Key Insights

- Tron daily perps volume has surpassed $1B for two consecutive days.

- The 7-day perps volume has reached $5.77B, a +176% growth.

- TRX coin remains consolidated above $0.27 with long-term trend intact.

Tron Perpetuals Volume Surpasses $1B Daily as TRX Consolidates At $0.28

Tron Perpetuals Volume leads market activity. In spite of this TRX trades at $0.2788 with $435M in 24-hour volume. TRX price slipped -0.04% today and its weekly drawdown is currently at -0.27%. Daily perps volume is stable above $1B as traders prefer Tron for derivatives over spot. This is supported by USDT liquidity that helps it in keeping long-term bullish momentum alive.

Tron Perpetuals Volume Breaks Market Trend

Tron’s derivatives market has shown a notable rise in perpetual futures trading despite the general slowdown. Daily perps volume has surpassed the $1 billion mark for two consecutive days. This is due to the sustained momentum and active trading activities.

The 7-day cumulative perps volume on Tron has hit $5.77 billion. This milestone represents a +176% growth week-on-week basis. This increase however contrasts with stagnating and declining derivatives activity on the competing chains.

Crypto analyst Crypto Patel tweeted about this unusual trend, noting that Tron is “defying the broader market slowdown.” The data shared suggests that this is a major structural shift in trader behavior toward Tron.

https://x.com/CryptoPatel/status/2004499933995409745?s=20

Tron’s growing derivatives volume has coincided with a slight decrease in total value locked. Over the past month Trons (TVL) has risen by 1.58%, and this has helped it in maintaining a DeFi TVL of $4.39 billion. Strong inflow of stablecoin has provided liquidity support for the leveraged traders on the network.

Stablecoins, particularly USDT, provides the collateral necessary for efficient margin trading and frequent position turnover. This has caused many traders to prefer to leverage Tron’s ecosystem for speculative strategies.

The huge difference between DEX spot volume ($53.5M) and perps volume ($1.008B) shows that traders prefer it for derivatives trading over spot trading. This trend shows the chain’s increasing role in leveraged exposure.

Tron Perpetuals Volume Supports Revenue Efficiency

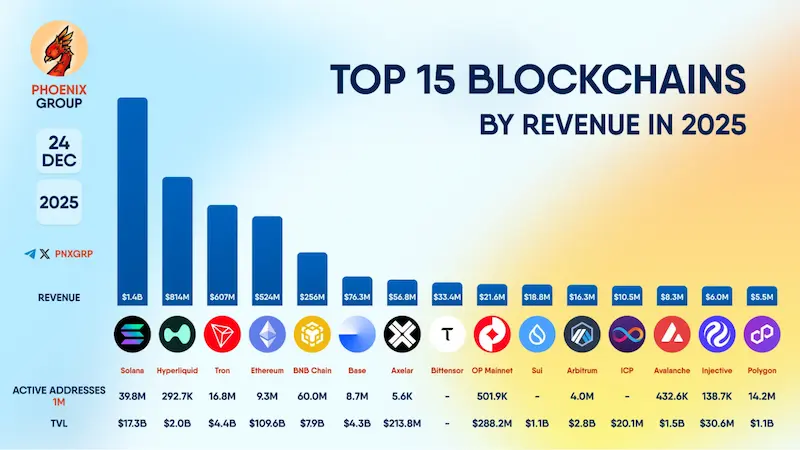

Tron ranks among the top revenue-generating blockchains in 2025 after posting an annualized $607 million. Despite having a lower TVL its high-frequency economic activity contributed notably to this performance.

Stablecoin settlement, especially USDT, drove consistent fee revenue across 16.8 million active addresses. This effort resulted in the current $4.4 billion TVL as Tron’s network is accepted as a global payments and liquidity platform.

Source:X

Source:X

Perpetual’s trading adds an additional revenue layer to Tron’s ecosystem with its derivatives activity enhances real economic output on-chain. This reflects both utility and liquidity depth.

Tron converts a relatively smaller capital base into substantial real revenue, strengthened by the growing derivatives volume. This merger supports speculative and hedging strategies.

Tron’s network performance suggests that it has transitioned from primarily payments usage toward a broader financial utility hub. The combination of liquidity, stablecoins, and derivatives adoption reinforces its economic activity.

Through all this usage Tron has maintained a sustainable income stream. Holding huge capital has positioned it as one of the most economically productive blockchains despite its softer activity in DeFi and NFT sectors.

TRX Price Performance and Market Structure

TRX coin is currently consolidated around $0.279 after a multi-month upward trend where short-term fluctuations resulted in profit-taking. This structure suggests a healthy market correction ahead as selling pressure eases.

TRXUSDT Price Chart | Source:X

TRXUSDT Price Chart | Source:X

Moving averages are sloped upward supporting long-term price stability. The MA(120) has acted as a strong support zone, that is reinforcing the broader bullish trend on higher timeframes.

Key near-term support for TRX lies between $0.26 and $0.27, as upside resistance around $0.30–$0.32 remains a tough hurdle to break. Consolidation in this range indicates that buyers are resting after the previous gains.

Lower volume during the retracement phase signals that sellers lack conviction even as buyers remain patient.

Should volume return and the broader market recovers, TRX looks positioned for more uptrend. Both technicals and network fundamentals are bullish.