Key Insights

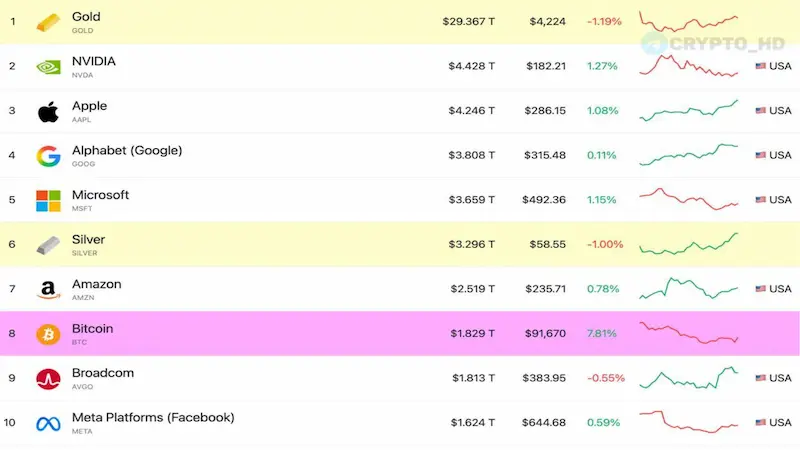

- Bitcoin is ranking among the global top eight assets, after reaching a $1.829 trillion market capitalization driven by growing institutional investor adoption.

- Bitcoin’s daily price gains of 7.81% led top-ten assets and sustained intraday momentum pushed Bitcoin above $91,670 as buyers market confidence rose.

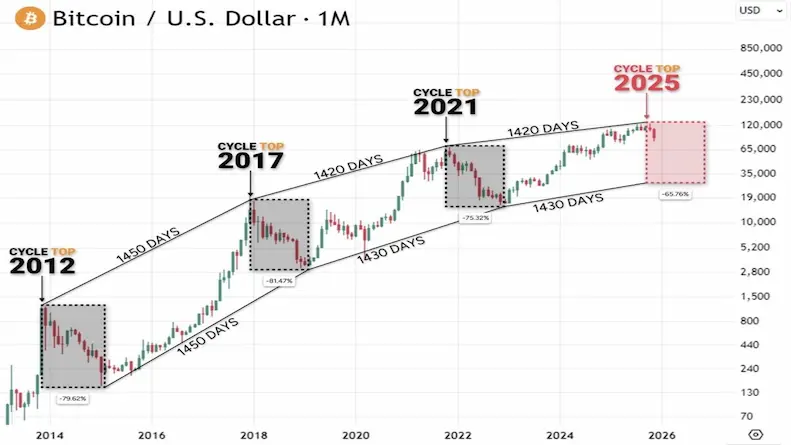

- Historical four-year cycles show a potential for a 2025 peak between $120K–$150K ,a typical price oscillation cyclical investor behavior.

Bitcoin has re-entered the global top eight assets by market capitalization. The assets total market cap is now valued at $1.829 trillion. This milestone reflects the growth from a niche digital experiment to a globally recognized financial asset.

In return, Bitcoin’s price surged to $91,253.21 recording a 7.85% rise in 24 hours and 4.88% over the past week. The continued buyers’ interest saw $80.4 billion exchange hands in the last 24 hours.

Bitcoin Surges Past $91K, Leading Daily Market Gains

Bitcoin’s market cap rise coincided with a strong trading session that saw it reach $91,670. Intraday charts posted a daily gain of 7.81%.This robust market performance placed it the leading among top-ten assets by largest percentage change.

Early trading sessions displayed consistent higher lows. However, late but sustained momentum indicated the presence of steady buying pressure among both retail and institutional investors.

Top Ten Global Assets By Market Cap / Source: X

Intraday trading data shows that, around midday, Bitcoin hovered near $87,000. This momentarily pause was due to short term traders profit taking.

However, late in the afternoon, it surged past $90,000, reaching $91,500. Trading volume remained slightly higher during the rise, a sign that buyers supported the move.

Pullbacks were minimal because of increased investor participation and an increase in market confidence. In turn this is helping Bitcoin continue its upward trend through the day.

Bitcoin Gains Momentum Over Traditional Assets

Separate analysis charts comparing Bitcoin and gold show different patterns. Gold rose steadily at first but later levelled off and pulled back. This pattern is suggesting less investor interest.

Bitcoin, on the other hand, bounced back strongly after an early dip. Bitcoin continued an upward shift in demand for digital assets over traditional stores of value.

The pattern of higher highs points to renewed optimism and how dynamic evolving investor preferences are. Its worldwide access makes it attractive during uncertain economic times. This in turn has resulted in high investor interest and speculation.

The coin stands alongside gold and silver in terms of recognition and market value.This put emphasis on it as a prominent asset in global finance and it is a notable milestone.

Past Cycles Suggest a 2025 Peak and Future Trends

Bitcoin has followed a consistent four-year cycle peaks in 2012, 2017 and 2021 that were followed by declines that lasted roughly 1,400–1,450 days.

What is drawing attention is that if history repeats, the current technical models suggest that the 2025 cycle peak may reach $120,000–$150,000.After the projected peak, the same historical patterns point to a potential correction toward $25,000.

Bitcoin’s Historical Trend / Source : X

This is a zone aligned with logarithmic support levels and long-term price channels. If this comes to be,Bitcoin’s cycle is suggesting there could be predictable oscillations. This surge is further strengthening Bitcoin’s bullish market pattern.

Bitcoin’s increasing adoption by institutions and its expanding role in global finance are strengthening its presence around the world.