Key Insights

- Inflows of ETH into small-cap and leveraged ETFs indicate both growing retail interest in the crypto market and increased accumulation by institutions.

- Inflows into Bitcoin and Ethereum via exchanges have slowed, reflecting decreased selling pressure

- ETH has established higher lows and is trading in a range between $2945 and $3042, indicating continued accumulation and potential upward price movement.

ETH Price Prediction: Market Activity Signals Consolidation Phase

Since reaching the peak of $3,400, Ethereum’s been sitting in a range for a while now, but with a growing number of inflows into the ETFs that have gone up over the last few months, we see a small bullish trend forming.

Shifting Market Trends And Exchange Inflows

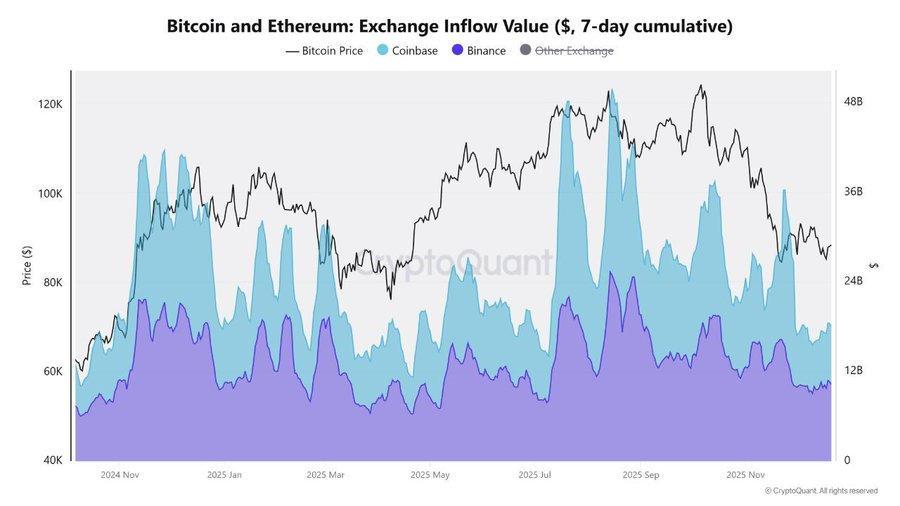

Research by CryptosRus – @cryptosR_Us revealed that exchanges are seeing a large decline in deposits into Bitcoin and Ethereum since the previous year.

Coinbase alone has experienced a decline of over 60% in dollar volume deposited into both Bitcoin and ETH in the past 7 days from its all-time high of over $21 billion.

Binance has seen a decrease in demand for the cryptocurrency, but the platform’s inflow numbers are still relatively strong.

The current trend towards decreased buying demand could be the result of increased demand for the available cryptocurrency and indicates that there is still a high likelihood of further consolidation.

In addition, it appears that investors are holding more onto their investment positions rather than cashing out.

“Bitcoin and Ethereum exchange inflows reveal retail sell-offs at peaks, while institutional accumulation stabilizes long-term price trends.” (Source X)

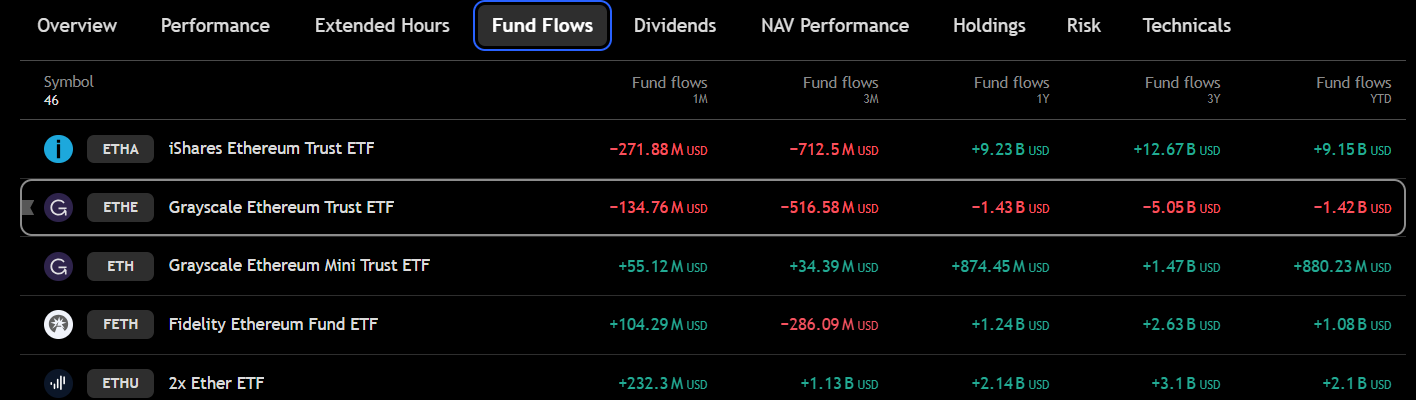

ETF Flows Indicate Strong Retail and Institutional Interest

Over the last few months, fund flow trends have been contrasting for the asset ETFs. iShares Trust ETF has seen a combination of short-term outflows and solid accumulation of shares for the long-term.

Grayscale Trust has had continuous outflows. Smaller or leveraged products such as Grayscale Mini Trust and 2 x Ether ETFs continue to show inflows.

Fidelity Fund has short-term growth, but long-term and three-year charts indicate steady accumulation. These trends indicate increasing retail and continuing institutional interest in being able to add flexible exposure to the digital asset.

“Ethereum ETF flows reveal rising retail and leveraged demand while traditional large trusts face short-term outflows.” ( ETF flows)

Technical Analysis: Consolidation Within Key Price Levels

Ethereum’s present trading price shows $2964 in a range of support at $2945 and resistance between $2994 – $3042. Higher-low price action since the end of November suggests that the asset has been gradually accumulating, and currently sits within an indecisive state by testing the middle band of the Bollinger Bands.

As per the MACD, momentum remains slightly negative, with the histogram illustrating the lack of any large selling pressure.

If it were to break out above 3042, there is potential for price movement toward $3100 – $3200, but if it falls below $2945, it could lead to a retest of the $2850 area.

These strengthening support and resistance levels suggest that consolidation in the market is currently taking place.

Ethereum consolidates near $2,965; key resistance $3,042, support $2,945, with potential breakout in either direction. Source: TradingView

Future Outlook for ETH Price Prediction

The ETH price forecast creates an indication that movement will remain sideways for an extended period in the range of $2945.00 – $3042.00. ETH could still push higher if fresh money starts flowing into smaller exchange-traded funds. Conversely, larger ETFs may recover if the cryptocurrency markets stabilize again.

While the ongoing accumulation of ETH, combined with lower levels of exchange inflow, points toward reduced selling activity. Traders see an upward breakout through the resistance area or a downward break below the support area as the determining factor for the next major price move for ETH.

Overall, the crypto marketplace is filled with a cautious degree of optimism as the volume being traded by both retail and institutional investors appears to offset one another.

Final Thoughts

After experiencing a price correction and now in a period of consolidation, Ethereum has entered a stage of accumulation with relatively stable inflows, as reflected by the price action over this period being fairly consistent.

Although ETH’s price has fluctuated between $2,945 and $3,042, with momentum indicators indicating some bullishness on the upside, its recent price pattern clearly demonstrates that both retail and institutional investors remain active participants and are interested in continuing to invest in ETH.