Key Insights

- Bitcoin market sentiment is neutral, with market price stability continuing, accompanied by consistent ETF inflows and cautious market activity.

- Liquidity expectations made headlines following announcements about injections of Fed dollars and forecasts of capital expansion.

- Institutional demand remained robust with heavy inflows into Bitcoin ETFs, and mainstream adoption continued to drive practical applications.

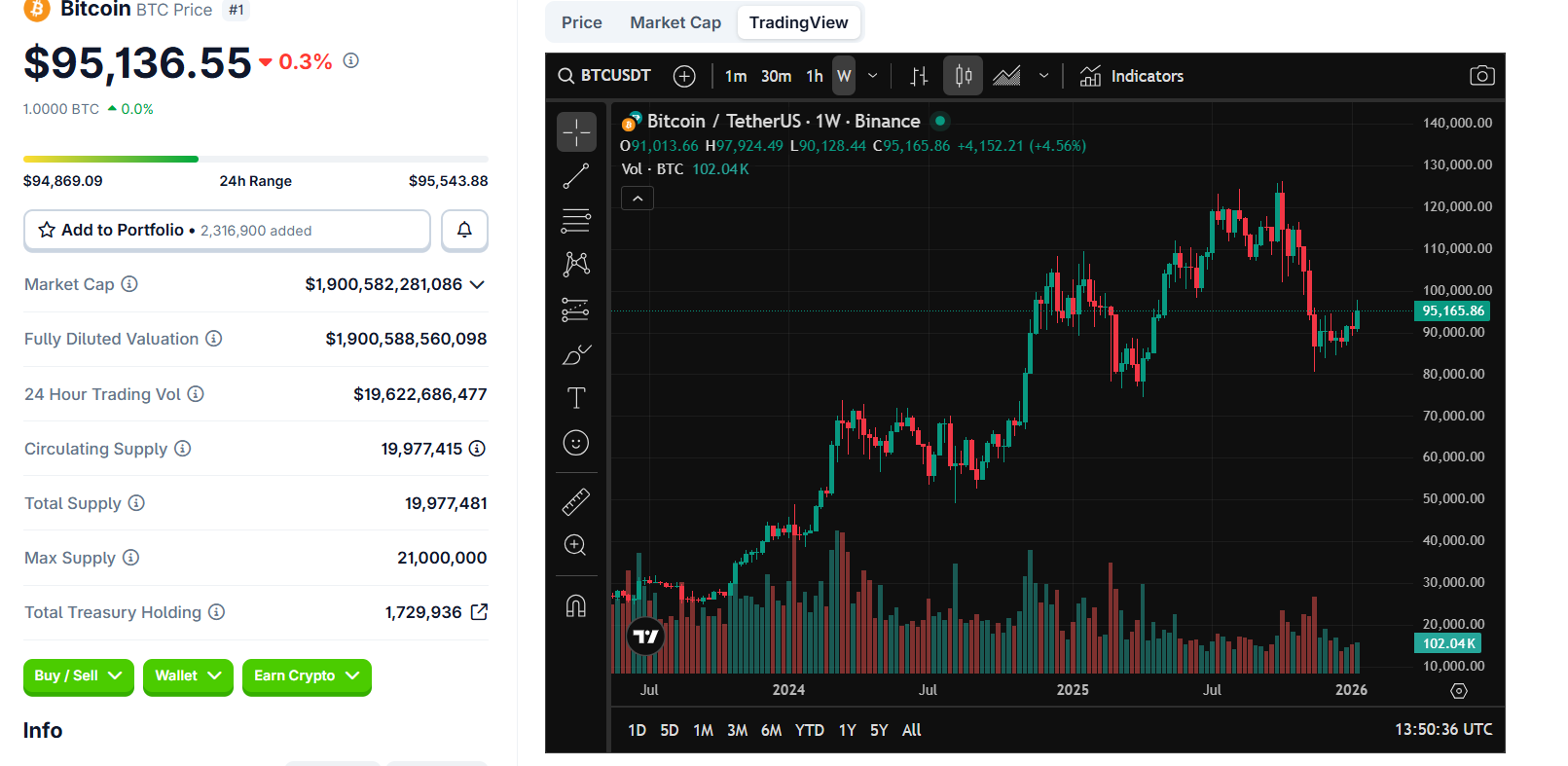

Bitcoin market sentiment remained stable during trading in the range of approximately $95,000, balancing neutral investor sentiments, liquidity forecasts, and institutional demands. Although price movement appeared cautious, market structure continued to evolve and develop due to ETF flows and activity by corporations.

Balanced Bitcoin Market Sentiment Keeps Prices Stable

According to Crypto Town Hall, the Crypto Fear and Greed Index currently stands at 49, indicating a neutral sentiment for the overall crypto market.

Consequently, traders continue to take a slow, methodical approach to the macroeconomic developments and the recent price action of Bitcoin.

Such sentiment often mirrors accumulation/consolidation phases, where Bitcoin has traded within a relatively limited range and indicates lowered speculative activity and overall calmer trading.

It appears that the vast majority of crypto market participants are currently waiting for confirmation instead of momentum.

As a result, market sentiment for Bitcoin has remained unchanged in spite of external headlines and short-term fluctuations in price.

ETF activity is continuing to serve as an anchor for the volatility of cryptocurrencies, as the constant inflow of interest is maintaining interest in Bitcoin and other cryptocurrencies, even though general market enthusiasm is still low.

Liquidity Expectations Draw Market Attention

Gordon Gekko has recently tweeted that the Federal Reserve is going to inject an additional $55.3 billion into the economy in the next three weeks.

Instead of traditional monetary policy measures, Gekko indicates that this will be a direct injection of liquidity into financial markets.

Every major thing we do in investing usually stems from liquidity expectations. When investors believe that they will have access to capital (liquidity) without the government controlling the amount, they start selling to adjust their risk levels.

The Bank of America (BoA) forecasts a liquidity injection of $600 billion this year based on an understanding of how the Federal Reserve has aligned its policy with the increase in capital available in the market.

Despite the above statements regarding liquidity expectations, trading activity has remained orderly so far today.

Market participants have not reacted aggressively to changes in prices in Bitcoin and instead are waiting patiently for confirmation that this higher level of liquidity exists.

Corporate Bitcoin Adoption Supports Market Structure

Steak ‘n Shake has announced plans to purchase $10 million worth of Bitcoin for its corporate treasury after accepting and receiving Lightning Network payments for several months.

The company reported that they have seen increases in its same-store sales due to the introduction of Bitcoin payment options.

All payments made via Bitcoin will be placed in the Strategic Bitcoin Reserve rather than being converted to cash, and the company’s transaction fees are lower than those associated with other payment methods.

The estimated 105 BTC purchase represents the company’s initial public treasury investment in Bitcoin, and it is reported that double-digit sales growth has been experienced since the acceptance of Bitcoin payments began.

Corporate acceptance of Bitcoin provides a base for the Bitcoin market. Visibility into actual use of Bitcoin, which goes beyond just being an investment vehicle, toward creating more favourable market sentiment for Bitcoin.

ETF Flows and Price Levels Guide Positioning

Bitcoin market sentiment appears to be steady because of the recent growth in Bitcoin ETF inflows, which totalled $1.42 billion over the past week. This is the highest weekly inflow recorded since October 2025.

Although the majority of ETF inflows tend to indicate longer-term investment strategies, analysts believe these volatile inflows were primarily due to overall investor demand for Bitcoin.

Over the past week, relative price consolidation of Bitcoin has been maintained despite relatively little price increase from its highs of more than $120,000, with Bitcoin being priced at approximately $95,136 and continuing to maintain a significant psychological level above $95,000.

The prior week saw the price of Bitcoin consolidate within this range as investors continued to purchase Bitcoin.

Many analysts believe this continued demand for Bitcoin will continue as BTC moves closer to the support levels of $90,000 and $85,000 and the resistance levels of $100,000.

Source: Coingecko

Changpeng Zhao, the founder of Binance, recently stated in a video that the 2026 cycle may be the test of the traditional models of cycles within cryptocurrency.

Changpeng Zhao attributes the continued growth of Bitcoin ETFs to policymakers and regulated agencies aligning their policies to promote Bitcoin while bringing forth renewed institutional investment activities to promote Bitcoin as a store of value.

Bitcoin market sentiment continues to be supported by the influx of institutional funds, increasing corporate adoption, and anticipation of increased liquidity from the entry of Bitcoin ETFs.