Key Insights:

- Vitalik Buterin cautioned against this acceleration, urging that human autonomy and decentralization should be prioritized by Ethereum AI development.

- The Bitmine deal to buy Ethereum worth $83.4 million is in contrast to large asset managers selling ETFs.

- ETF flow data also reported Ethereum inflows, in addition to outflows in other areas

Ethereum AI is still an important point of discussion as blockchain technology, artificial intelligence, and institutional players converge in relation to Ethereum.

The other notable factor was that the Ethereum founder, Vitalik Buterin, recently revisited his thoughts on cryptocurrency and artificial intelligence. There were also notable ETH treasury purchases and ETF flows that kept the focus of the cryptocurrency community on the digital token.

Vitalik Buterin Revisits Ethereum and Artificial Intelligence

According to Vitalik, Ethereum & AI have great potential to grow together if not rushed through unsupervised speedup and pushed too hard before we’ve figured out how to best progress forward in relation to general outcomes without understanding our values first.

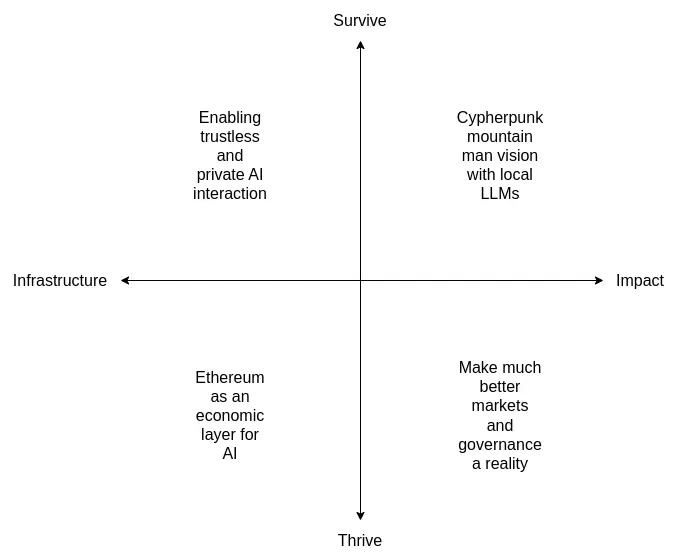

Buterin made it clear that he thinks we need more things like empowering individuals, decentralization, and safety through the lens of Ethereum, supporting the development of AI systems that enable human freedom while limiting centralization and destructive competition.

He gave a number of good examples of ways this could happen, including the creation of local language models, creating privacy-preserving APIs, and utilizing cryptographic signing to enable individuals to truly use AI systems while maintaining their privacy and autonomy.

Source: X

Ethereum as an Economic Layer for AI Activity

According to Buterin, it is possible for Ethereum to act as an economic base for transaction activities between AI, instead of being used as a batch layer for coordination purposes.

He mentioned three principal methods that could be used, such as payment processing, reputation systems, and dispute resolution using on-chain means.

This allows for autonomous functioning systems to be held accountable while transacting with one another. Economic coordination in this sense helps provide a decentralized authority rather than supporting one entity’s dominance over another.

The Ethereum AI framework can also provide secure bot-to-bot interaction as well as allow for open and unregulated experimentation using bots. These ideas persistently continue the underlying blockchain principles of validation and unregulated access

Institutional ETH Accumulation Draws Market Attention

Bitmine’s recent purchase of $83.4M of Ethereum (ETH) for its treasury furthers the institutional exposure to ETH, with the 40,000 ETH purchase executed through the institutional broker, Tom Lee, suggesting continued interest in ETH as a strategic asset.

As treasury accumulation continues to create a positive sentiment during periods of volatility in the markets, the recent purchases of ETH by institutions will continue to provide momentum as they accumulate and incorporate ETH into their treasuries.

There was also mixed ETF data, as Ash Crypto reported that BlackRock sold approximately $45M of ETH through its ETF products.

ETF Flow Data Shows Mixed Signals Across Assets

According to CoinTelegraph, Bitcoin, Ethereum, and XRP saw record net inflows from spot ETFs on February 9. There were inflows of $57.05 million for Ethereum spot ETFs. Bitcoin had the highest amount of inflows at $145 million, while XRP had inflows of $6.31 million. Solana spot ETFs saw small outflows of $14.5M.

These numbers seem to indicate money was being redeployed to specific investments and not an overall exit from the crypto market. The ongoing narratives around Ethereum AI continue to flow with these movements of funds, but are not solely influenced by ETF decisions.

Final Thoughts

Ethereum AI is becoming more of a focal point as we continue to move forward with both technical vision and market activity in tandem. Vitalik Buterin has developed a framework that highlights the importance of privacy, decentralization, and verification.

In addition, the flows of both ETFs and the actions of treasuries indicate that institutions are shifting their positioning in the marketplace. Ultimately, this evolution is leading Ethereum’s development through two avenues: infrastructure planning and measured capital allocation, thus allowing it to maintain active participation in innovation and in the markets.