Key Insights:

- Ethereum ecosystem 8.7 million smart contract deployments in Q4 2025 is the highest quarterly total record.

- Rollups, RWAs, stablecoins, and smart wallet infrastructure drove the growth.

- Despite stronger developer activity ETH price has stayed weak.

Builders Are expanding on-chain infrastructure- Ethereum records 8.7 million smart contract deployments in Q4

Ethereum smart contract deployments reached a new quarterly record in Q4 2025. On-chain data points to steady infrastructure growth. This is reinforcing Ethereum’s position as a core blockchain for developers.However, despite this ETH prices moved sideways.

Ethereum is trading at $2,975.77 after a modest 1.70% gain over the past 24 hours and a huge $18.3 billion in trading volume.

Trading volume is modestly high and this has led to weekly gains of 0.34%. Ethereum’s market capitalization stands at $359.4 billion. This high mark is reflecting steady but cautious market participation.

Ethereum Smart Contract Deployments Reach a Historic Quarterly Peak

In Q4 2025, Ethereum smart contract deployments reading is at 8.7 million wallets. The figure marked the highest quarterly total recorded on the network. This high growth rate was aided by several consecutive quarters of rising deployment activity.

The tracking data indicates a steady acceleration opposed to the previous single short-lived spike. Analysts noted that such sustained deployment trends are difficult to manufacture.

This is because each contract requires time, capital, and developer commitment. Therefore this reflects genuine network utility.

According to CryptoQuant data, the 30-day moving average for new contracts reached 171,000. This trend reflects consistent activity across decentralized applications, tokens, and protocol upgrades.

Joseph Young commented that contract deployment is one of the hardest on-chain metrics to inflate. He described the current data as growth as organic and termed it as one driven by real builders.

https://x.com/iamjosephyoung/status/2005949735446687882?s=20

Ethereum continues to absorb the increased load without major disruptions. Each deployment consumes block space and gas. The network comfortably handles the volume during a period of elevated activity.

Ethereum Smart Contract Deployments Driven by Infrastructure Expansion

Layer 2 networks played a central role in Ethereum smart contract deployments. Rollups such as Base, Arbitrum, and Optimism helped reduce costs and improve execution speed. Consequently, developers responded with higher deployment rates.

Ethereum shifted toward a settlement-focused architecture and this supported growth notably. Each rollup launch and app-specific chain increased contract activity across the ecosystem. The scaling roadmap continued to attract builders.

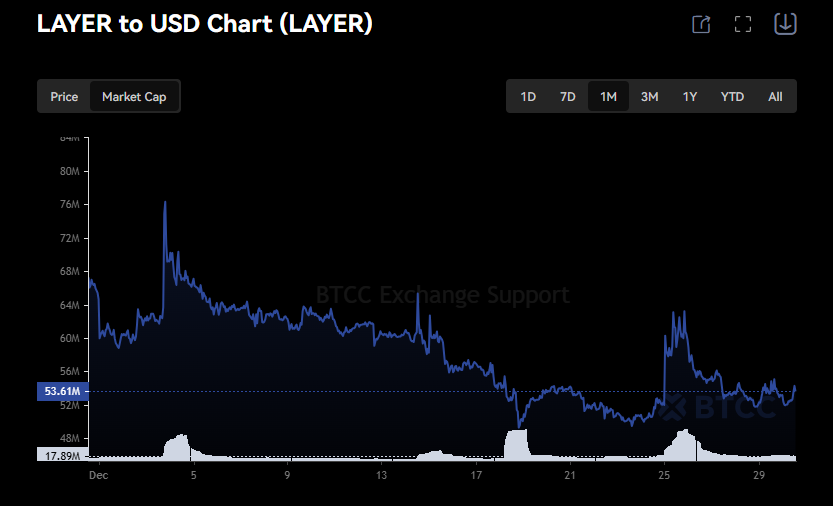

Layer 2 Data Source: Solayer

Layer 2 Data Source: Solayer

Real-world asset issuance added further demand for smart contracts. Tokenized treasuries, funds, and credit systems required multiple contracts for operation and compliance. This made it hard for most users who in turn opted for Ethereum as the preferred testing ground.

Stablecoins also contributed to contract growth. Issuance frameworks, treasury systems, and integrations across DeFi required continuous contract deployment. These helped in payments and yielding strategies.

Wallet use and innovation increased contract usage. In addition, account abstraction, smart wallets, and intent-based design relied on contract-based architecture. These improved user experiences and brought higher deployment volume.

Price Action Lags as On-Chain Activity Expands

ETH price performance remained bearish during most of the year, especially Q4 . CoinGecko data shows that ETH fell nearly 27.6% during the quarter. Prices have stabilized near $3,000 by year-end.

Source: CoinGecko

Source: CoinGecko

Exchange reserves increased by more than 400,000 ETH in December. On-chain data suggested distribution activity rather than accumulation. Continued whale and institutional transfers added more uncertainty.

Developer activity stayed strong across DeFi, NFTs, GameFi, and restaking. Analysts are still optimistic about the long term.

However, Benjamin Cowen said Ethereum may have difficulty reaching new highs in 2026 due to overall market weakness.

Ethereum smart contract deployments showed steady network use, pointing to ongoing infrastructure growth rather than short-term speculation.