Key Insights

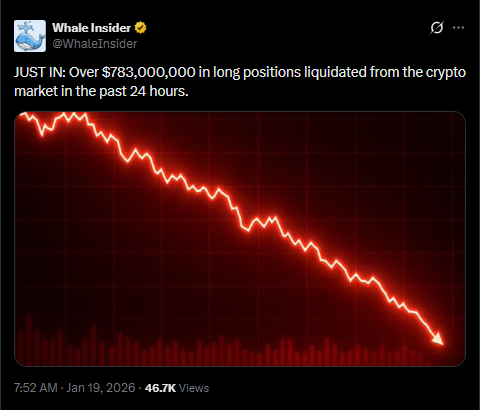

- Bitcoin market liquidations wiped out more than $738 million as prices fell during the Asian trading session.

- The value of the cryptocurrency markets fell 2.8%, with Bitcoin and other altcoins experiencing losses.

- Options open interest was higher than futures open interest, indicating lower liquidation risk.

The liquidation of Bitcoin markets was a dominant theme in early Asian markets, as traders liquidated leveraged crypto derivatives contracts worth over $738 million. The move unfolded during a period of reduced liquidity, with U.S. equity and bond markets closed for the Martin Luther King Jr. holiday and global policymakers convening in Davos for the World Economic Forum.

Bitcoin Market Liquidation Strikes Thin International Trading

The sell-off was also accompanied by increased geopolitical tensions since U.S. President Donald Trump threatened to demand tariffs, which caused macro pressure on already crowded crypto positioning.

CoinMarketCap reported that the cryptocurrency market capitalization fell by 2.8% in the past 24 hours to reach $3.26 trillion. The aggregate market value has fallen by over $111 billion since last Thursday, underscoring the magnitude of the liquidation-driven pullback.

On the weekend, President Trump announced that a 10% export duty would be levied on eight nations that resisted the U.S. plan to assume control of Greenland. The announcement was made only a few days before Trump is likely to appear at the World Economic Forum in Davos.

The tariff threat intensified fears of another trade war between the U.S. and the EU, which was accompanied by a sell-off in the crypto market. Moreover, market participants changed their exposure as geopolitical risk rose and participation in the conventional financial markets declined.

Derivatives Deleveraging After Months of Risk Minimalization

Bitcoin futures open interest (OI), a metric that quantifies the number of open leverage contracts, has declined sharply since October.

CryptoQuant analyst Darkfost reported that Bitcoin futures OI has crashed by 17.5% over the last three months, from 381,000 BTC to 314,000 BTC. This fall has been accompanied by a 36% price correction since the beginning of October, signaling a period of risk aversion and deleveraging.

Despite the recent liquidation, futures OI has risen nearly 13% since the start of the year. Coinglass data shows that notional futures OI increased from an eight-month low of $54 billion on January 1 to more than $61 billion by January 19, and reached an eight-week high of $66 billion on January 15.

Darkfost noted that current data indicate a gradual recovery in open interest, suggesting a measured return of risk participation rather than aggressive leverage accumulation. Futures OI, however, remains approximately 33% below its all-time high of $92 billion recorded in early October.

Options Open Interest Surpasses Futures

Another structural shift in derivatives markets emerged alongside the Bitcoin market liquidation. Bitcoin options open interest has overtaken futures open interest, according to observations from Coin Bureau co-founder and CEO Nic Puckrin.

Checkonchain data shows aggregate Bitcoin options OI across exchanges at approximately $75 billion, compared with $61 billion in futures OI. Based on Deribit data, the largest open interest is at the $100,000 strike price, where the contracts are valued at approximately $ 2 billion.

The move implies that the larger participants in the market are employing more options strategies, such as hedging and expiration mechanisms, rather than using directional leverage as a primary driver.

Derivatives Market Reset After Loss in Leverage

The recent Bitcoin market liquidation wiped out a large amount of short-term leverage, especially among traders who had taken on near-term positions.

Futures open interest data show that while participation has begun to recover modestly in January, the market remains well below prior leverage peaks.

Source: Whale Insider(X)

The dominance of options over futures highlights a change in how exposure is being expressed. Options contracts do not trigger liquidation cascades in the same manner as futures, which can amplify price moves during sharp corrections.

As of Monday, Bitcoin futures and options data indicate the market has undergone a substantial reset compared with late 2024. The liquidation event, coupled with months of declining derivatives exposure, suggests a market operating with less leverage than it used to.