Key Insights

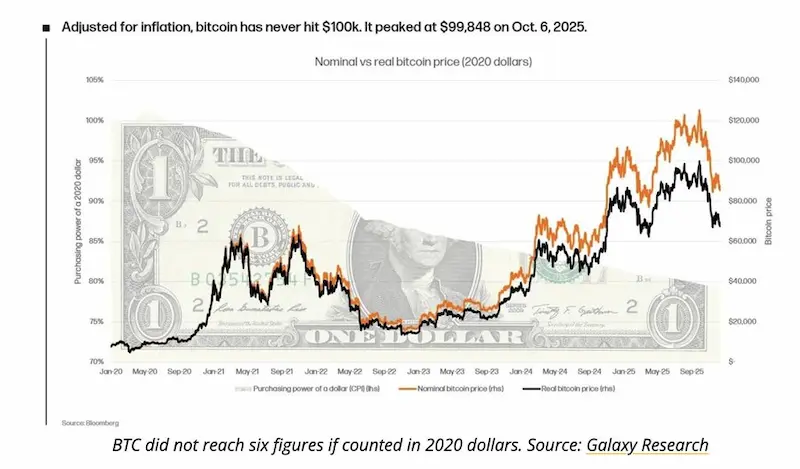

- Inflation-adjusted values indicate that Bitcoin’s peak in 2025 did not manage to go past 100,000 USD despite good nominal performance.

- Institutional participation is transforming models used in predicting the prices of Bitcoin by lowering volatility associated with halving events.

- Bitcoin’s daily chart exhibits a period of consolidation below $90,000 as market participants wait for the necessary data to determine market direction.

Bitcoin Price Prediction Faces New $100K Debate After Inflation

Institutions are reassessing the valuation of Bitcoin as well as the impact of inflation on Bitcoin’s market structure. Recent market commentary and research indicate that adoption is continuing to increase, and the volatility of Bitcoin has decreased. The price’s milestones when adjusted for real dollar purchasing power will appear different than what we presently understand them to be.

Institutional Forecasts Challenge Traditional Cycle Models

The latest report from Grayscale, tweeted by CryptosRus on X, indicates a positive bitcoin price forecast in the first half of 2026. Grayscale believes the Bitcoin market is transitioning into the institutional market due to support from the macro market as well as better regulatory environments.

According to the commentary, this trend challenges the four-year halving cycle. As a growing number of institutions invest in Bitcoin, the behavior of the markets seems less speculative and more systematically driven. The trend of lower volatility is becoming a defining one, even in a correctional cycle.

This reflects a shift in the analysis of institutional structures as a whole. Where analysts used to concentrate solely on halving times, they are now focused on conditions surrounding liquidity, macro hedging demand, and regulatory certainty within the context of their bitcoin price forecast formulation.

Inflation-Adjusted Data Reframes the $100,000 Narrative

Coin Bureau referred to the data from Galaxy Research, showing that Bitcoin has never actually reached $100,000 in constant dollars. In constant dollars from 2020, Bitcoin reached a height of $99,848 on October 6, 2025.

The chart compares the Bitcoin price against both nominal and inflation-adjusted prices, along with the decrease in purchasing power of the U.S. dollar. Nominal prices peaked at approximately $120,000-$125,000; however, as cumulative inflation continued to decrease the value of those profits, eventually, profits became less significant to investors.

Market Psychology Analysis

Historic highs in nominal terms are apparent, but where genuine prices of around $100,000 are concerned, the resistance level has yet to be breached. It is now playing an important part in the Bitcoin future projection level.

Bitcoin’s nominal highs mask inflation impact, with real prices peaking just below

$100,000 despite record 2025 rally (source: x)

Daily Chart Shows Post-Peak Consolidation

On the BTC/USD daily chart from Bitstamp, the price of BTC is currently trading close to $86,801 with the slightest of setbacks in the past day. Market action is well within the expected correction phase post the peak in October 2025 at close to $125,000-$128,000.

Lower highs and lower lows make up the current trend. The resistance zone between $85,000 and $90,000 is a sign of uncertainty in the market following strong distribution. The region is currently acting as a temporary area of demand.

The momentum indicators also demand caution. The value of RSI is observed to be at 41, which remains majorly below the central line. MACD remains in the negative region, although some progress has been made in its histogram. All the indicators form a cautionary market prediction for the value of Bitcoin.

Bitcoin trades near $86,800 as weakening momentum and bearish indicators suggest

Bitcoin trades near $86,800 as weakening momentum and bearish indicators suggest

continued downside risk. (TradingView)

Macro Data Adds Short-Term Uncertainty

The market remains sensitive over the short term as the U.S. labor data approaches. A tweet from @DeFiWimar highlighted possible outcomes based on the initial jobless claims, with risk markets responding sharply to outliers.

Such a macro release continues to impact Bitcoin’s intraday market volatility, even as the long-term investor concentrates on structural adoption dynamics. Traders remain caught between inflation-adjusted valuation issues and lower market volatility at the moment.

A nominal increase, alongside the easing of inflation, would need to happen to confirm the breakout. Until this happens, bitcoin price prediction models are pegged to technical levels and macro environments.

Final Thoughts

The dynamic marketplace that is developing in the industry of Bitcoin is also altering the manner in which valuation metrics are determined. On one hand, institutional projections indicate that there is strength in the future, whereas on the other hand, adjusted inflation data caution that one must be careful in estimating projections of future prices based on headline numbers.