Key Insights

- ADA trades near the $0.38 support zone as futures activity continues to dominate short-term price movement.

- Nasdaq Crypto Index inclusion confirms Cardano meets institutional standards for liquidity, custody, and market integrity.

- Grayscale’s Smart Contract Fund lists ADA as its third-largest holding, reinforcing sustained institutional portfolio exposure.

Nasdaq Crypto Index intake and renewed institutional participation through Grayscale have led to greater market focus on Cardano. Although its derivatives activity has influenced near-term pricing trends for ADA, Cardano price analysis remains under some short-term selling pressure; it is presently testing several significant support zones on the 4-hour time frame chart.

ADA Price Action Remains Under Pressure

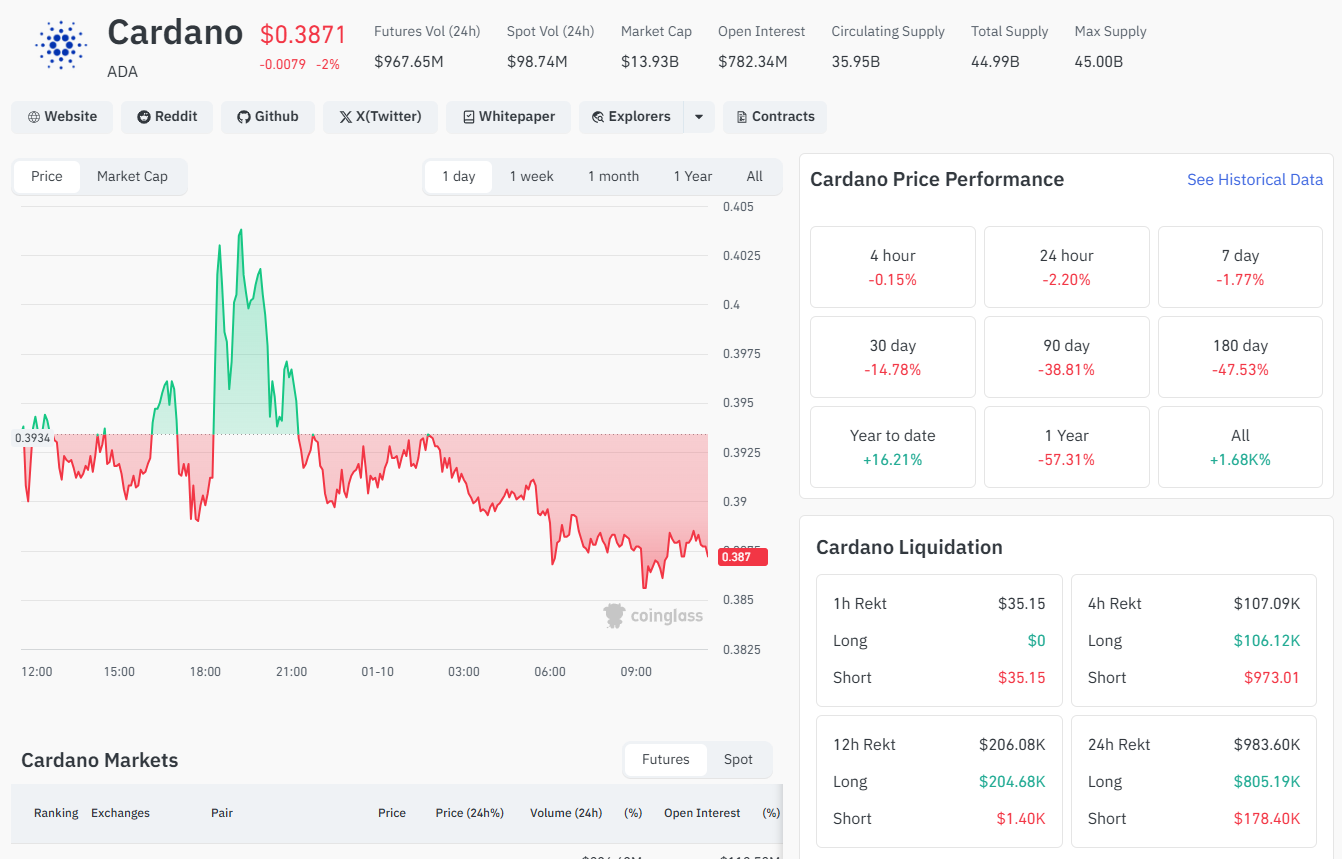

As of this writing, Cardano ADA price analysis shows that the current ADA Price is trading near $0.387, after the Price was rejected earlier near $0.40.

Therefore, the current 4-hour structure is showing that ADA is creating Lower Highs and has rejected from the $0.42-$0.43 region.

The compression in the current price indicates that traders are cautious about any price movement back to support.

The last few candles, in recent trading sessions, indicate the volatility in this market has decreased, and the Price of ADA is currently around the Lower Bollinger band.

At the moment, we continue to observe sell pressure on this market, and to an extent, the momentum has been becoming exhausted. Volatility is anticipated to peak due to the current compression of prices.

With the Bollinger Bands remaining slightly contracted, and with the Middle Band located at approximately $0.3966, which is acting as Resistance, the price of ADA continues to struggle below this level. A sustained push above this area would indicate less selling pressure on ADA Price.

ADA consolidates near $0.38 support as bearish momentum persists, with Bollinger Bands signaling potential volatility expansion. (TradingView)

ADA consolidates near $0.38 support as bearish momentum persists, with Bollinger Bands signaling potential volatility expansion. (TradingView)

Futures Activity Shapes Short-Term Market Direction

The analysis of ADA’s price also indicates a disparity between the dominance of futures in the market versus spot trades. The futures volume almost reached $968 million, while the spot trading volume was under $100 million.

This implies that leveraged traders are responsible for driving the vast majority of short-term market movements.

While prices continue to decline, open interest has stayed high at approximately $782 million. Therefore, traders have left their positions open due to expecting to see more price movement before deciding when to exit their trades.

Continued long liquidations have shown that a de-risking process has taken place on the derivatives market.

The liquidation numbers indicate there is still substantial pressure for long trades over several different time frames. In the last 24 hours, long trades represented the majority of the forced liquidations. This trend has verified that the market continues to have a cautious outlook based on trading below critical resistance levels.

ADA trades near $0.387 as futures-led selling pressures price, with heavy long liquidations reinforcing short-term bearish momentum. (CoinGlass)

Institutional Recognition Supports Long-Term Visibility

Cardano gained institutional exposure through its inclusion in the Nasdaq Crypto Index, in addition to its price movement. Dave (@ItsDave_ADA) shared that ADA now meets Nasdaq’s minimum requirements for liquidity, custody, and integrity of the market for digital assets. Cardano is supported by three primary exchanges: Coinbase, Kraken, and Bitstamp.

Inclusion of Cardano into the Nasdaq Crypto Index places Cardano next to other liquid digital assets that are tracked by institutional benchmarks.

This further increases the trust and confidence that exists in the market for Cardano due to the custodial services of companies like Fidelity, BitGo, and Gemini, as well as the increased institutional interest that results from its inclusion in the Nasdaq Crypto Index.

The inclusion of Cardano into a group of digital assets that are tracked by institutional benchmarks does not provide immediate trading opportunities for Cardano.

However, it provides further support for Cardano’s positioning within regulated investment structures. All market participants will continue to monitor how this newly acquired institutional exposure works in concert with the overall sentiment of the market for Cardano.

Grayscale Exposure Adds to Market Attention

Cardano (ADA) price analysis is being evaluated due to renewed interest from many investment companies. According to The Angry Crypto Show, Grayscale recently added Cardano to their Smart Contract Fund as the 3rd largest holding in the portfolio, which represents 18.55% of the total investment in Shares.

This investment shows that ADA is an attractive asset for investors to include within a diversified portfolio of smart contracts. Grayscale’s current holding of ADA is more a reflection of their strategic allocation than with respect to price predictions.

The structure of this fund illustrates Grayscale’s view of the importance of networks in the overall smart contract marketplace.

In spite of this positive news, the price of ADA is still mainly influenced by its technical levels. Investors have been monitoring the $0.38 support level, and if this level breaks down, it potentially sends prices towards the mid-$0.36 region.