Key Insights

- Bitwise Crypto ETFs intends to launch 11 single-strategy funds in the US.

- Derivatives are combined with fund exposure to hold tokens directly.

- The products target DeFi AI, privacy, and layer-one networks.

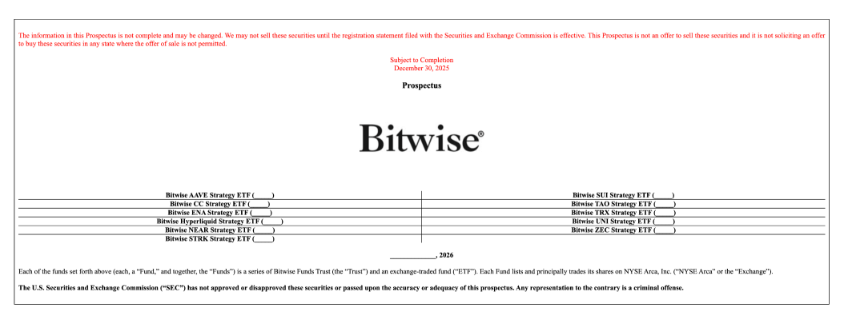

Bitwise Crypto ETF Filing Expands Single-Token Strategy Funds to 11 Assets

Bitwise crypto ETFs are set to expand further into the U.S. regulated investment market after the asset manager filed with the Securities and Exchange Commission to launch 11 single-token strategy exchange-traded funds.

According to the documents, the approach aims to standardize the method of exposure across various blockchain networks while ensuring compliance with U.S. fund regulations.

Structure of the Bitwise Crypto ETF Strategy Lineup

The Bitwise crypto ETF filings describe each product as a “Strategy ETF,” a designation that differentiates the funds from plain spot products. Instead of holding only the underlying token, the funds would combine multiple exposure channels.

The filings state that each fund may invest up to 60% of its assets directly in the relevant digital token. At least 40% of assets would be allocated to securities issued by one or more exchange-traded products that either hold or provide exposure to the same cryptocurrency.

Source: SEC

Source: SEC

Additionally, this allocation model contrasts the strategy funds with fully spot-backed ETFs, which normally base their approach on direct token ownership only. Rather, the methodology has been a hybridization of physical ownership and second-market instruments, resulting in a hybrid exposure model for all 11 proposed products.

Comparison of Assets by Blockchain Industries

The proposed fund value is an approximate number of the blockchain applications. The decentralized finance exposure includes a Bitwise AAVE Strategy ETF that tracks the Aave lending protocol and a Bitwise UNI Strategy ETF that tracks Uniswap and the Unichain layer-2 network.

The products based on infrastructure include the Bitwise NEAR Strategy ETF, which is built on top of the sharded NEAR Protocol architecture, and the Bitwise SUI Strategy ETF, which is built on top of the Move-based blockchain developed by Mysten Labs.

An example of a layer-2 scaling technology that uses Starknet and the implementation of ZK-STARK is the Bitwise STRK Strategy ETF.

The Bitwise ZEC Strategy ETF provides privacy-oriented exposure, trading Zcash and its zk-SNARK-based transaction model.

Moreover, the lineup is completed with specialized protocols, such as the Bitwise TAO Strategy ETF of the decentralized AI marketplace Bittensor and the Bitwise ENA Strategy ETF associated with the synthetic dollar system of Ethena.

Additional filings cover more specialized networks, including Bittensor’s artificial intelligence marketplace, Ethena’s synthetic dollar protocol, Hyper liquid’s derivatives-focused trading infrastructure, the Canton Network, and the TRON blockchain.

Each fund is designed to track a single protocol, rather than aggregating exposure across multiple assets, by applying a consistent structural framework to various blockchain use cases.

Placement Within Bitwise’s Broader ETF Lineup

The new filings build on Bitwise’s existing U.S. ETF presence, which already includes spot products holding Bitcoin, Ethereum, Solana, and XRP directly.

The company also operates an index-based ETF that tracks a screened basket of large digital assets, as well as an equity-focused ETF that holds publicly listed companies with crypto-related activities. Futures-based strategies linked to CME contracts are also part of the firm’s current offerings.

Bitwise crypto ETFs have expanded steadily in recent years, including the launch of a Dogecoin ETF that accumulated notable assets despite operating outside the 1940 Act framework.

The new single-token strategy funds would sit alongside this existing shelf but differ in risk profile. Unlike index products that spread exposure across multiple assets, each proposed ETF would concentrate on one token while applying the same exposure framework across all funds.

Operational Roles and Service Providers

According to the filing, Bitwise Investment Manager will act as adviser for all 11 funds. Portfolio management responsibilities are shared by Jennifer Thornton, Daniela Padilla, and Gayatri Choudhury.

The Bank of New York Mellon administers and holds traditional securities, while Coinbase Custody Trust Company and BitGo Europe GmbH handle digital asset custody.

The funds are expected to operate under a unitary fee arrangement, although specific expense ratios were not disclosed at the time of filing.

However, each fund intends to qualify as a Regulated Investment Company for U.S. tax purposes, allowing the income distributed to shareholders to be taxed at the shareholder level.

Shares of the funds will trade throughout the day on secondary markets, where prices may fluctuate from the net asset value, depending on market conditions.

Despite these factors, the filings position the strategy funds as an extension of Bitwise’s existing ETF shelf, offering single-asset exposure across a defined set of blockchain protocols under a uniform investment framework.