Key Insights:

- Solana Price has held strong support reactions near key technical zones, where repeated tests ended in a consolidation that attracted steady buyer interest.

- Analysts have identified a developing multi-year structure extended accumulation phases pressing toward a major supply region that is shaping long-range expectations.

- Institutional flows show sizable ETF-driven SOL acquisitions, indicating structured demand and evolving market depth and trade behavior.

Solana traders assess shifting technical patterns, strengthening institutional inflows, and evolving macro structures that have shaped the latest movement in price and sentiment. Market conditions remain steady while participants wait for clearer confirmation signals.

Short-Term Technical Structure Near Support

Solana Price Analysis pointed to a well-defined support zone on the 1-hour chart. Price is hovering near $137 and is resting on a cluster formed by AVWAP, POC, and a tapped weekly level.

This zone has seen several retests during the week which has created a tight consolidation band where buyers have returned and stabilized prices. The shared projection outlined a possible liquidity sweep under recent lows, forming a W-shaped reaction.

This path showed price dipping briefly before reclaiming the $139–$140 region. This scenario suggests that short-term traders are preparing for a potential continuation move toward the $144.80 resistance.

Solana 1Hour Chart / Source: X

Solana 1Hour Chart / Source: X

That level represents a previous swing high and this makes it a reasonable upside target in the current structure. A long lower wick in the projected move illustrated the expectation of a brief stop-hunt before strength returned.

Market participants continued to watch the weekly open zone, which acted as a balance area. A reclaim above this level would add weight to the idea of a short-term recovery.

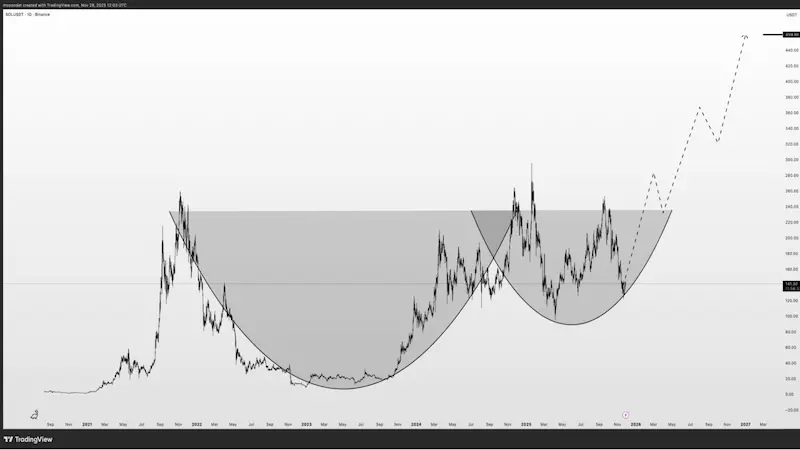

Macro Structure Shows Multi-Year Development

A multi-year pattern resembling a large cup-and-handle formation with two rounded bases has appeared across separate cycles. This is representing extended periods of accumulation after earlier peaks.

When price pressed into the lower boundary of an established supply region that historically served as resistance. The projection outlined a gradual climb through the $220–$240 band, which formed the core of that supply area.

Solana Multi Year Pattern / Source : X

Solana Multi Year Pattern / Source : X

Each move in the illustration showed measured expansions and controlled pullbacks, reflecting how long-term structures often evolve during recovery phases. The mid-range remains an important checkpoint for long-term traders tracking structural progress.

As surfaced in the projection the next target is in the $450–$460 zone. This level sits above prior macro highs and represents an area where potential price recovery could occur according to chart projections.

It served as a high-end marker rather than a near-term expectation, forming part of the long-range trajectory described in the chart.

Institutional Flows and Market-Cap Behavior

On-chain data recorded two large transfers—36.7K SOL from a Coinbase hot wallet and 56.4K SOL from Firelocks Custody—into Bitwise’s BSOL ETF. These inflows added about 93,000 SOL within an hour indicating that there was structured accumulation driven by ETF operations.

Such movements are typically planned buying rather than short-term speculation. ETF allocations tend to create consistent demand because the fund must secure SOL when new capital enters.

Solana’s circulating supply remains comparatively tight and these flows could influence market depth and short-term responsiveness. This is because the involvement of regulated custodians suggested operational readiness for larger institutional participation.

A separate chart tracking a seven-day market-cap trend showed an early climb from the low-$70B range, moving toward $80B on 27 November. After reaching its peak, the market cap eased gradually into the $76–$77B area. Therefore the retreat was a cooling phase and not a market shift.