Key Insights:

- NYSE will operate a separate digital venue offering continuous trading and on-chain settlement for tokenized stocks.

- Investors retain dividends and voting rights while trading tokenized stocks through blockchain-based infrastructure.

- BNY and Citi will support tokenized cash, collateral movement, and funding beyond traditional banking hours.

Tokenized stocks are moving closer to mainstream finance as the New York Stock Exchange develops a new blockchain-based trading platform. The system supports continuous trading, instant settlement, and stablecoin funding, while maintaining shareholder rights under established regulatory standards.

Why Is NYSE Launching a New Digital Trading Platform?

What will 24/7 trading mean for global investors?

The New York Stock Exchange confirmed it is building a dedicated platform for trading tokenized securities.

The venue will operate separately from the traditional exchange, rather than modifying existing market infrastructure. Trading will run continuously, without standard market opening or closing hours.

The platform will support tokenized U.S. stocks and exchange-traded funds with on-chain settlement.

Investors will retain ownership rights, including dividends and voting participation. Settlement will occur instantly, replacing the current T+1 settlement model used in equity markets.

According to the NYSE, its Pillar matching engine will integrate with blockchain-based post-trade solutions.

The structure of the engine allows for orders to be sized in dollars and funded by stablecoins and will help create a complete digital workflow encompassing trading, clearing, and settlement.

What Do Industry Experts Say About This Move?

Market participants provided additional details following the announcement. Bull Theory’s post indicated that the platform offers fractional access for digital securities and ongoing trading.

The post also suggested that this effort is not about recreating the way cryptocurrencies are traded but rather the adoption of blockchain technology by traditional financial institutions.

Simon Taylor shared a similar perspective to Bull Theory, stating in a post on his X account that this is a completely new trading venue.

He explained how the NYSE will issue securities as digital instruments natively. He also made it clear that both traditional and digital exchanges would operate concurrently on the NYSE.

By analyzing the NYSE’s approach to the tokenization of existing assets against other similar projects currently in the market, it was noted that the NYSE has made significant progress by developing all three components of issuance, trading, and settlement on-chain.

How Will Banking Partners Support the Platform?

The Exchange is working with several large banks, including BNY and Citi, to support tokenized deposits, manage collateral, and transfer funds over various time zones.

This setup enables trading to happen outside of traditional banking hours. While many blockchain networks will settle using the Exchange, no specific information was provided about which ones will be supported by the NYSE.

According to the NYSE, they will continue to offer the same levels of regulatory protection as currently required, and before proceeding with development, they will need to obtain the proper regulatory approvals.

No timeline for launch has been given; however, ICE confirmed that this development is consistent with their overall strategy to create on-chain market infrastructure, combining current trust frameworks and digital settlement efficiencies.

Broader Market Context and Capital Flows

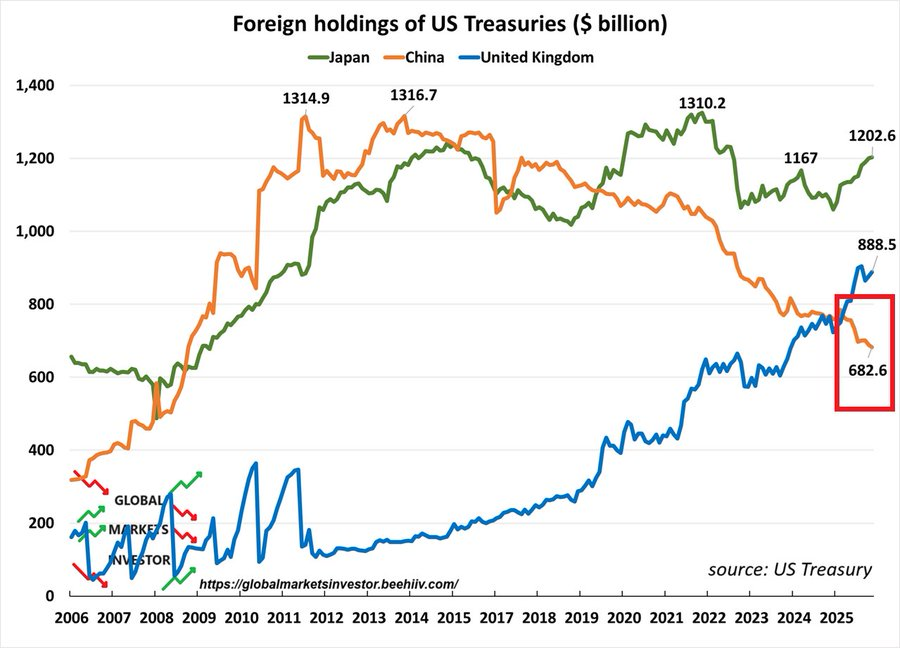

As global capital markets adjust to recent structural changes, the news comes out that China sold a reported $6.1 billion worth of American treasury bonds in November.

This is the lowest level of American treasury bond holdings for China since 2008.

According to Global Markets Investor’s blog post, China has sold over $76 billion of American treasury bonds since the beginning of 2025.

This information indicates that there have been shifts in the global allocation strategies of the major holders of American debt.

Source: X

Source: X

The same patterns and trends provide a broader context for the increasing demand for alternative infrastructure within financial markets.

Tokenized stocks are drawing attention in financial markets as well; several firms have recently released a series of limited offerings and are now preparing to enter the market space. The NYSE’s platform is a major exchange being placed at the forefront of this transition.

Final Thoughts

With the initiation of a dedicated blockchain trading platform, the New York Stock Exchange has begun transitioning to a new form of Market Structure.

Supporting Tokenized Stocks on the Blockchain in a Continuous Trading Environment with Instant Settlement helps to align the market’s existing safeguard protocols and regulatory processes with their Digital platforms.

While also creating new opportunities for investors by allowing for access to a broader range of assets, while continuing to provide regulatory Oversight and ensuring operational stability.