Key Insights:

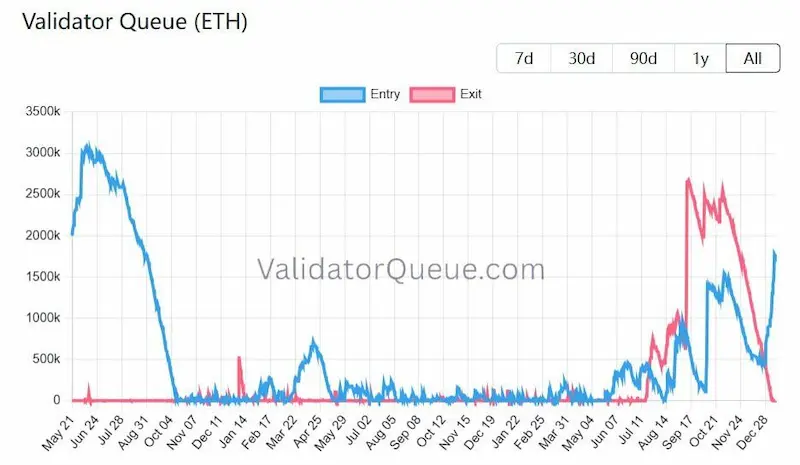

- Ethereum validator queue reached 1.759 million ETH, extending activation waits to about thirty days networkwide.

- The validator exit queue fell to zero, indicating that withdrawals slowed while staking participation remained broadly stable.

- Institutional staking activity increased, with large allocations supporting steady entry growth despite sideways ETH price action.

Ethereum staking has experienced a revival with many more validators entering than leaving, according to on-chain data indicating increased activation times, consistent withdrawal behaviour, and price consolidation around significant resistance and support levels, which all demonstrate changing trends in how people are participating on Ethereum.

Ethereum Validator Queue Shows Renewed Entry Pressure

Ethereum validator queue growth is currently 1.759 million ETH. This is the highest it has been since the end of August 2023. The increase is due to constant deposits from institutional and individual investors alike.

Validator activation is restricted by network rules based on the number of validators activated per epoch, so the increased demand for validator activation causes an increase in wait time.

The length of time until a validator is activated is estimated to be around 30 days, with several more hours of delay. All validators will have the same wait time irrespective of their size or structure.

The continued growth in the Ethereum validator queue indicates that those who are entering the queue are anticipating the receipt of rewards in the future.

The continual accumulation of entries indicates that staking is being thought of as a secure long-term position and not just one that is being viewed as a speculative opportunity.

Exit Activity Declines as Withdrawal Pressure Eases

Currently, there are zero validators in the exit queue for their exit from the Ethereum network due to no requests being processed.

This suggests that withdrawal request processing has completely caught up with demand for exit from the Ethereum network.

The validator exit queue is typically larger when there is volatility in the price of Ether (ETH) or a lack of confidence for existing stakers.

The cleared exit validator queue indicates that existing stakers within the Ethereum network have stabilized their behavior with the addition of new validators entering the network.

With entry demand increasing and the exit demand decreasing, the exit validator queue indicates the lack of sell-side pressure from validators exiting the network with unstacked ETH.

Reducing the number of validators exiting the Ethereum network reduces potential liquidity risks. Fewer existing validators result in a more limited circulating supply of ETH.

Balance in the Ethereum network supports orderly participation of validators within the Ethereum network without requiring forced exits.

Institutional Staking Adds Support to Entry Growth

Demand for new participants in the Ethereum network is also being driven by large stakes that are being added to the network.

In a recent article from Pushpendra Singh Digital, we learned that Bitmine has added 49,088 ETH to its staking operations. As such, Bitmine’s total ETH Staked is now equal to 593,152 ETH or $1.85 billion.

The addition of such large stakes also shows us that the number of Validators will continue to grow at a steady rate.

Institutional Staking has a Longer Planning Cycle than regular staking, so it tends to be less affected by sudden fluctuations in value.

In addition, these larger stakes appear to be consistent with the longer timeframes for activating miners on the Ethereum Network at this time.

In addition, having larger stakeholder groups increases the likelihood of the continued predictability of queue growth and gives investors more confidence in the staking system of Ethereum, despite having periodic price dips followed by uncertain times in the entire market.

ETH Price Consolidates Near Key Technical Zones

As staking rights on the Ethereum network continue to develop, so too does the overall price of ETH, which, thus far, has maintained a very narrow price range between approximately $2,950.00-$3,300.00 with significant downward movement from prior peaks.

The price has continued to see pressure due to selling activity against the upper boundary of this range.

Recent activity has also demonstrated support in the $3,000.00 area. Trader Ted Pillow posted on his social media account that ETH’s price has continued to remain stagnant, while he continues to monitor volatility tied to international events.

He indicated that as long as ETH remains above $3,000.00, there is potential for the price to continue higher.

Traders continue to closely monitor the interplay between changes in ETH’s price behavior and the Ethereum validation queue.

A consistent trading pattern, combined with increasing entrants into the validation queue, is indicative of solid value in the market, despite little upward movement in price at this time.

Traders continue to monitor the potential for either a breakout above existing resistance or a fall below existing support to provide additional insight regarding future prices.