Key Insights:

- Schiff believes that while China focuses on factories and gold, the United States focuses on Bitcoin and digital assets.

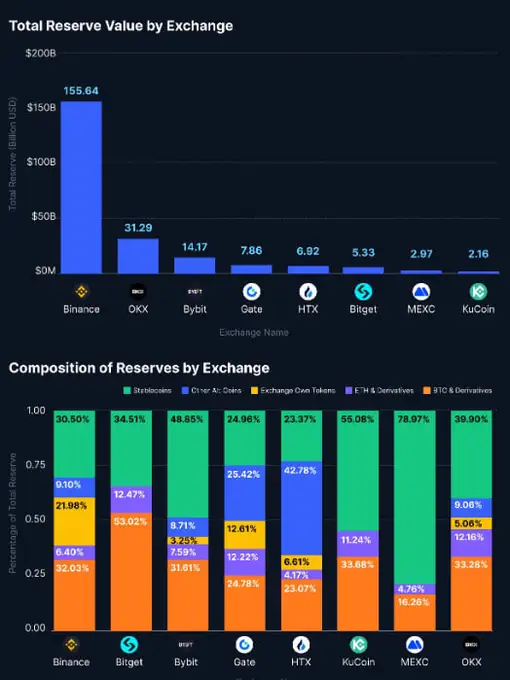

- Binance topped exchange reserves with $155.6 billion, which is far more than its rivals, as per CoinMarketCap’s January 2026 report

- Unverified rumors about QE triggered Bitcoin’s volatility without any confirmation from the Federal Reserve’s schedules or announcements.

Bitcoin news dominated market conversation as economist Peter Schiff criticized former US President Trump’s strategy to make the US the hub for Bitcoin and other digital assets. According to Schiff, such a strategy could lead to a drain of resources in other sectors as China focuses on manufacturing and gold accumulation.

Recently, Trump called himself a strong supporter of crypto and said the United States should lead the Bitcoin industry to remain ahead of China. These comments came after the global Bitcoin mining power transitioned to the United States from China following China’s crackdown on Bitcoin miners in 2021.

Schiff questions U.S. Bitcoin capital strategy

According to Schiff, the leadership of China is pragmatic and therefore wouldn’t have a priority on Bitcoin.” He went on to say that “While we are focusing on digital assets, China is busy building factories and accumulating a larger and larger stockpile of gold.” This statement received a great deal of attention among traders and analysts.

Data analysed by various market participants indicates that the amount of seized Bitcoin held by China is approximately 190,000 to 194,000 BTC the U.S. manages approximately 198,000 BTC from confiscations.

Simultaneously, China’s gold reserves are estimated at approximately 2,306 tonnes by December 2025 (this represents approximately $319 billion in value).

Market debate over crypto and traditional assets

Market participants have been divided in their opinions about Trump supporting cryptocurrency as a leader.

Those who support this position see a future where Bitcoin mining, blockchain development, and other crypto services provide a source of capital and innovation.

Schiff’s comments on Bitcoin have brought back up the long-held discussion about Bitcoin’s potential to provide national security.

Schiff has long been a vocal advocate for gold as a store of value and has strongly questioned the ability of Bitcoin to survive over the long run.

With the focus on cryptocurrency development becoming part of the political landscape, Schiff’s statement on Bitcoin has received much attention in the press.

Binance leads exchange reserve rankings

According to CoinMarketCap, regarding the State of Crypto, it was reported that Binance had a total of $155.6 billion in reserves, which was approximately 5 times more than the amount held by OKX ($31.29 billion). These amounts placed Binance far ahead of other exchanges.

In the report, it was indicated that Binance’s reserves included approximately 30.5% stablecoins and approximately 32% Bitcoin, indicating that holdings of assets were well-diversified.

Other exchanges appear to have a greater level of dependence on either stablecoins or native tokens. Proof of reserves demonstrates that user deposits are solidified by corresponding crypto assets that exist on the blockchain.

Source X

Unverified QE rumors fuel market volatility

Bitcoin news was about a supposed “emergency” announcement from the Federal Reserve to restart “quantitative easing.”

According to Wimar X, the Fed would inject $8.2 billion into the market before a scheduled speech by Governor Lisa D. Cook and pointed to imminent “emergency” measures.

Available data do not support this claim: the Federal Reserve’s official schedule reports only the routine purchase of U.S. Treasury securities and a standard, scheduled policy address; there is no indication that any new QE measures will take effect.

At this point, the price of Bitcoin is about $76,350, but the price of Bitcoin is highly volatile due to the $2.5 billion in liquidations that have occurred over the previous few days as a result of traders reacting to unconfirmed information in the marketplace surrounding an emergency announcement from the Federal Reserve that was not even made.

Ongoing crypto policy and market attention

Market sentiment around Bitcoin remained strong due to a mix of political statements, data on exchange reserves, and wild speculation regarding future policy directions.

Continued narrative surrounding leadership within the space of cryptocurrency continued to shape trader expectations through providing context for also evaluating liquidity and risk appetite regarding macro policy.

Participants within the market continued to look to updates provided by regulators, exchanges, and policymakers as being important in understanding current trends.

Final Thoughts

Bitcoin news is a combination of policy discussions, market transparency data, and speculation on the impact of macroeconomic events.

Negative commentary by Peter Schiff regarding Donald Trump’s cryptocurrency vision and how Binance has excessive reserves, along with rumors of fraudulent quantitative easing (QE) create a quick shift in sentiment.

With the current political and economic environment, traders and analysts will continue to watch for signals from the existing government authorities or verified data.