Key Insights:

- Major banks in the U.S. offer Bitcoin trading, custody, ETFs, and collateral services to their institutional and high-net-worth clients.

- Vietnam is launching a five-year crypto exchange pilot to reduce capital outflows and enhance local market supervision.

- The partnership between Ripple and Riyadh Bank demonstrates the increasing adoption of blockchain technology by banks in the Middle East, in line with Vision 2030.

Bitcoin adoption is moving forward as banking institutions, governments, and financial entities globally increase their interest in digital assets. Current events include U.S. banking services, Middle Eastern blockchain trials, Asian regulatory pilots, and increased exposure to bitcoin, indicating overall acceptance within the financial system.

U.S. Banks Expand Bitcoin-Linked Services

According to River’s Bitcoin Adoption Report 2025, many of the Largest U.S. Banks are starting to provide products related to Bitcoin.

Among the Largest Banks Moving into Bitcoin are JPMorgan Chase, whichhas started allowing clients to trade in Bitcoin as well as accept it as collateral for loans.

PNC Financial has officially opened custody and trading services for private customers. Wells Fargo, Goldman Sachs, and Morgan Stanley have limited custody or trading services for certain high-net-worth customers.

In January of 2026, Bank of America took a different route; it allowed its financial advisors to recommend spot Bitcoin ETFs (Exchange Traded Funds). They limit how much of that position a client can have in their overall stock portfolio, with a maximum between 1% and 4%.

As summarized by a Bitcoin Magazine X post, “This trend is showing increasing institutional confidence in future Bitcoin spot ETFs,” citing U.S. Spot Bitcoin ETFs currently hold approximately $130 billion in total assets.

Citigroup is working on offering custody services this year and will offer more cautious but continual growth from the institutional sector.

Source: x

Source: x

Ripple and Riyadh Bank Launch Blockchain Trials

Internationally, stories of Bitcoin adoption are associated with broader blockchain efforts. On 26 January 2026, Ripple agreed with Jeel, which is the technology and innovation division of the Riyadh Bank of Saudi Arabia.

By working together, Jeel and Ripple are aiming todevelop the possibility of interoperable cross-border payments, the secure custody of tokenized digital assets, and build a tokenization platform within a regulatory sandbox framework.

Riyad Bank is managing in excess of $130 billion in assets under management and is implementing Jeel as part of Saudi Vision 2030.

Reece Merrick, Vice President of Ripple, has commended the country’s plans for digital transformation. The XRP price experienced a 4% increase directly after the announcement, which indicates to market participants the positive sentiment.

CoinMarketCap tweeted about the Partnership and announced the interest banks in the Middle Eastern Region are showing.

This Partnership is aligned to the overall trend of modernising the financial setup while ensuring regulatory compliance, and banks and institutions have a role in the financial setup.

Ethereum Leads Tokenization as Institutions Accumulate Bitcoin

Tokenization is neither an isolated area in itself nor defined by a single entity, but a continuing theme of Bitcoin adoption supported by institutional infrastructure.

Ethereum has established itself as the leading platform with 61.2 % of all tokenised assets, approximately $200 billion worth, transacted on its network – reflecting the significant reliance on established blockchain rails.

As the infrastructure continues to develop, institutions will continue to accumulate Bitcoin, as evidenced by a recent report that an American Bitcoin Corp owned by the Trump family has increased its treasury by 416 BTC, bringing its total holdings to 5843 BTC, confirming the growing interest among businesses in digital assets as a long-term store of wealth.

This illustrates the relationship between Bitcoin and Ethereum – Bitcoin acts as a store of value (reserve), whilst Ethereum is the platform for the settlement and issuance of tokens for regulated entities.

Vietnam and Arizona Advance Regulatory Frameworks

In Asia, Bitcoin adoption is heavily impacted by regulatory policy decisions. Vietnam announced that it will issue five licenses for domestic cryptocurrency exchanges as part of a 5-year trial program to authorize the establishment of these businesses.

Initially, only five licenses will be granted, with Techcombank and its security-related division (TCBS) among the very first companies to apply for one of these licenses, both having met the significant capital requirement of $400 million each.

The overall strategy of the pilot program is to take action to reduce the amount of trading and money leaving the country, that is, to keep track of all transactions with sufficient control.

Vietnamese traders will be required to link their digital wallets to the licensed platform within six months.

Officials within Vietnam have reported over $230 billion worth of electronic transactions prior to June 30, 2025.

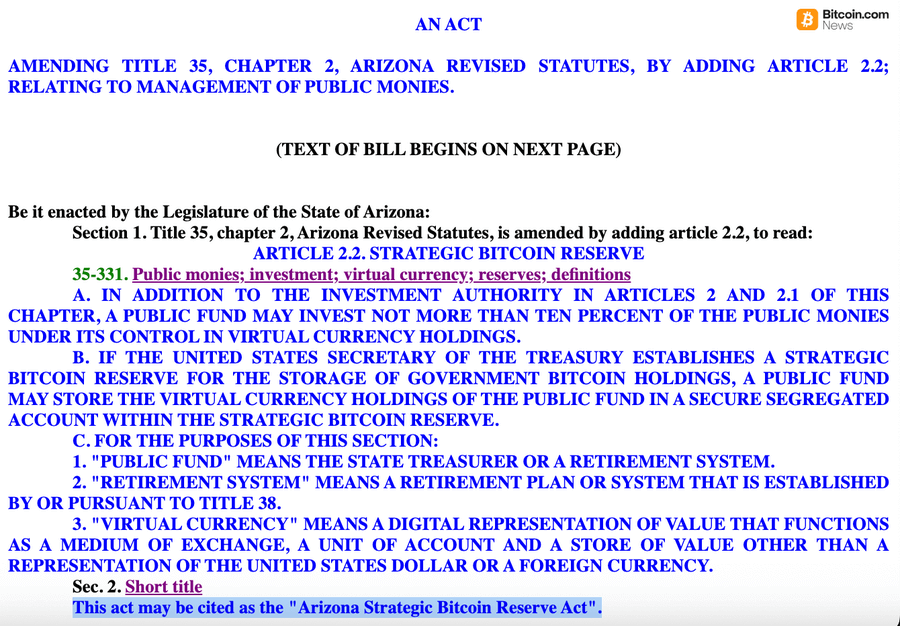

The same trend is evident in the U.S., where the Arizona Legislature has advanced two different pieces of legislation related to cryptocurrencies.

SB 1042 authorizes the State of Arizona to invest 10% of state funds into Bitcoin and other cryptocurrencies, and SB 1043 authorizes state agencies to accept cryptocurrency as a form of payment.

Both bills passed out of the Senate Finance Committee, according to reports from Bitcoin.com News.

Source; X

Source; X

Final Thoughts

In the United States, banks have begun to expand their bitcoin services very cautiously; other areas of the world, such as Asia and the Middle East, have begun testing regulated frameworks designed to support bitcoin use in their jurisdictions.

These things combined indicate that a system has been established by which Bitcoin is integrated into regulated finance. And as the system continues to evolve, it will support continued demand for bitcoin as an investment vehicle and for other purposes.