Key Insights

- Bitcoin formed a new weekly Golden Cross, a signal that historically aligned with sustained price advances.

- Short-term charts show Bitcoin consolidating near key levels as momentum indicators remain positive but controlled.

- Institutional access expands as major banks and lawmakers move toward clearer Bitcoin participation frameworks.

Bitcoin News Today: Golden Cross Forms as Institutions Step In

Bitcoin news today reflects a market influenced by technical indicators, ongoing consolidation, liquidity management, and growing access to the asset by institutional investors. Recent chart formations, global economic events, and developments in policies have indicated that bitcoin is moving within a defined phase of consolidation.

Bitcoin Prints a New Weekly Golden Cross

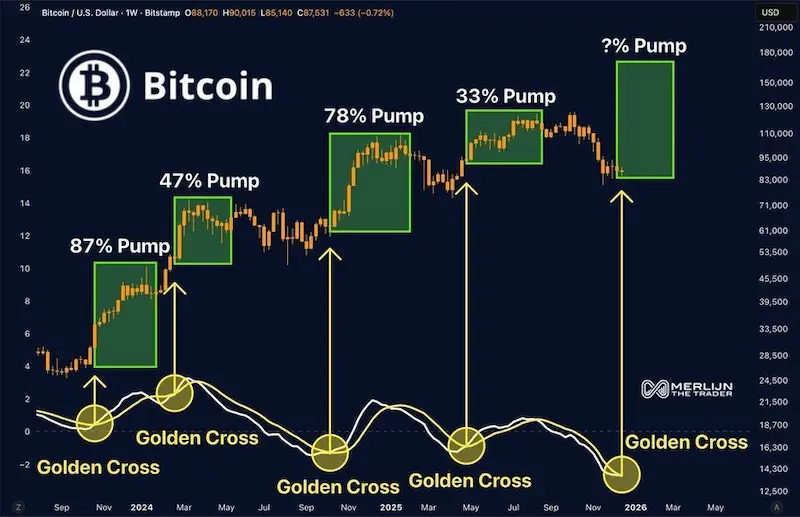

Bitcoin News Today focuses on a newly created golden cross on the Weekly BTC/USD Chart, which was released by “Trending Bitcoin.” This is now the fifth time that this signal has occurred in Bitcoin’s trading history, and the past signals have marked the beginning of an extended upward price trend.

With previous occurrences demonstrating price changes of +87%, +47%, +78%, and +33%, each time the cross occurred, it was not in a period of extreme bullishness, but rather during a period of indecisiveness in the market.

These types of crossovers will be identified towards the beginning of the longer-term price moves in cycles of a Bitcoin bull market.

In addition, at the last crossover, Bitcoin was trading between $70,000 and $75,000, but after coming down from an area of $110,000 – $115,000, it has continued to trend upward and retrace back to a price level above $87,500, with the long-term structure providing continued support for higher highs and higher lows.

Short-Term Charts Show Stable Consolidation

Today’s Bitcoin News Summary features additional short-term price activity based on Four-Hour Chart data from the beginning of January 2026. Bitcoin has been trading at around $89,600 and remains within a well-defined range.

There have been multiple support levels, with one forming close to $88,000, while another is located further down at approximately $84,000.

On the other hand, resistance areas are coming in between $90,500 and $92,000. Furthermore, each higher low during the last week of December indicates that there has been an accumulation taking place over time instead of increased selling pressure.

Trend indicators. Both MACD and RSI show bullish momentum and thus point to continued bullishness for the near future. The RSI remains above its neutral level of 59, with strong bullish momentum building up.

In addition, the MACD has not only crossed above the zero line, but also has seen an increasing positive histogram as well, therefore establishing trending momentum conditions in the short term.

Federal Reserve Liquidity Activity Gains Attention

Bitcoin News Today is indicative of global economic developments following Coin Bureau’s overnight report on recent Federal Reserve liquidity operations.

The Fed injected $18.5 billion in liquidity into the marketplace through repurchase agreements and simultaneously drained $5.7 billion of liquidity from the marketplace through reverse repos.

These types of actions intend to promote short-term funding market stability. Because liquidity conditions typically impact risk sentiment, Blockchain traders (investors) and institutions are closely monitoring these actions.

Although Bitcoin trades without relying on a central banking institution to function, all markets’ liquidity shifts impact investment funds available for each asset class.

During times of uncertainty within global economics, caution is warranted rather than aggressive investment exposure.

Institutional Access and Policy Signals Shape Outlook

Bitcoin News Today states that increased institutional participation in Bitcoin is coming as a result of new information released by the Bank of America.

According to Trending Bitcoin, Bank of America has now allowed its wealth clients to invest 4% of their total investments in Bitcoin and other cryptocurrencies.

This allows more wealthy clients access to the cryptocurrency market for investment purposes and will create more liquidity in the markets over time. As more institutional investors participate, there is a greater possibility that the prices of bitcoins and other cryptocurrencies could be more stable over time. This reflects changing attitudes toward cryptocurrencies within traditional financial institutions.

Regulatory developments also continue to be important in the United States. Crypto Tice reports that U.S. lawmakers are expected to pass legislation that will create a framework for the regulation of cryptocurrency trading and its markets.

The proposed legislation will help remove the uncertainty of compliance issues that have existed for years.

NoLimitGains also reports on the rising geopolitical tensions around the globe and the resulting caution in the markets in the interim. Similar scenarios from the past have caused intense volatility in the short term.

Current investors continue to weigh their short-term technical strength against their longer-term understanding of geopolitical risk.