Key Insights:

- Tokenomics guides on how crypto tokens are issued, distributed, and used.

- According to tokenomics tokens fail due to weak utility, poor incentives, and centralized distribution.

- Understanding tokenomics helps investors understand and assess long-term sustainability.

The Hidden Economic Mistakes That Cause Promising Crypto Tokens to Lose Value

Tokenomics is a key factor that defines crypto performance. Recent data shows that over 50% of all newly listed tokens have already failed.

More than 1.8 million projects collapsed in 2025 alone, underscoring systemic flaws in economic design and demand creation.

Analysts have warned that speculative models without any clear utility or sustainable incentive structures are driving a wave of token deaths.

This is as traders sift through a maturing market. However, economic fundamentals help to separate enduring tokens from those destined to fade.

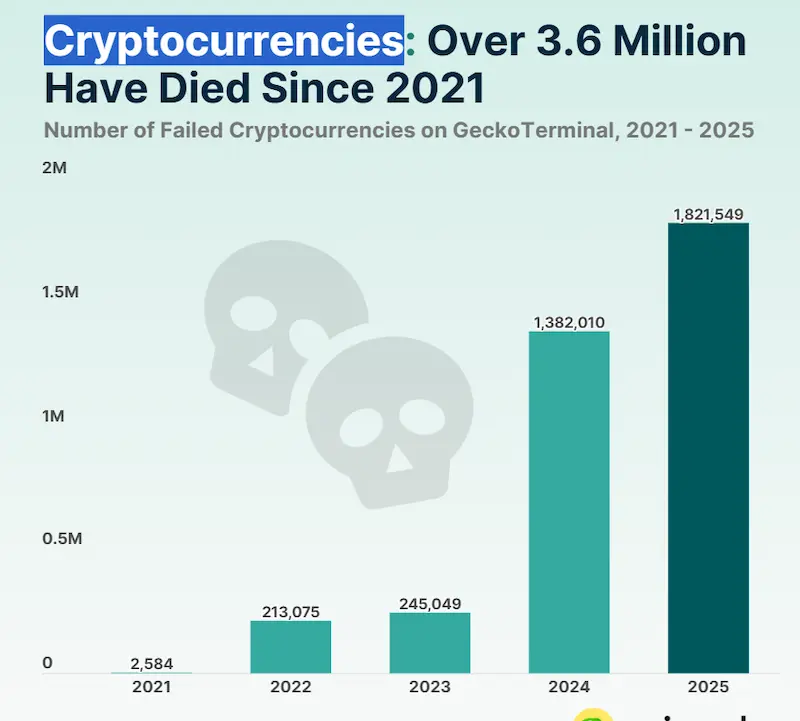

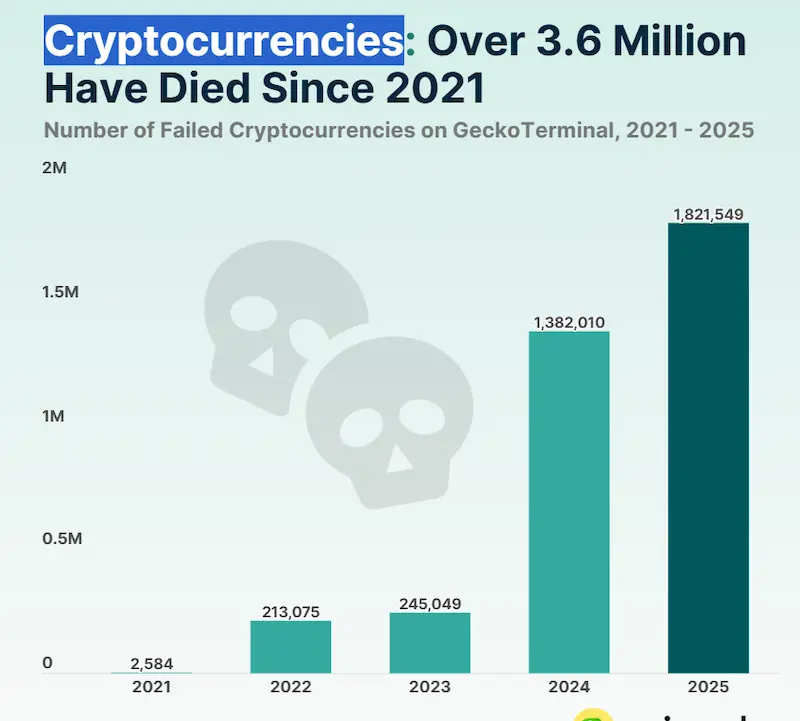

The Token Failure Surge: A Data-Driven Reality Check

Recent market data highlights a grim reality for crypto tokens: more than half of all tokens launched since 2021 are now considered failed or defunct. This is according to data listed on CoinGecko’s decentralized exchange tracker.

Nearly 7 million tokens have been launched since 2021. However, about 3.7 million are no longer actively traded, a 52.7% failure rate. In the first quarter of 2025, 1.8 million tokens collapsed. This is the highest number ever recorded in a single quarter.

Source: CoinGecko

On top of that, industry analytics show that 85% of tokens launched in 2025 are trading below their initial entry price. Many have lost between 70–90% of their initial valuation.

This surge can be attributed to failures attributed to rapid meme-coin proliferation, simplified token creation platforms like Pump. Fun, and broad market volatility.

Therefore these figures show that surviving in crypto markets today requires more than branding and hype . It calls for solid token economic design from day one.

Supply, Distribution, and Inflation: Core Economic Failures

Tokenomics starts with supply design, therefore uncapped and poorly controlled issuance continuously dilutes holder value.

This is because when the market lacks sufficient demand, and the supply rises ,prices tend to depress and reduce traders confidence.

Distribution matters a lot, therefore, projects that allocate excessive tokens to founders, insiders, or early investors exerts outsized influence on markets that leads to price crash.

Hyperinflation events like Terra’s LUNA death spiral that wiped out billions are cases that show the need for balanced issuance, vesting schedules, and scarcity mechanisms in tokens long-term viability.

Utility and Incentives: Why Purpose Drives Persistence

Furthermore, tokens need genuine utility within their ecosystems because without real use cases — whether for transaction fees, governance, staking, or access rights — tokens are reduced to speculation tools.

This is because projects that rely solely on speculative trading rarely maintain demand once short-lived excitement fades.

Another factor is overly generous reward schemes and incentive driven projects. These can backfire when initial liquidity mining staking incentives dry up.

These models mostly attract speculators who are there for quick profit taking. Such participants tend to exit early and this causes massive sell-offs that result in price collapses.

However, by contrast, these well-aligned incentives encourage long-term participation, network security, and organic growth.

Governance mechanisms also enable true decentralized decision-making within the broad community engagement. They tend to outperform those where voting power is concentrated among a few large holders.

Liquidity and Market Reality: From Hype to Hard Metrics

Liquidity is the lifeblood of trading therefore those with liquidity black holes tend to experience sharp volatility and weak price discovery. This is because they lack deep, stable markets that make it difficult for buyers and sellers to transact without causing notable price impact.

Notably, current market trends show that most tokens launched without robust liquidity strategies. However, they mostly underperformed and despite these high initial valuations they ended up trading well below their entry levels.

Investors are warned of scepticism toward overhyped projects because these real-world token failures show that simple hype and celebrity endorsements do not translate into long-term adoption.

They should then look for strong underlying utility and sustainable economics, because early attention evaporates, and this mostly leaves projects abandoned and worthless.

Conclusion

The rising tide of crypto token failures is not random; it points to deeper structural flaws in tokenomics. From unchecked inflation and poor distribution to weak utility and misaligned incentives that has left most newly launched tokens struggling to maintain value, a move that has resulted in death of many.

For investors and builders understanding tokenomics is no longer optional It is essential in order to evaluate economic design, real utility, incentives, and liquidity before they commit their capital resources.

In conclusion, sustainable tokenomics separates enduring projects from those that are destined for the crypto graveyard.