Key Insights

- On-chain data shows five-year inactive Bitcoin holders sharply reduced selling compared with earlier cycle highs.

- Bitcoin continues consolidating between $94,000 and $98,000 while maintaining higher lows and steady momentum.

- Institutional inflows and ETF accumulation help absorb supply, supporting price stability near major resistance.

Bitcoin remains trading at a major psychological level as the latest on-chain data indicates that there is less selling by long-term investors. Simultaneously, exchange information and institutional action indicate that demand is stable, which influences the existing Bitcoin price prognosis.

Long-Term Bitcoin Holders Step Back From Selling

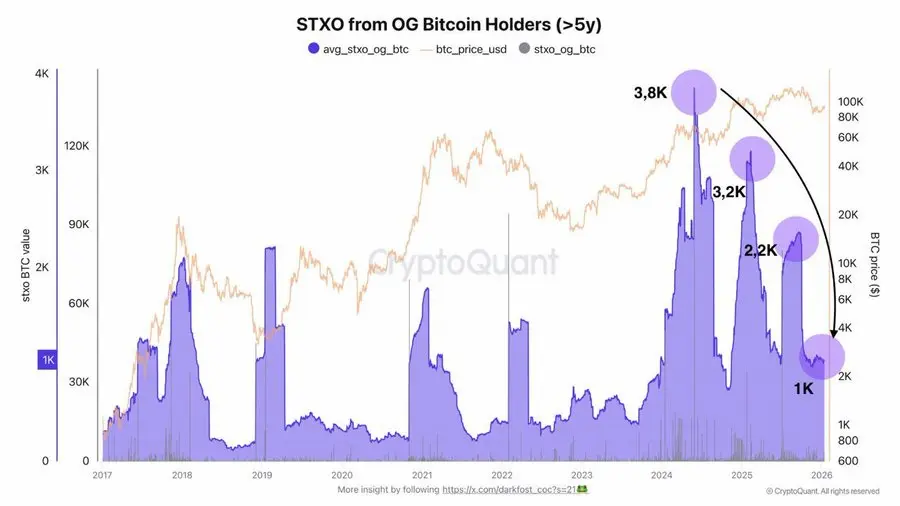

In relation to the current market, on-chain data provided by market analyst CryptosRus illustrates that Bitcoin spending from wallets that have not been active for over five years has slowed down. Such wallets are known as “OG holders” and tend to distribute coins when the liquidity is high.

In the early stages of the current market cycle, the spending of this group has been close to 3,800 BTC on a moving average basis. More recent figures, however, point to an average of 1,000 BTC in the last 90 days. This indicates less supply entering the market.

In past market cycles, OG selling was commonly observed to increase between 3,000 and 4,000 BTC near major market peaks. However, in the current market cycle, a different market trend is emerging, where selling pressure is easing while Bitcoin trades at record highs.

This shift influences the Bitcoin price outlook by limiting supply during upward moves.

Source: X

Bitcoin Price Holds Firm Below Key Resistance

Bitcoin is trading between $94,000 and $ 98,000 after rebounding from a low of almost $88,000 in December. The price framework is still on an upward trend of lower lows, which are sustaining instead of turning away from current levels.

Technical signs favour this opinion. The Relative Strength Index is high but not in the overbought area. Momentum indicators are still on an upward trend, which indicates the persistence of strength without too much speculation.

The area $100,000 is still a key resistance point. Close to $94,000 and close to $90,000 support has not been lost. These zones are determining the near term forecasts in the existing Bitcoin price perspective.

Source: TradingView

Derivatives Data Reflects Short-Term Market Pressure

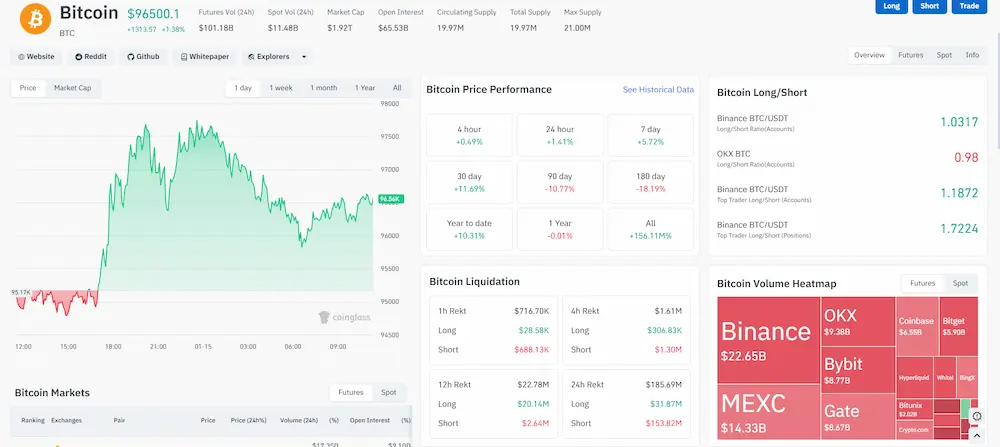

Futures trading is still the primary activity in the market, with its daily volume being over $100 billion. The amount of spot trading is significantly smaller, which is a symptom of leveraged positions that are causing short-run price action.

Liquidation data indicates high pressure on the short sellers. In the last 24 hours, over 150 million short liquidations had taken place. This operation is in line with the current rising price trend.

The positioning information of major exchanges indicates that leading traders have a net long stance. Positioning in the retail sector is rather equal. These factors favor the stable outlook of the Bitcoin price with the leverage in action.

Source: Coinglass

Institutional Demand Supports Market Structure

A post by Coin Bureau used projections of JPMorgan regarding the crypto inflows in 2026. The bank mentioned that there was an estimated entry of about 130 billion into the sector in the year 2025, and this is a reflection of long-term institutional involvement.

Bitcoin exchange-traded funds are sucking in existing supply, which compensates for lower selling by long-term holders. This balance helps the price to stabilize during periods of consolidation.

Assuming that selling out of older wallets suits and that the institutional demand is still strong, the price compression can be sustained at the resistance. An established increase above the threshold of $100,000 would change the Bitcoin price outlook to the range of higher suggested values, whereas accumulation is prevailing in the meantime.