Key Insights:

- BitMine’s Ethereum buying streak continued as the firm added more ETH during the market correction.

- Unrealized losses reached about $8 billion as Ether remained well below its prior high.

- Staking operations generated steady revenue despite falling prices and market volatility.

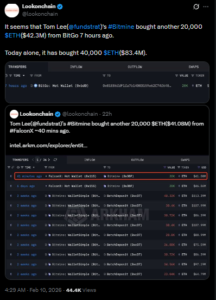

BitMine Ethereum buying streak further accelerated this week as the Ethereum treasury firm, under the leadership of chairman Tom Lee, purchased another large volume of Ether to its books.

BitMine Ethereum purchase streak grows as market falls.

According to on-chain data compiled by Lookonchain, Bitmine has been accumulating ETH during the recent price correction, supporting its long-term treasury strategy amid increasing market volatility and asset price declines.

The accumulation lifted the firm’s total holdings to more than 4.325 million ETH, valued at roughly $9.14 billion at prices recorded toward the end of last week. The move came as Ether remained well below its prior cycle highs, with market conditions continuing to pressure digital asset treasuries across the sector.

Source: Lookonchain

Arkham Intelligence data indicates that the latest Ethereum purchases were made in two separate transactions within a short period.

The continued decline has led to substantial paper losses for treasury holders, including BitMine.Despite this accumulation, BitMine is now reporting about $8 billion in unrealized losses on its Ethereum assets, as shown in the figures and on-chain statistics.

Additionally, the losses reflect the spread between acquisition expenses and current market rates following the broader crypto market decline. Ether has fallen far below its all-time high of around $4,900, reached in August 2025, and is now approximately 57% below that level.

The decline has affected large institutional participants across the market, though companies whose treasury strategies are strongly aligned with the long-term accumulation of digital assets have been impacted.

Tom Lee, the chairman of BitMine, stated that the losses the company had not realised were due to the design of its treasury structure. He stated that market drawdowns are also a normal part of the treasury structure.

He said the company’s Ether holdings are expected to experience losses during broader market downturns, given their direct exposure to price movements.

Staking Strategy Creates Revenue Stream.

Company disclosures indicate that about 67% of all the Ether that BitMine controls is staked on the Ethereum network. Under staking, Ether is staked to support network security and transaction validation, and rewards are paid in additional ETH.

Based on current staking rates and the value of assets staked, BitMine was reported to have about $ 202 million in annualized staking revenue. Individual data reveal that the company currently has 2,873,459 ETH in its treasury staked, generating revenue from yields and not directly reliant on short-term price changes.

In a separate filing, BitMine reported that the combined value of its cryptocurrency holdings, cash reserves, and internally classified “moonshots” stood at approximately $10 billion.

Comparison to the Other Institutional Responses.

The BitMine Ethereum buying streak contrasted with the strategy of other institutional buyers in the same time frame.

Trend Research, for example, reportedly dumped its entire Ether portfolio after incurring about $750 million in losses. Reports also stated that the funds being sold out were to be repaid to loans used to purchase Ether at previous market highs.

BitMine has stated that its operations are designed to mirror the price behavior of Ether, meaning that both its digital asset portfolio and equity valuation are expected to weaken during market downturns and recover during price rebounds.

Further disclosures released on Monday showed that BitMine acquired 40,613 ETH over the course of last week’s market correction. These purchases lifted total holdings to more than 4.326 million ETH, with an estimated value of about $8.8 billion at current prices.