Key Insights

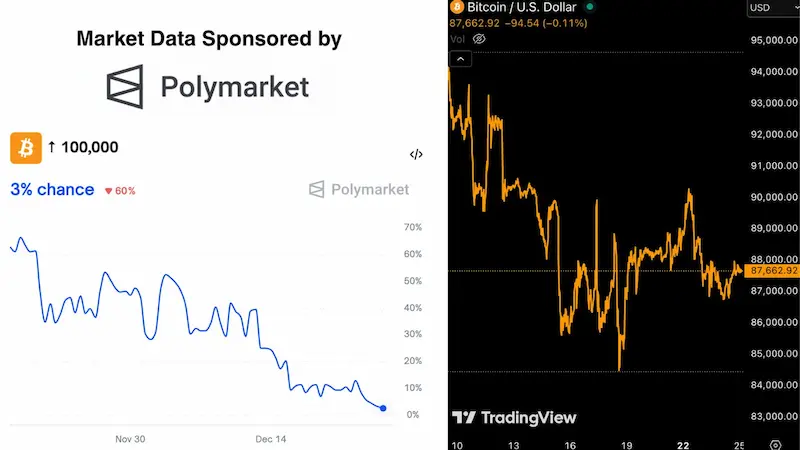

- Odds of Bitcoin reaching $100K before the year ends have dropped to 3% according to Polymarket data.

- BTC is being traded above $85K, despite volatility price has maintained resilience even as sentiment remains weak across derivatives markets.

- Historical year-end patterns show that when sentiment is at such extremes a regime shift is likely.

Polymarket Cuts Bitcoin $100K Year-End Odds to 3% Amid Market Uncertainty

Bitcoin is trading at $87,712.22 as at December 25th.The asset has posted a modest 0.87% gain over the past 24 hours amid active trading. Weekly performance also remains positive, with BTC up 1.07%. In spite of this Polymarket data shows that odds of Bitcoin reaching $100K before year end have fallen to 3%. This is a huge contrast between the steady price strength and the weakening year-end expectations. This further reflects a market balancing caution, liquidity, and resilient demand.

Polymarket Traders Pull Back From the Bitcoin $100K Narrative

Bitcoin $100K odds on Polymarket have steadily declined to around 3%. This gradual decline shows a prolonged loss of confidence. In addition, the smooth downward curve suggests that this is a gradual repricing and not a panic selling that caused the sudden market stress.

Mostly, probability markets capture expectations, and not actual execution. Therefore, each minor rebound in odds that failed to persist, indicates that traders consistently sold optimism tied to year-end upside scenarios. This shows that risk appetite continues to contract.

Source:X

Degenerate News shared the data on X, noting the sharp compression toward the lower bound. Such conditions often reflect disbelief and caution rather than immediate changes in Bitcoin’s underlying market structure.

Price Action Defies 100K Sentiment as Bitcoin Holds Key Levels

Bitcoin is being traded near $87,600.Its price structure is marked by sharp wicks and rapid reversals across intraday sessions. The structure reflects the consolidation period following an earlier impulse. This is marked by consistent lower highs that are forming under active resistance around 89K.

Despite volatility, the price has remained well above $85K. Buyers have continued absorbing sell pressure on every dip, but sellers are still limiting all upside momentum. This continued balance points to the current market indecision and it is therefore not a total breakdown.

TradingView indicators further support this view. MACD momentum has flattened, and the RSI is approaching the neutral zone. Additionally volume remains muted. All these signals are aligned with reduced participation during such holiday-influenced trading conditions.

History, Technical Levels, and Liquidity Shape Caution

Zooming in on higher timeframes ,the Multi-year chart shows a year-end weakness that often accompanies late-cycle phases. Some analysts are bearish. Their predictions show that BTC looks set for a serious breakdown. Citing the late 2021 and early 2023 periods. Both started with stagnation phases then deeper declines under low liquidity and risk-off conditions.

Source:X

Source:X

Attention has shifted and is now focused on the 50-week simple moving average. Historical cycles show that all decisive losses below it were preceded by average drawdowns near 60%. This further reinforces its importance for long-term participants.

On-chain activity has added more caution. Large exchange transfers involving Binance, CoinBase were cited. These movements involved around 2 Million BTC in total, and they caused notable market reactions. This triggered selling that formed long downside wicks and quick recoveries. This pattern suggests a liquidation-driven volatility.

Despite this happenings Binance Founder CZ took to X platform and reminded investors that: early Bitcoin buyers accumulated during periods of fear and uncertainty, not strength. These sentiments are bullish on the future of Bitcoin.

Bulls need to successfully reclaim the 90K regions first in order to reinforce the 100K narrative. Failure to do so could open the path for a prolonged downtrend below the 80K level.