Key Insights

- Bitcoin whales bought 269,822 coins worth $23.3 billion over 30 days in the largest buy spree since 2012.

- This mirrors historic patterns from 2013 and 2017 that preceded bull runs.

- Technical analysis of Bitcoin”s descending wedge pattern is projecting a $120,000 target.

Bitcoin is being traded at $87,168 after declining 5.61% over the past week. The drop happened amid historic whale activity. Glassnode data reveals that Bitcoin whale investors accumulated 269,822 BTC worth $23.3 billion in just 30 days. This marks the largest whale buying spree in 13 years.

$23 Billion Bitcoin Whale Accumulation Breaks 13-Year Records

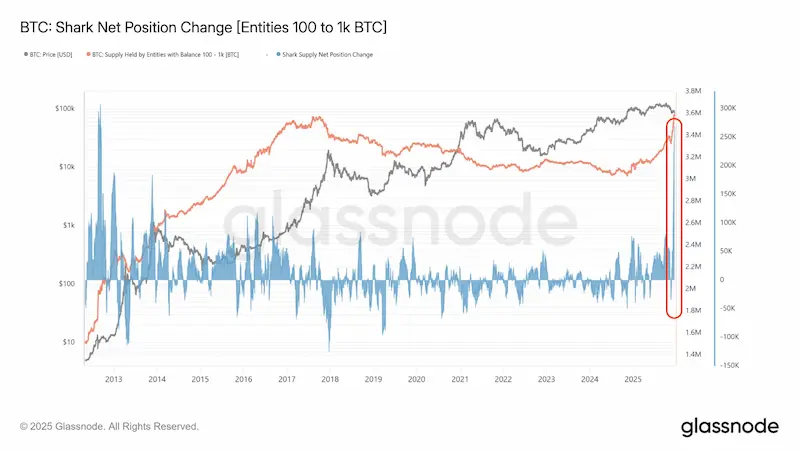

According to Glassnode data, an extraordinary wealth transfer occurred beneath Bitcoin’s recent volatile price action. Whales holding between 100 and 1,000 BTC deployed $23.3 billion over the past month. The last such accumulation was last seen in 2012 then in 2017 and 2021 ,and all preceded a bull market.

Retail investors capitulated during Bitcoin’s recent correction from $108,000, and triggered panic selling across multiple cohorts.

BTC Sharks Net Positioning / Source: X

BTC Sharks Net Positioning / Source: X

However, despite this uncertainty sophisticated investors absorbed this selling pressure with unprecedented aggression. This shows that they saw the decline as a strategic entry opportunity and not a cause for concern.

In addition, supply held by 100-1,000 BTC entities surged above 3.4 million BTC during this period. The compression of volatility in whale net flows since 2020 makes this spike even more significant. Years of relative stability were shattered by this massive transfer of coins from weak hands to strong hands.

Strategic Positioning Mirrors Historic Bull Market Precursors

Historical patterns have a consistent pattern preceding major Bitcoin rallies. In 2013 ,whales accumulated massively before a surge from $100 to $1,000. Then in 2017 the same event preceded the rally to $20,000.

Current whale behavior is operating at an exponentially larger scale and this could mean higher returns. This is a market timing, because whales deliberately avoided chasing Bitcoin’s 2024 rally from $70,000 to $100,000 and instead waited for this corrective price action.

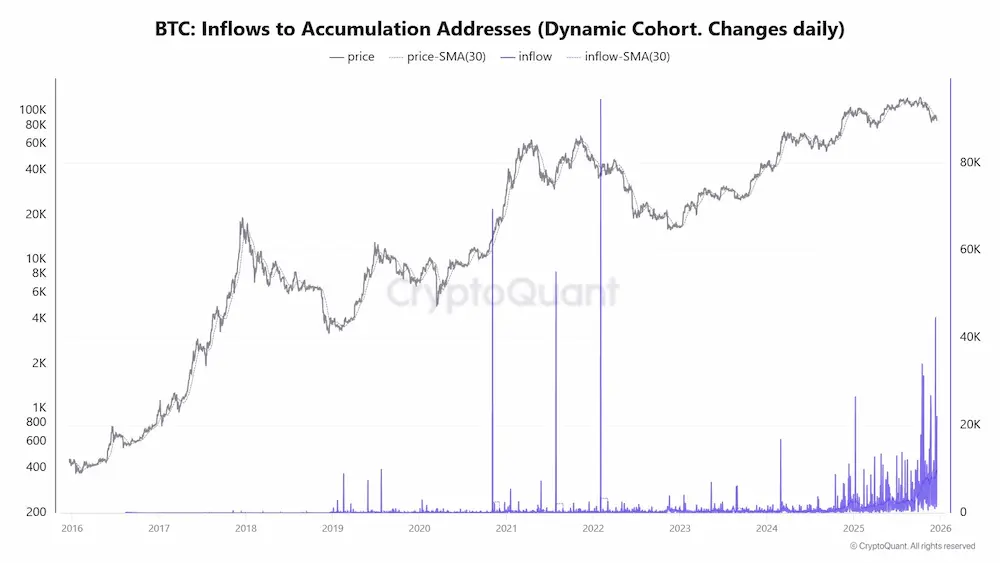

BTC Inflows To Accumulation Addresses/ Source:X

BTC Inflows To Accumulation Addresses/ Source:X

This underscores their conviction that current levels will offer superior risk-reward. Data from accumulation addresses shows that there is a sustained inflow that rivals only 2022’s generational bottom and 2021’s bull market.

The 30-day moving average remains elevated. Therefore, this is a deliberate campaign and not an isolated opportunistic buying. Smart money consistently bought as fear sent retail traders into a panic to sell.

Technical Structure Supports Bullish Bitcoin Whale Thesis

Bitcoin’s price action has formed a textbook descending wedge pattern over recent months. This technical formation typically appears as selling pressure exhausts pushing the price within narrowing trendlines.

If bulls hold the $84,000 and $92,000 consolidation box it could act as a potential launch pad. This however depends on if buyers will aggressively defend the lower boundary.

Analysts are bullish that a target of $120,000 could be achieved. This represents 37% upside from current $87,000 levels. The ascending trajectory suggests rapid price appreciation once momentum ignites.

This target is aligned with Bitcoin’s previous cycle high around $108,000 psychological resistance.Multiple catalysts have converged to support this bullish setup.

Whales accumulation , institutional conviction,inflow accumulation by active addresses, the descending wedge apex technical resolution are all bullish. This summed up with long-term holders distributing coins will create an opportunity for stronger hands to accumulate more.

This will possibly attract valuations, and potentially establish healthier market structure for the next upward cycle.