Key Insights

- Nansen AI trading allows its users to trade crypto with chat prompts using live on-chain data.

- The system interprets wallets and flows, and it must be approved by a user before execution.

- Base and Solana have self-custody aided by Trading through Nansen Wallet.

Nansen AI-powered trading has moved beyond analytics with the launch of a conversational trading feature across the company’s web and mobile products, marking a shift toward direct trade execution linked to real-time on-chain intelligence.

Nansen AI-powered trading introduces conversational execution.

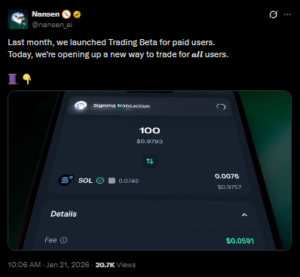

The update, announced on Wednesday, enables users to initiate and complete crypto trades via natural-language prompts rather than traditional charts or order books, according to the company.

Under the new system, users can place trades by typing conversational commands into Nansen’s mobile application. The interface interprets these requests using live on-chain data before presenting execution options.

Rather than automating trades end-to-end, the platform emphasizes user confirmation before completion, the company said.

Moreover, the feature also integrates on-chain signal analysis before execution. Nansen AI reviews wallet activity, token flows, and network-level behavior to generate data-backed insights intended to inform trading decisions.

Source: Nansen

This workflow, referred to internally as “vibe trading,” links analysis and execution within a single interface while stopping short of autonomous decision-making.

Trading is conducted through the embedded Nansen Wallet, which is powered by Privy’s self-custodied wallet infrastructure. According to the company, this setup allows users to trade without relinquishing custody of their assets.

Network support and execution partners

At launch, Nansen AI-powered trading supports activity on Base and Solana. The company stated that it plans additional blockchain networks but did not provide a timeline.

However, cross-chain execution is carried out in collaboration with the decentralized exchange Jupiter, the centralized exchange OKX, and the cross-chain protocol LI.FI.

These integrations will enable token swaps and cross-network routing across supported networks, enabling the platform to expand coverage without building native liquidity infrastructure.

Nansen stated that the partners will facilitate broader network access as support is added.

Trading access is currently limited by jurisdiction. The company stated the feature is unavailable in several regions, including Singapore, Cuba, Iran, North Korea, Syria, Russia, and parts of Ukraine, citing regulatory requirements.

Additionally, eligibility is determined at the account level, and access restrictions apply across both web and mobile interfaces.

Dataset-driven AI and comparative claims

A central component of Nansen AI-powered trading is the firm’s proprietary on-chain dataset.

Nansen said its database includes more than 500 million labelled blockchain wallet addresses used to identify behavior patterns, track capital flows, and generate trading signals.

According to Nansen, this dataset allows its AI agents to perform tasks such as wallet identification, token discovery, due diligence, and portfolio analysis with higher accuracy than general-purpose AI systems.

The company stated that its agents achieved quality scores above 85% in internal “Expert Mode” testing focused on on-chain analysis, compared with lower scores attributed to broader large language models.

Nansen co-founder and CEO Alex Svanevik said the platform relies on foundational AI models that are fine-tuned with blockchain-specific data. He stated that standard language models require additional tooling to accurately interpret wallet labelling and trading behaviour.

The company compared its system to general-purpose AI tools such as Google’s Gemini and OpenAI’s ChatGPT, stating that those systems are not designed to understand on-chain datasets natively without customization.

Positioning within broader AI trading activity

The launch comes amid broader experimentation with AI-assisted trading across the crypto sector. Firms are starting to experiment with conversational interfaces and automated analytics to minimize friction to retail participation, especially as the volume of blockchain data grows.

In one autonomous trading competition in China, lower-cost Chinese models, including QWEN3 MAX and DeepSeek, produced stronger results than several higher-profile systems. QWEN3 MAX was reported as the only model in that test to generate positive returns.

Nansen did not disclose whether those models are used within its own platform. The company said its system combines foundational models with proprietary data and internal tooling tailored specifically for crypto markets.

Control framework and product availability

While Nansen AI-powered trading introduces conversational execution, the company emphasized that users retain control at every stage of the process. Fully autonomous trading features are expected to become available starting Wednesday for eligible users, subject to regional restrictions.

Henri Stern, co-founder and CEO of Privy, stated that the integration enables immediate trade execution while maintaining self-custody via embedded wallet infrastructure. Nansen confirmed that trading is now available to approved users through both the mobile application and a web-based trading terminal.

The company stated that the product is designed to close the gap between analysis and execution by allowing users to act on insights within the same environment where those insights are generated.