Key Insights

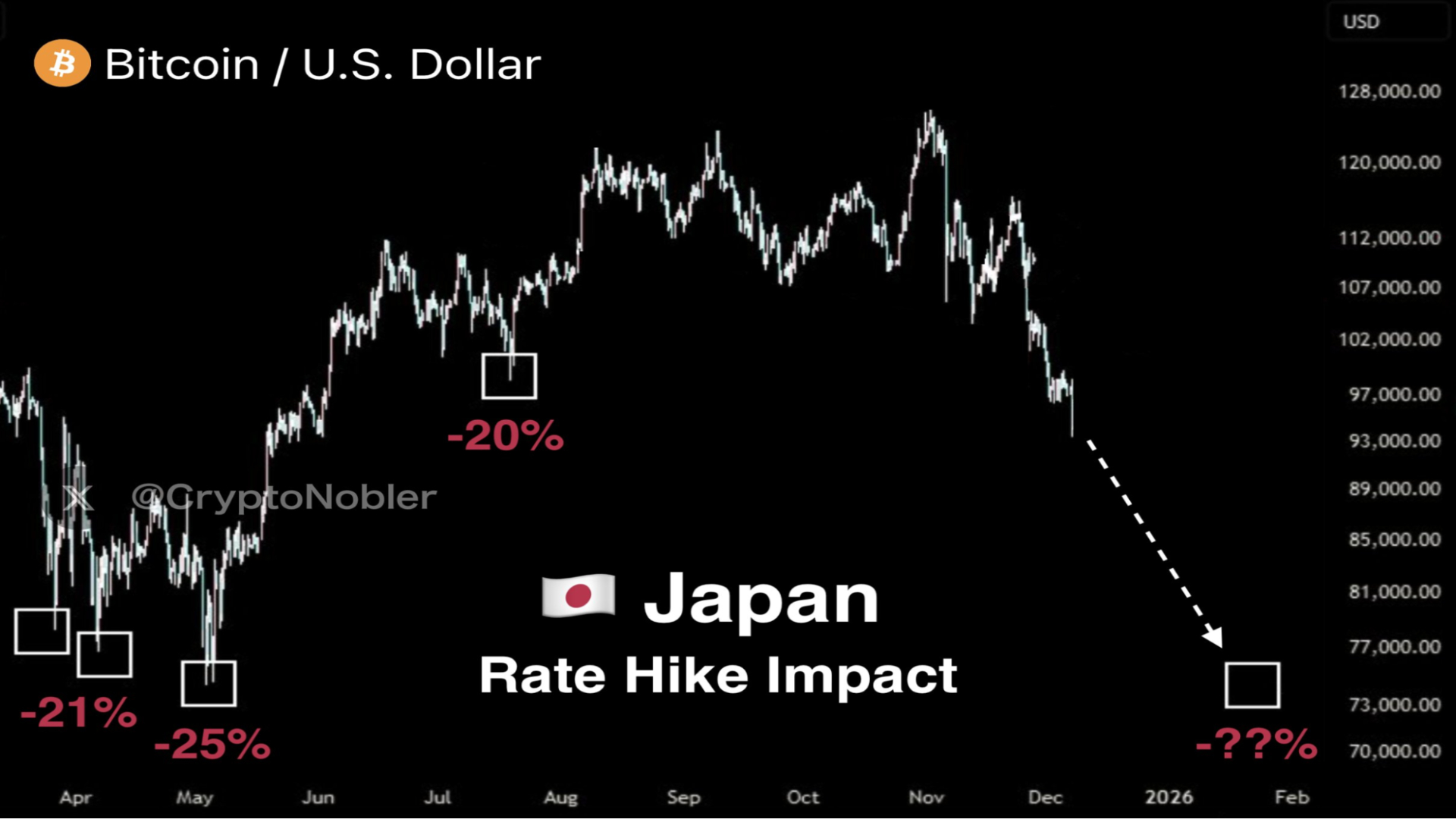

- Historical data shows that usually Bitcoin drops 20–25% after Japan rate hikes .

- A rise in Japanese rates weakens the yen carry trade and reduces liquidity as it puts pressure on leveraged Bitcoin positions across global markets.

- In the past, both Bitcoin and Ethereum have experienced steep declines triggered by reactive selling as traders unwind positions.

After losing 2.11% in just 24 hours Bitcoin tumbled to $90,171.44.Liquidity concerns are growing and traders are eyeing the Bank of Japan’s looming rate hike, which historically triggers sharp BTC sell-offs.

Intraday trading volume is at $67 billion and it has forced liquidations that are pressuring the market. The crypto giant recorded a bare 0.19% gain over the past week, signalling cautious investor sentiment.

How Past Bank of Japan Rate Hikes Shook Bitcoin

Bitcoin has always reacted sharply to Japanese rate hikes and often declines steeply shortly after the Bank of Japan (BoJ) tightens its monetary policy. Historical trends recorded drops between 20% and 25% respectively within a week in the last two such events.

In April 2023, Bitcoin dropped about 21% after a BoJ rate hike. May saw a 25% fall, followed by a 20% slump in midsummer. These moves show just how quickly Bitcoin reacts to changes in Japanese interest rates.

The mechanism behind these declines is closely tied to the Japanese yen and global liquidity flows. When the BoJ raises rates, typically the Yen strengthens. This puts much pressure on carry trades funded with low-yield yen. These are often used to finance investments in higher-yielding assets abroad, including some cryptocurrencies.

Global liquidity is temporarily reduced because traders have unloaded a notable amount of positions. This has ended up forcing leveraged risk assets like Bitcoin to undergo rapid sell-offs. Crypto analyst 0xNobler highlighted that Bitcoin is already showing pre-hike behavior reminiscent of past events.

Bitcoin Vs BoJ Rate Hike / Source: X

Bitcoin Vs BoJ Rate Hike / Source: X

Local highs have started rolling over, and momentum indicators are signalling a slow down. According to analysts if historical patterns repeat, BTC could face significant downward pressure that could push it below $70,000 by December 19, 2025.

Bitcoin and the Yen Carry Trade: Liquidity Under Pressure

The yen has for a very long time provided liquidity support for Bitcoin and other high-yield assets. Investors are borrowing low-yield Japanese yen to invest in assets that are offering higher returns abroad. This approach remains profitable but as long as Japanese rates stay low and the yen remains weak.

Nic Puckrin, co-founder of Coin Bureau, explained that rising Japanese rates could reduce carry trade opportunities. Fewer carry trades thrive in tighter liquidity, due to the resultant stress on risk assets, particularly Bitcoin.

BoJ Governor Kazuo Ueda recently hinted at a potential rate hike that could lead the two-year Japanese yields to surge to levels not seen since 2008. Traders have started unwinding leveraged positions, a move that has contributed to selling pressure on cryptocurrencies.

Short-Term Crypto Market Movements and Forced Selling

Bitcoin and Ethereum have shown rapid downside moves ahead of the expected rate hike. BTC has dropped sharply from $92,600 to around $89,500,which is reflecting massive forced liquidations instead of organic profit-taking. Ethereum followed a similar path, and fell from $3,255 to $3,120 in a quick succession of events.

Continued compression under resistance zones has been resolved violently. Each attempted bounce proved to be shallow and it signalled a retreat in risk appetite. These suggests that the crypto market is gradually adjusting to a world with a tighter liquidity. Additionally leveraged positions are being unwound in anticipation of BoJ rate hikes.

Furthermore, the historical link between Japanese monetary policy and sharp cryptocurrency corrections add more weight to the matter.