Key Insights

- The biggest banks in Japan utilize XRP for transferring money internationally after they received regulatory approval and completed testing their systems.

- Within a few weeks, the XRP ETFs have collected more than $1.3 billion in assets from investors.

- Recent trends indicate that many investors are holding long positions on XRP in addition to the high level of short positions being liquidated.

Is XRP Adoption at Risk Despite Japan Banks and ETF Inflows?

XRP adoption is gaining traction as regulated banks and institutional investors increase their exposure during a cautious phase of the crypto market. ETF inflows, derivatives positioning, and banking integration in Japan signal growing alignment between demand and real-world financial use.

Japan’s Banking Sector Begins XRP-Based Transfers

According to a social media update from Skipper | XRPL, Japan’s bank has begun to incorporate XRP into the process of sending money internationally between countries.

With the support of major banking institutions like Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho, this implementation has received regulatory go-ahead, so it may commence with all supporting regulations in place.

The goal of the new payment method is to achieve a transaction settlement timeframe of between 3 and 5 seconds, and to lower the cost of sending money internationally by upwards of 40%.

According to reports from pilot studies conducted before the launch, the goals set by Japan’s institutions were achieved and were used to support the migration of the pilot programs to live banking activity.

In addition, the announcement referenced the future of the token usage within regulated Japanese banks.

Plans for expanding the asset to other forms of payment (such as domestic payments) will be explored by mid-2026, when full integration into Japan’s regulated banking system is projected to occur.

Spot XRP ETFs Continue Absorbing Market Supply

According to Moon Lambo, in addition to this, five newly launched spot XRP ETFs have experienced significant growth in their net assets during their 34 trading days of operation.

Within that time, these five active ETF products have accumulated nearly USD 1.37 billion in net assets under management.

The total net asset amount held by these five ETFs represents approximately 0.7% of the total supply of the token and just over 1.14 % of the overall market cap of XRP.

It is noted that these inflows into the XRP ETF products were made during a time period characterised by increased fear in the crypto markets and a decrease in risk appetite from investors.

The data presented above indicates that inflows into XRP ETFs were greater than outflows from Bitcoin and Ethereum ETF products.

The divergence indicated in the data suggests that the asset has been attracting significant amounts of dedicated demand from the marketplace for adoption.

Derivatives Data Reflect Directional Market Positioning

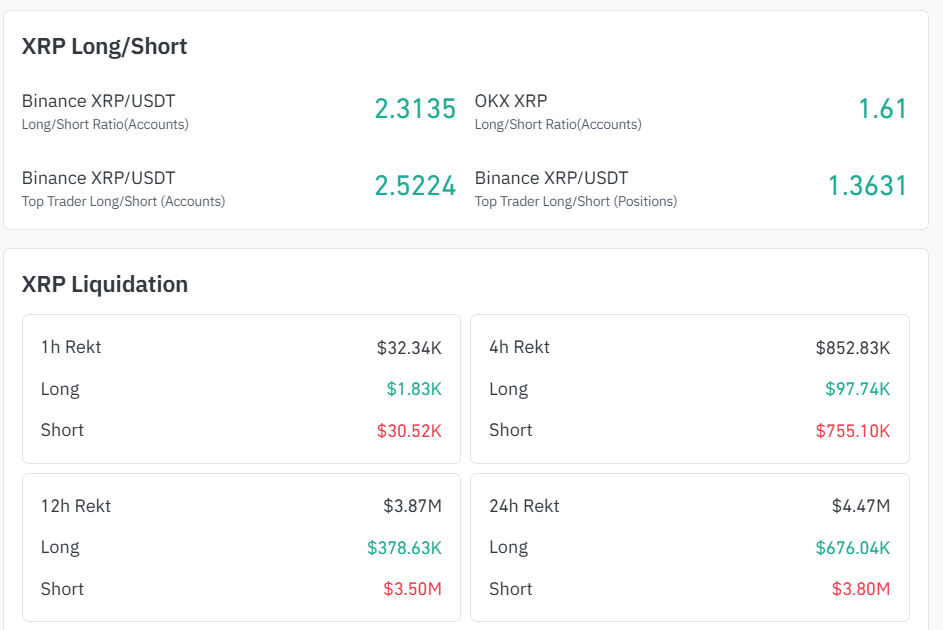

Metrics for Derivative trading support the idea that Long-side activity is very prevalent at many Major Exchange Companies.

Account ratios at both Binance & OKX Support that activity is heavily weighted on the LONG Side, with Proven Asset Managers watching their Exposure by using the right size of positions.

Also very supportive are Liquidation Data, showing there are more Short Liquidations than Long Liquidations on Several Time Frames. This shows there continues to be a Build-Up of Pressure on short-position traders during the most recent price advances.

This Positioning indicates a Participation in the Long Trend, without employing Excessive leverage to participate in that trend. XRP Adoption Storylines support an Exposed Trader Discipline on the XRP Market and not Speculations.

“XRP sentiment turns aggressively bullish as long dominance rises and repeated short liquidations confirm sustained upside pressure.”(CoinGlass)

Technical Structure Aligns With Adoption Developments

XRP reclaimed $2.00 following several months of consolidation on the four-hour timeframe. The momentum indicators (RSI & MACD) are both positive.

Currently, XRP’s price is participating in the same direction as the momentum indicators; as regulated use of XRP increases through banks and institutions, so too does the likelihood of continued price growth.

The increasing rates at which institutions use XRP are likely what have contributed to the currently increasing price of XRP and relatively large trading volume.

This means that much of the current price action for XRP is based on growing acceptance by active financial markets, rather than temporary spikes in price.

“XRP breaks above $2.00 with strong momentum as RSI overheats and MACD confirms bullish

“XRP breaks above $2.00 with strong momentum as RSI overheats and MACD confirms bullish

trend continuation.”(TradingView)

Final Thoughts

XRP utilization has increased due to regulated banks adopting it and institutions investing in it. This includes ETFs being invested in and Japan rolling out banks utilizing XRP. This will be backed by a strong market.

As these changes continue, the asset will fit into a financial system that is going through many changes and being built up, rather than simply being used in cycling through temporary markets.