Key Insights:

- The Netherlands introduces annual taxation of unrealized gains in cryptocurrency and securities.

- Thailand’s regulatory authority is working on crypto ETFs, futures, and tokenized assets to increase institutional investment through exchanges.

- Institutional adoption goes from strength to strength with BlackRock and Ondo expanding their tokenized assets on Ethereum and Solana trading infrastructure.

Tokenized assets reshape global crypto markets in 2026

The tokenized asset class is transforming the global cryptocurrency markets as government agencies, institutional investors, and cryptocurrency exchanges begin to implement new regulatory structures around digital finance.

Europe advances stricter crypto taxation frameworks

With the introduction of a new law for the Netherlands in 2028, there will now be a taxation on unrealised gains from Bitcoin, Stocks and Bonds. The law calculates taxes annually, using the difference in value of the asset at the start and end of the year.

According to Crypto Rover: “Investors will be taxed, even if they don’t sell any of their Assets.”Additionally, all Income will be paid to the Holders to be taxed just like other types of investments.

Therefore, the taxation of Digital Assets has largely followed the Global Trends from Traditional Investment models within Europe.

It is already believed that as Digital Asset Taxation standardisation occurs across Europe, it is likely to have an effect on how many such Investments are managed by investors, which could ultimately lead to changing where or how they choose to invest in a Resource.

Thailand expands access to regulated crypto investment products

Thailand’s Securities and Exchange Commission (SEC) is developing new regulations for crypto-based ETFs, futures contracts, and tokenized assets.

The new rule framework will set up regulated exchanges and create a robust market infrastructure to allow safe, structured access to ETF trading.

ETF creators will provide simplified participation options by addressing issues with storage/security and making sure they meet local regulatory requirements.

With ETF products launching in Thailand, market makers will likely create liquidity for the market.

Since 2018, Thailand’s approach to crypto regulation has been evolving as the country attempts to create a regulatory environment for innovations while improving supervision of the industry. the regulatory body will continue to develop its regulations relating to exchanges and crypto marketing campaigns; they wish to support innovation and stimulate growth.

This initiative follows the launch of a Bitcoin ETF (spot-trading only) available to institutional investors in 2024, and officials are looking to attract more institutional investor interest while protecting individual investors with a stringent level of oversight.

Institutional capital strengthens blockchain-based finance

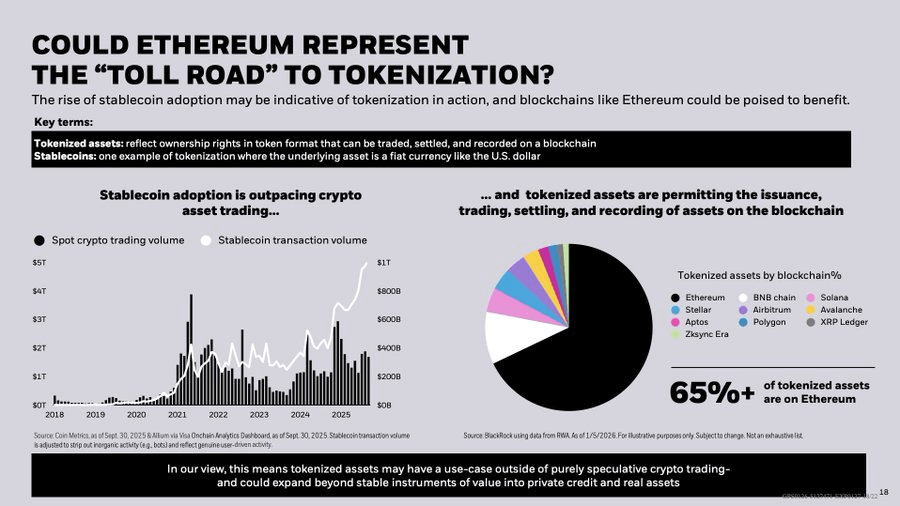

According to BlackRock’s outlook on Investment for 2026, Tokenization, along with Blockchain Technology, is one of the largest contributors to the growth of this sector.

As per their report, approximately 65% of all asset tokens on the Ethereum Network are currently in operation.

Cointelegraph also reported that since 2023, Stablecoin trading volumes have surpassed all Spot Crypto Trading volumes combined.

BUIDL (Blackrock) is currently managing $1.6bn of assets within its Ethereum BUIDL Fund (Funds managed by Blackrock).

Furthermore, the total value of tokenized markets globally now stands at approximately $21billion.

Therefore, this report indicates that many Institutional Investors are becoming increasingly comfortable using Blockchain Technology as an asset class, and that asset managers now consider utilizing distributed networks as viable operational avenues rather than a technology experiment only.

Source: X

On-chain equities accelerate adoption across global markets

According to Joshua Jake, Ondo Finance has released over 200 tokenized real-world assets, which include stocks from major U.S. companies.

As a result of these developments, tokenized asset activity on the Solana network increased significantly.

Additionally, because of the increased ability to trade through decentralized exchanges, the amount of trading of equities on-chain rose in tandem with access to those services.

Tokenized equities have provided many market participants with the capability of owning smaller pieces of investments while at the same time being able to access them at all hours.

They also represent new ways to settle and liquidate traditional equity assets using blockchain technology.

On-chain Equities also provide a way for users to participate in both traditional and digital markets while offering advantages such as access to quicker settlements and maintaining the ability to view assets in their original form.

Final thoughts

As tokenized assets continue to be instrumental in determining the evolution of markets through regulations, infrastructure, and the participation of individuals and organizations.

Governments are developing tax laws, regulators have begun to open up investment channels for individuals and institutions alike, and asset managers are working to use the blockchain to its fullest capability.