Key Insights:

- Sui’s Bitwise Spot ETF will introduce the asset to a set of institutional-focused investors.

- The trading volume surge placed Sui among the top networks due to increased broader participation and increasing activity across its expanding ecosystem.

- Market structure is stabilizing at multi-month demand zones where renewed liquidity and improving conditions have continued growth.

Sui has entered the Bitwise Spot ETF as its market activity intensifies despite recent price pressure. The token trades at $1.55 with a 24-hour volume of $1.09 billion. Sui recorded a 4.51% daily drop and a 6.69% weekly decline, yet ecosystem growth and rising network engagement continue to draw investor attention.

Sui Secures a Place in the Bitwise Spot ETF Holdings

According to an official report,Sui has joined the Bitwise 10 Crypto Index ETF. This step has placed the asset among established industry leaders. The ETF allocates 0.24% to Sui. This inclusion shows the network’s readiness is based on liquidity, custody standards, and long-term viability.

This development opens the door for Sui to reach a much wider investment audience. Many institutions and financial advisors prefer using regulated funds to access the crypto market, so its addition to the Bitwise ETF makes Sui more accessible to them.

The listing also brings Sui beyond the typical crypto-native crowd. It gives traditional investors a way to gain exposure without the challenges of handling private keys or managing custody on their own. That shift naturally broadens the network’s visibility and positions it more firmly on the radar of mainstream market participants.

The ETF also comes at a moment when its on-chain activity is rising and new solutions are emerging. This development and growth played a role in Bitwise’s decision to include Sui in its portfolio.

Trading Volume Expansion Strengthens Sui’s Market Position

Sui’s trading volume surged to about $780 million. This milestone puts Sui behind only Ethereum, Solana, and BNB Chain. This has seen it surpass several longer-running ecosystems in daily activity.

Participation and broader demand across its markets increased volume after weeks of expanding DeFi activity, deeper liquidity pools, and new protocol deployments.

Therefore Sui’s trading momentum stems from organic and not short-term speculation. Crossing the $500 million daily threshold is interpreted as a sign of rising institutional-grade participation.

In addition, higher volume also tends to create a reinforcing cycle. Because more liquidity encourages additional traders and tighter spreads that improve execution. This continuous increase in broader activity further attracts more capital. For Sui, this moment has positioned its network as a fast-advancing competitor within the Layer 1 landscape.

Market Structure Shows Sui Stabilizing at Key Levels

Analysis by crypto analyst Michaël van de Poppe observed that Sui coin delivered one of the strongest recoveries over the past week. The analysts noted that liquidity is returning to the asset ecosystem and this has prompted solid performances last quarter of the year.

Sui’s total value locked briefly moved above $1 billion before consolidating. This pause offered additional support for continued development. This is as current price stabilised inside a multi-month demand zone. Historically this point has served as a base for renewed rallies.

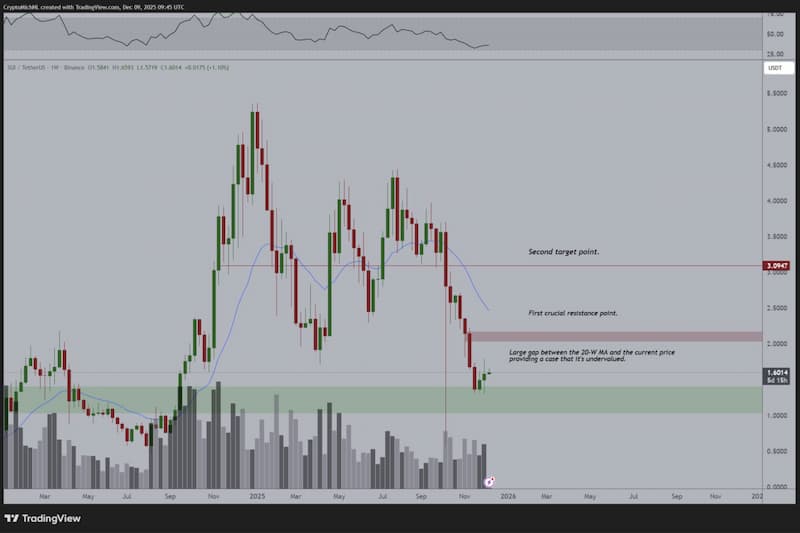

SUIUSDT Price Chart / Source: X

SUIUSDT Price Chart / Source: X

Buyers appear to be defending this region with consistent activity and this is giving the asset a foundation for further movement.A wide gap remains unfilled between the current price and the 20-week moving average.

Such a distance often signals oversold conditions and leaves room for upward movement if momentum builds. If bulls push higher key resistance between $2.00 and $2.20 will be the first level to watch.

Then if momentum for potential continuation holds, bulls could push price further toward the $3.09 zone, where previous supply emerged.This combination of ETF inclusion, liquidity expansion, and structural stability are shaping Sui’s evolving position as a growing Layer 1 contender.