Key Insights

- Regulators in the US are planning joint regulatory measures for crypto regulations and removing the uncertainty from the crypto space.

- JP Morgan contributes to the adoption of cryptocurrency through the launch of a tokenized treasury fund on the Ethereum blockchain.

- State policies and ETFs are coming up as an indication that the adoption of cryptocurrencies is growing with the inclusion of public markets.

Crypto adoption is still moving forward in the US financial market with the efforts of the government, financial institutions, and states. The recent developments suggest more control, more institutionalization, and more access to the financial market.

U.S. Regulators Signal Coordinated Crypto Oversight

U.S. financial regulators focused attention on the cryptocurrency market with the announcement of an event jointly hosted by the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission).

This event is titled “SEC-CFTC Harmonization: Financial Leadership in The Crypto Era” and will take place on January 27, 2026, at the CFTC Headquarters in Washington, D.C., both in-person and via free livestreaming.

The primary topic of discussion will be the overlapping jurisdiction of digital assets under both agencies’ rules and regulations, as well as how to harmonize agency activities with current U.S. law while enabling innovation and providing clearer guidelines to market participants.

The session will consist of opening remarks by both agencies, plus a moderated fireside chat.

Participants in the cryptocurrency industry view this meeting as part of a larger collaborative effort related to establishing common standards for cryptocurrency adoption among various regulatory bodies.

Source: X

J.P. Morgan Advances Tokenized Finance on Ethereum

On-chain institutional crypto adoption received new visibility due to a post by Merlijn The Trader regarding J.P. Morgan’s tokenized treasury fund (which is also now live on Ethereum).

This new tokenized treasury will be known as My OnChain Net Yield Fund or MONY, and it is part of J.P. Morgan’s Kinexys platform.

They will invest in Treasuries (with maturities of less than six months) and repo agreements secured by Treasury securities.

Each MONY token will be priced at $1, and the management fee will be 0.16%. Investors in the fund will be required to invest using USDC, and participation will only be available to qualified investors with a minimum investment requirement of one million dollars.

The launch of MONY demonstrates the continued movement of large banking institutions towards utilizing the Ethereum protocol for the settlement of financial products backed by physical assets in an environment governed by traditional regulations.

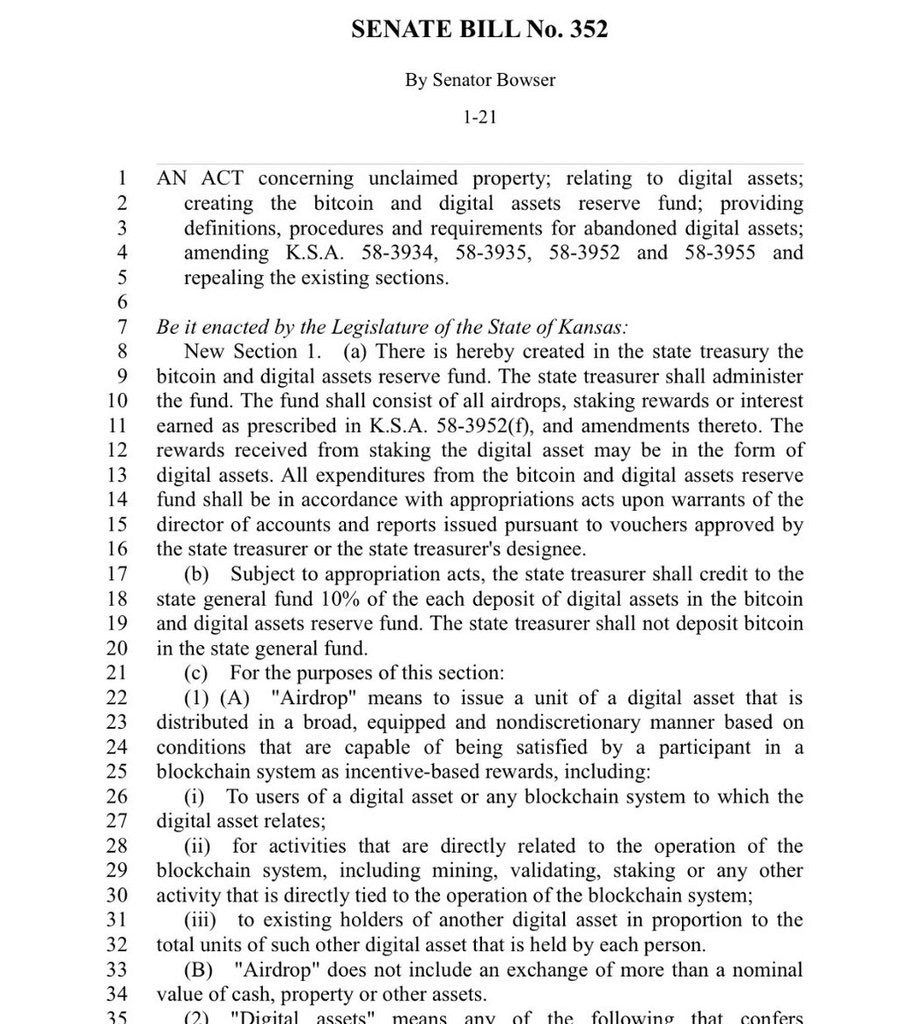

Kansas Moves Toward a Digital Assets Reserve Framework

Statewide Crypto adoption at the State Level was announced by AshCrypto in Kansas, as lawmakers introduced legislation that would include Digital Assets under Unclaimed Property laws.

Senate Bill 352 authorizes the state treasurer to take possession of and manage University-held funds, including airdrop tokens, staking rewards, and other digital currencies in accordance with State Law.

Under the current design of SB 352, no Bitcoins will be disposed of, and 10% of the proceeds will go toward funding Government services, while preserving the Digital Asset itself.

This is a more progressive way to manage previously unclaimed Digital Assets in Kansas than under traditional methods.

This bill was submitted as part of the 2026 Session of the Legislative Assembly. The bill is currently under consideration by a House committee.

The introduction of this bill indicates an increase in Government engagement with the Custody and Management of Digital Assets.

Dogecoin ETF Expands Regulated Market Access

According to a report from Mario Nawfal, the Dogecoin ETF is now being traded on NASDAQ under the ticker TDOG issued by 21Shares.

Each share of this fund will be backed 1-for-1 by Dogecoin stored in institutional custody. Additionally, retail investors will have the ability to invest in this ETF through traditional brokerage accounts without having to directly hold any cryptocurrency tokens.

The launch of this ETF follows European launches of other Dogecoin-based products as well as the introduction of leveraged Dogecoin ETF offerings in late 2020.

This new ETF also builds off the existing partnership between 21Shares and the Dogecoin Foundation to create additional support for cryptocurrency adoption via existing investment channels within the United States’ regulated financial system.

Final Thoughts

Crypto regulation, banking infrastructure, state policy, and exchange-listed products are supporting the growth of crypto adoption.

All of these activities demonstrate a coordinated effort across multiple industries, rather than a series of unrelated events.

As regulatory jurisdictions align and increased access to digital assets becomes available, digital assets will slowly but surely become a part of current financial systems and keep getting integrated into existing financial systems.