Key Insights

- Riot Platforms sold 1,818 bitcoin in December, even as monthly production rose.

- Holdings declined to 18,005 BTC with hashprice remaining close to five-year lows.

- Miners face pressure after halving, while some pivot toward AI data centers.

Riot Platforms’ bitcoin sell-off activity reached a record level in December, as the U.S.-listed mining company liquidated $161.6 million worth of Bitcoin during the month, according to its latest production and operations update released on Jan. 6.

The move represented the largest monthly BTC sale in the company’s history, reflecting mounting pressure from deteriorating mining economics, despite Riot reporting higher Bitcoin production compared to November.

Production rises while holdings decline

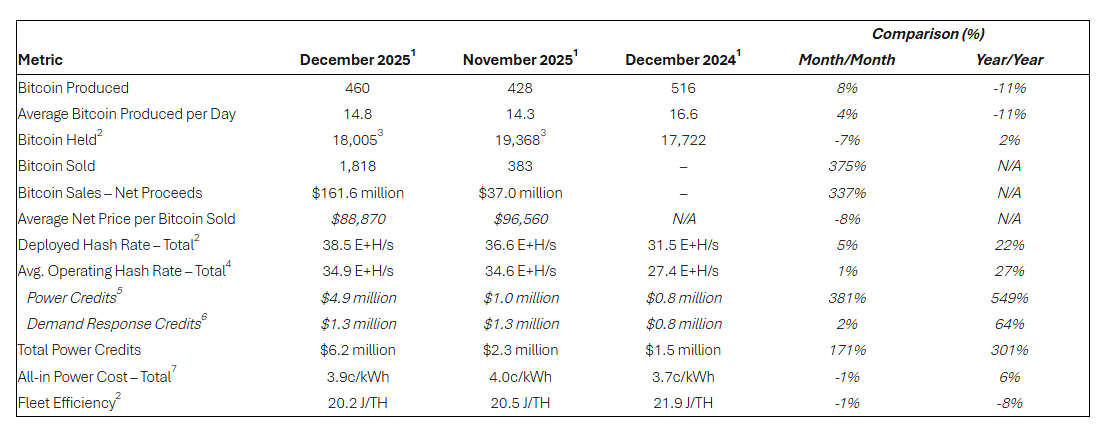

During December, Riot Platforms produced 460 Bitcoin, up month over month, yet sold 1,818 BTC at an average net price of $88,870. The volume sold was nearly four times the amount mined during the period.

According to an announcement on Tuesday, Riot stated that the December sales represented a 375% increase from November and reduced total Bitcoin holdings to 18,005 BTC as of December 31, down from more than 19,300 at the end of the prior month.

Source: Riot Platforms

Source: Riot Platforms

Of the Bitcoin held at year-end, 3,977 BTC were classified as restricted. According to Riot’s regulatory filings, restricted Bitcoin refers to assets owned by the company but pledged as collateral under debt facilities and held in segregated custody accounts.

The decline in total holdings occurred despite a slight increase in average daily production, which rose to 14.8 BTC in December.

The deployed hash rate of Riot rose to 38.5 exahash per second in the month, equivalent to a 22% annual growth, and its average operating hash rate rose to 34.9 EH/s.

The efficiency of the fleet has also increased, and the energy consumption has dropped to 20.2 joules per terahash, compared to 21.9 joules per terahash a year ago.

Hashprice pressure and network conditions

The Riot Platforms bitcoin sell-off coincided with hashprice levels hovering near $37 per petahash per second, close to a five-year low.

Hashprice is a measure of the expected price of miners’ income per unit of computational power. As such, it has been under strain due to both high network difficulty and continued increases in hashrate.

Despite a rise in the price of Bitcoin on the market in 2025, growing competition among miners diluted per-unit returns.

Moreover, Glassnode data revealed that the total network hashrate had decreased from approximately 1.1 zettahash per second to only slightly above 1 ZH/s, indicating that some miners have started to reduce their operations or leave the market.

The riot report highlighted that these network dynamics continue to affect margins in operators whose power costs are competitive.

Additionally, Riot recorded an average power cost of $0.039 per kilowatt-hour in December, which was offset by power and demand response credits of $ 6.2 million.

Although the credits were used to equalize expenses, the company recognized that these measures could only provide a short-term cushion against structural strains.

The daily issuance through the network was brought down to approximately 450 BTC. The transaction fees paid less than 1% of the revenue of miners for most of the year 2025, which subjected operators to a drastic increase in difficulty and hash rate.

Despite efficiency and scale gains, the outcomes of Riot in December showed that the unit economic growth was not enough to sustain the production changes.

Mining firms explore AI data center opportunities

As mining economics have tightened, several Bitcoin miners have pursued alternative revenue streams by leveraging their power infrastructure and data center assets.

The sector’s large-scale, energy-dense facilities have attracted interest from technology companies seeking capacity for artificial intelligence workloads.

In August, Google became the largest shareholder of TeraWulf, holding about 14% of outstanding shares after expanding a financial backstop tied to a 10-year colocation lease with Fluidstack.

Under the arrangement, TeraWulf supplies data center capacity for AI computing.

A month later, Google acquired a 5.4% stake in Cipher Mining as part of a multi-year data center agreement involving Fluid stack. The transaction included a guarantee of $1.4 billion in obligations under a 10-year contract to lease computing capacity from Cipher.

In November, IREN entered into a five-year, $9.7 billion deal with Microsoft to install Nvidia GB300 GPUs in its machines.

This was announced in the same month that the largest Bitcoin miner, in terms of market capitalization, revealed a deal with Dell Technologies to purchase GPUs and supporting hardware worth $5.8 billion.