Key Insights

- Ethereum Staking has surpassed 36 million ETH, representing approximately 30% of the total supply, thus resulting in decreased liquidity available in the market

- Currently, ETH is trading at approximately $3300 with bullish support present; resistance is found near $3400, restricting any upward movement.

- Treasury Debt Buybacks continue to add liquidity to support Risk Assets as Ethereum consolidates within a much tighter daily range.

Ethereum has recently been in a crucial trading zone due, in part, to significant increases in staking volume and the continuing gradual improvement of liquidity on the blockchain. Stakeholders are currently attempting to determine if the current price will reconnect with the immediate area of resistance. If it finds support at a lower level, it will ultimately influence predictions related to the near-term price movement of Ethereum in both spot and derivative markets.

Ethereum Staking Growth Reshapes Market Supply

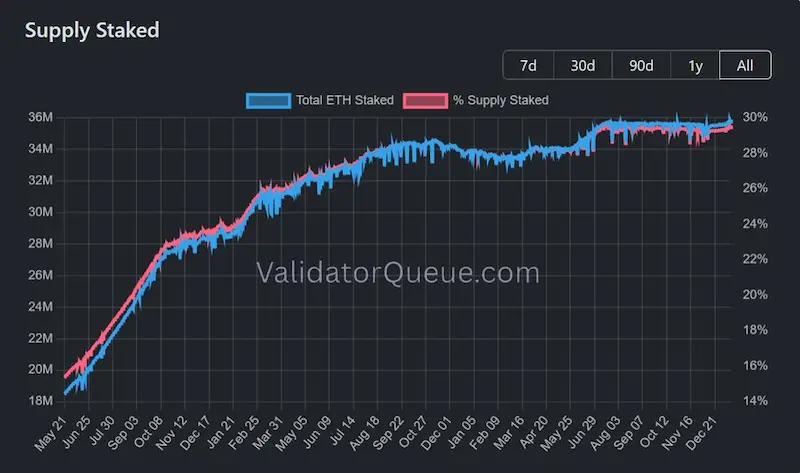

Coin Bureau released some new statistics on Ethereum staking, showing it reached another record level, topping 36 million ETH staked.

This means that about 30% of the asset circulating supply is now “locked up” in the proof-of-stake system, and therefore not available as liquid to sell on the exchanges.

The continued increase in staked ETH has occurred consistently without any significant declines since approximately mid-2023.

There have been very few validator excisions, which suggests that most validators are taking a long-term approach with their investments rather than trying to capture short-term interest rate profits.

Continuous increases in the amount of staked ETH will also reduce the volume of available tradable Ethereum during times of increased market demand, which directly impacts ETH price predictions.

Staking activity is an indicator of confidence in both the security and sustainability of the Ethereum Network.

The fact that the amount of ETH being staked will keep increasing will mean that the market is reacting more strongly due to demand as the amount of liquid ETH becomes even lower, particularly at price points where there is strong technical volume.

Ethereum staking hits new highs as over 36M ETH locks supply, reinforcing long-term network security and bullish fundamentals. Source: X

Ethereum staking hits new highs as over 36M ETH locks supply, reinforcing long-term network security and bullish fundamentals. Source: X

Liquidity Signals Support Risk Assets

A different market signal emerged after CryptosRus commented on U.S. Treasury bond purchases.

The Treasury quietly purchased approximately $2 billion of its own bonds and pushed liquidity into the financial system, which typically provides liquidity support for assets that carry risk (such as Digital Assets) when they are in consolidation.

Liquidity moves tend to alleviate pressure on funding and help reduce downward movements.

This liquidity environment helps establish the assumptions for short-term pricing models based on macro liquidity adjustments.

Historically, Crypto Market Liquidity will benefit the Market as it gradually improves. Currently, Ethereum has a range of near-future price structures built on the premise of caution rather than panic.

The upcoming weeks will tell us whether or not the liquidity support will align with some kind of technical breakout in the upcoming weeks.

ETH Price Struggles Near Key Resistance

Ted Pillows has provided some technical commentary indicating that Ethereum has struggled to reclaim the $3,400 area of resistance.

Multiple daily charts illustrate that this was and continues to be an area of short-term resistance, as evidenced by intraday rejections.

The inability to regain the $3,400 resistance area has left it vulnerable to further testing of the critical support area around $3,200.

In the most recent pullbacks, the $3,200 support level has held up, preventing more extensive declines in price.

Thus, to any near-term determination of price direction for Ethereum, the $3,400 and $3,200 support and resistance areas will remain critical.

The price structure continues to display lower highs from previous peaks, thereby confirming continued bearish pressure that has not yet been fully resolved.

However, selling pressure has begun to ease. The market will need to establish a solid footing above $3,400 for any kind of directional signal.

Source: X

Source: X

Technical Structure Signals Decision Phase

When looking at the daily ETH/USD price charts, we see that Ethereum is currently trading within the higher end of a defined pattern consolidating between 2 areas.

According to Bollinger Bands, volatility is increasing due to previous compression. Historically, the increased volatility leads to directional expansion.

The support level ($3,180) corresponds with both the Bollinger band basis and previous areas of consolidation.

However, the higher range of resistance $3,380 to $3,400 is the upper band, which creates a greater chance for rejection of prices at this level. The above technical levels define the current projections for Ethereum.

The technical momentum indicators indicate an early indication of a potential increase in short-term strength for ethereum price prediction.

However, momentum can only be confirmed once the price has closed above the resistance level daily. Until then, the current expectation of ETH will remain range-bound.

Source: TradingView

Source: TradingView

Final Thoughts

Ethereum continues to sit between strong support levels and strong resistance above. More than 15 million ETH have been staked, reducing liquidity, while market liquidity conditions are providing a neutral environment.

Short-term Ethereum price prediction will depend on reclaiming significant resistance or maintaining the existing support level while traders monitor every price action as it slowly creates volatility.