Key Insights:

- The updated CFTC collateral eligibility regulations apply to the RLUSD stablecoin.

- GENIUS Act associates payment stablecoins with regulated futures markets.

- XRP ETFs saw weekly inflows, while Bitcoin and Ethereum funds decreased.

The RLUSD stablecoin is now under closer regulatory scrutiny following the U.S. Commodity Futures Trading Commission’s expansion of the scope of tokenized collateral eligible for regulated futures markets. The new framework expands eligibility to cover some more stablecoins, issued by national trust banks, and this shift puts RLUSD in a better regulatory environment as Ripple builds its banking business in the US.

RLUSD Stablecoin and Updated CFTC Definitions

The clarification follows previous CFTC instructions and aligns with current legislative developments under the GENIUS Act, which will reshape the approach to payment stablecoins in derivatives markets.

CFTC Chair Mike Selig announced the expansion of the commission’s list of eligible tokenized collateral via an X post.

According to Selig, the change reflects coordination between the CFTC’s new collateral framework and the recently enacted GENIUS Act. He stated that the updated approach positions the United States as a leading jurisdiction for stablecoin-related innovation within regulated financial markets.

Under the new CFTC framework, stablecoins issued by national trust banks can now be expressly accepted as tokenized collateral on regulated futures exchanges.

At the time, the definition applied pending the effective date of the GENIUS Act. That earlier guidance already covered RLUSD under state-level regulation, but it did not explicitly reference national trust banks as eligible issuers.

Source: Bitcoinlfg

The commission later stated that, after issuing the December letter, it became aware that its wording could be interpreted as excluding stablecoins issued by national trust banks.

In response, the CFTC reissued its guidance as Letter 25-40, expanding the definition of payment stablecoins to include national trust banks. The agency said the exclusion was unintentional and clarified that both state-regulated entities and national trust banks may issue payment stablecoins.

RLUSD Stablecoin GENIUS Act Implications of RLUSD

The legislation establishes a framework for payment stablecoins that comply with federal standards once it takes effect next year. Under the act, approved stablecoins that meet its criteria could be used across a wider range of regulated financial markets, such as derivatives exchanges regulated by the CFTC.

As Ripple continues to be regulated by the state and moves toward the status of a national trust bank, RLUSD could qualify as a subject of the existing definition of the state-based type of national trust bank and the broader category of national trust bank issuers.

Consequently, the stablecoin is subject to the CFTC’s collateral eligibility framework, provided it adheres to all regulatory requirements.

RLUSD Grows XRP Ledger Market Capitalization

Messari, an analytics company, said that RLUSD held 58.6% of all the market capitalization of tokens on the XRPL by the end of the fourth quarter of last year. This was a significant increase compared to the third quarter of 2025, when RLUSD accounted for 27.9% of the network’s aggregate token market cap.

According to Messari’s report, RLUSD also saw 187% quarter-over-quarter growth in its market capitalization during the period.

The growth in holders was also modest but positive, rising 4.3% quarter over quarter. By 2025, the market capitalization of the RLUSD stablecoin had grown to 235 million on the XRP Ledger. Furthermore, Current values indicate an XRPL market value of around $246,000,000.

In addition to the XRP Ledger, market information shows that the RLUSD stablecoin has reached a much larger combined supply across multiple networks. According to CoinMarketCap data, the overall market capitalization of RLUSD is almost $1.5 billion when the supply on both the XRP Ledger and Ethereum is combined.

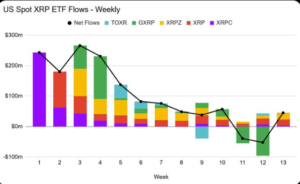

XRP ETF inflows differ from the overall crypto fund outflows

Independently, current market trends indicate that flows of funds in the digital asset space vary. XRP spot exchange-traded products recorded net inflows of $45 million over the past week, according to the latest available data.

Source: Crypto Analyst Carpe Noctom

This was against the general market trend, with Bitcoin funds recording $80 million in outflows and Ethereum products registering net losses of $ 149 million in the same period.

The bulk of XRP ETF inflows was recorded on Friday, Feb. 6, when $39.04 million entered the products in a single day. Among issuers, the Bitwise XRP ETF led daily inflows with $8.29 million. The accumulation took place during a period of heightened volatility across digital asset markets, which had pushed overall sentiment to multi-year lows.