Key Insights:

- BitMine plans to launch MAVAN in early 2026 to earn a yield from a large Ether treasury.

- The firm holds over four million ETH with partial staking already underway.

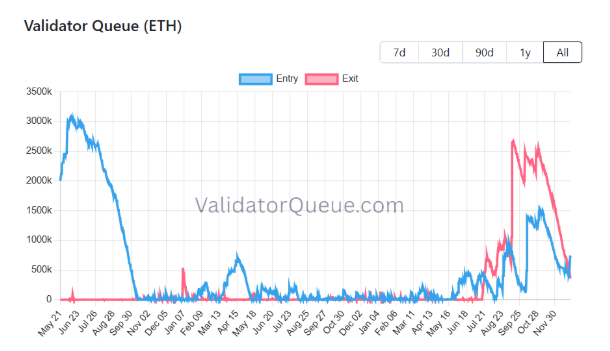

- Recent staking activity increased Ethereum validator entry queues.

BitMine Outlines Ethereum Staking Strategy as Validator Network Launch Nears

BitMine is preparing to shift its Ethereum treasury strategy from accumulation to yield generation as it moves toward launching its Made in America Validator Network (MAVAN) in early 2026.

The listed crypto firm, chaired by Thomas “Tom” Lee, disclosed that it now holds 4,110,525 Ether, a position the company values at approximately $12 billion.

In a press release on Monday, the disclosure places BitMine among the largest publicly reported holders of Ether. It positions its balance sheet as one of the most concentrated corporate exposures to the Ethereum network.

The company stated that the validator initiative is designed to generate staking income from its Ether holdings while retaining custody of the underlying assets. MAVAN is expected to operate as BitMine’s in-house staking infrastructure, allowing the firm to earn rewards directly from Ethereum’s proof-of-stake system rather than relying solely on third-party providers.

According to the company, the rollout will occur after a testing phase that is already underway.

BitMine Ethereum Treasury and Validator Rollout

BitMine’s Ethereum treasury has expanded rapidly, and the company has framed MAVAN as the next operational step. In a statement released Monday, Lee said the validator network is intended to deliver secure staking operations and will be deployed during the early part of calendar year 2026.

The move signals a transition from holding Ether as a treasury reserve toward actively generating yield through network participation.

https://twitter.com/BitMNR/status/2005657702207545512

At present, BitMine is not staking its entire Ether balance. The company disclosed that 408,627 Ether is currently staked with third-party providers as part of its preparation for MAVAN.

Moreover, rewards in staking Ethereum are currently paid in Ether and depend on several factors, including the availability of validators, network activity, and general yield terms.

Additional revenue can also be generated from maximum extractable value (MEV), which is linked to transaction ordering and block production. These variables collectively influence the returns that large-scale validators can achieve.

Staking Revenue Projections and Assumptions

BitMine has drawn attention for outlining the potential scale of staking revenue once its Ether holdings are fully deployed. Lee stated that, at scale, staking fees could total $374 million annually, based on a compounded effective staking rate (CESR) of 2.81%.

The company has not indicated that these assumptions are guaranteed, and current staking levels remain well below the full treasury balance.

Market Liquidity and Share Trading Activity

BitMine’s equity has become part of the broader discussion surrounding its Ether-focused strategy. Investors in corporate crypto treasuries, which serve as an indirect investment in digital assets, have been drawn to their liquidity profile.

Disclosures from BitMine list several institutional backers, including ARK, Founders Fund, Pantera, Kraken, DCG, and Galaxy Digital. The company has linked this support to its longer-term objective of reaching 5% of the total Ether supply, a target it refers to internally as the “Alchemy of 5%.” No timeline has been provided for reaching that level.

Regulatory Environment and U.S.-Based Staking.

The Made in America frame, MAVAN, implies that there are still regulatory concerns regarding staking in the US. In 2023, the Securities and Exchange Commission filed an action, which caused Kraken to close its staking-as-a-service offering in the United States and pay a settlement of $30 million.

That enforcement action reshaped how U.S.-based entities approached staking operations.

Under President Donald Trump, the SEC has moved to dismiss its civil enforcement action against Coinbase, signaling a broader shift in crypto enforcement priorities.

Additionally, BitMine has not explained the implications of regulatory changes on the design of MAVAN; yet, a domestic focus is consistent with a dynamic policy environment.

Recent Staking Activity and Queue Impression.

Building more on this sentiment, Blockchain analytics platform Lookonchain reported that the company staked 342,560 Ether, valued at more than $1 billion, in the two days leading up to Sunday.

Nonetheless, staking involves locking Ether into Ethereum’s proof-of-stake network in exchange for an annual percentage yield typically ranging from about 3% to 5%.

Source: ValidatorQueue

The scale of the staking activity has affected Ethereum’s validator queues. According to ValidatorQueue, the entry queue is at 12 days and 20 hours, with 739,824 Ether in the entry queue. The exit queue is at 6 days and 2 hours, with 349,867 Ether awaiting entry and withdrawal, respectively.