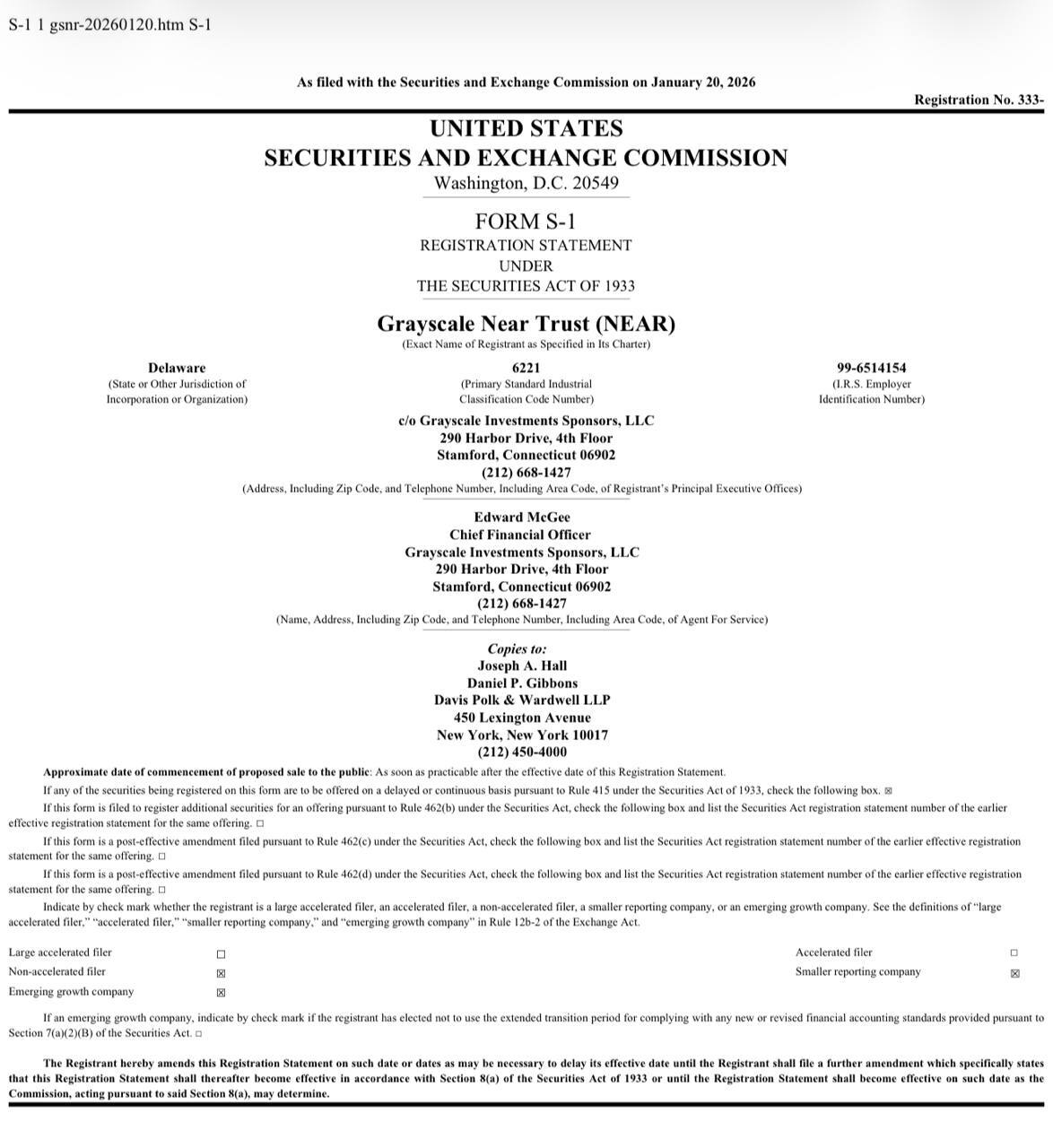

Grayscale Files S-1 to Convert Near Trust Into ETF

Grayscale Investments has made an application to the SEC to change its Near Trust into a spot ETF.

This application can be viewed on the SEC’s website and was supported by the findings of Cointelegraph and the SEC.

At present, the Near Trust holds approximately $900,000 worth of NEAR tokens and trades OTC. The current price for each share of the Near Trust is $2.85, while its net asset value is currently $2.19.

Source: X

Source: X

If the application is granted, the ETF would trade under the ticker GSNR and allow in-kind creation or redemption of shares. The NEAR tokens that the trust holds are kept in a cold storage account with Coinbase.

These filings represent a continuation of the trend of converting previously existing Bitcoin and Ethereum trusts into ETFs and demonstrate the increasing interest from institutions in layer-1 networks that enable the development and deployment of applications and solutions involving AI.

Final Thoughts

The crypto market news for this week demonstrates continued activity across many segments within the crypto space, from infrastructure to token offerings to unsuccessful launches of exchange-traded funds (ETFs) and ongoing innovations in both mobile applications and data services.

Evidence of continued momentum in the digital asset market highlights that these markets are still functioning, developing, and adapting to changes to the ecosystem surrounding the legacy banking system through innovative approaches.