Key Insights:

- Chainlink price holds a key demand zone as buyers return, giving LINK early stabilization after recent weakness.

- The Chainlink reserve nears one million LINK, reducing liquid supply and supporting a stronger market structure.

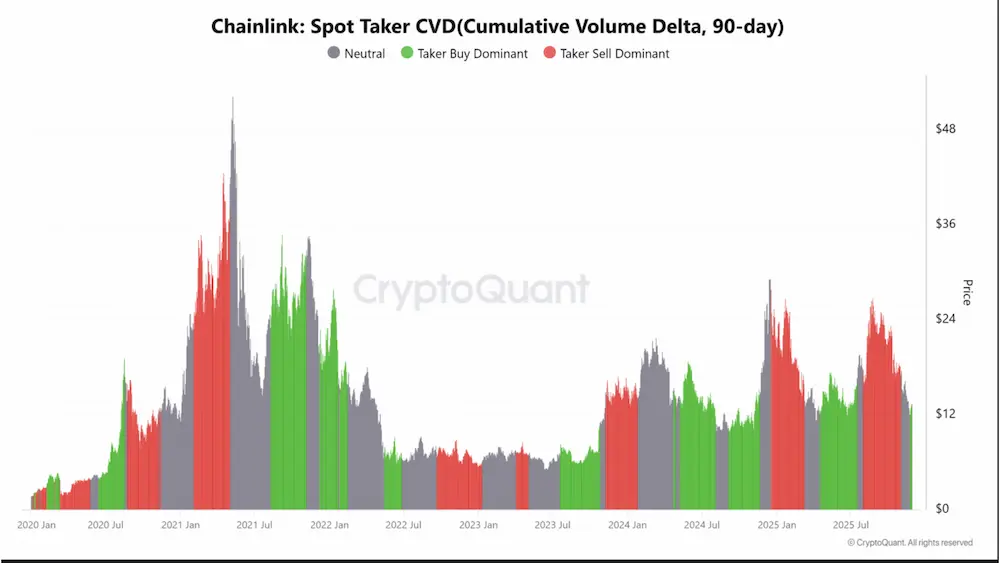

- Spot Taker CVD shows rising buyer activity, signaling growing demand as LINK approaches a critical resistance level.

Chainlink price shows signs of stabilization as the network’s reserve approaches one million LINK tokens. Buyers are defending key demand regions. The expanding reserve reduces the liquid supply and strengthens the market structure.

Chainlink Price Tests Major Demand Zone

Chainlink trades between $12.00-$13.20, a range that has resulted in good rallies in the first half of this year. Buyers actively defend this range as the price touches lower boundaries. Sellers failed to push deeper last week, and buyers returned quickly.

The regression trend continues to limit recovery, but shorter upper wicks suggest weakening sell pressure. The first resistance stands at $14.65. LINK price tested it twice and saw rejections. A breakout above $14.65 could open the path to $19.05. This aligns with weekly resistance shaping previous selloffs.

Official Chainlink tweets shared updates about reserve growth and price action. Investors are encouraged to follow these posts for real-time information.

Chainlink Reserve Expands and Reduces Liquid Supply

The Chainlink Reserve holds 973,752.70 LINK after adding 89,079.05 LINK. Weekly accumulation removes tokens from circulation and supports price stability. The reserve typically grows when enterprise activity strengthens.

<embed> https://x.com/chainlink/status/1994089163566539122?s=20 </embed>

Reduced liquid supply helps maintain buyer support inside demand regions. Historical data shows LINK reacts well when reserves absorb tokens near critical price zones. This structure reduces selling pressure and gives the market a steadier base.

Posts from Chainlink noted reserve increases and explained how inflows support price during weaker market periods. Investors can monitor the network’s reserve updates for insights on future trends.

Spot CVD Shows Strong Buyer Activity

Spot Taker CVD over 90 days shows clear buyer dominance. Market buys are outpacing sells, and the line trends upward. This confirms stronger buy-side activity near the demand region.

Source: CryptoQuant

Source: CryptoQuant

Earlier rallies followed similar patterns, where buyers stepped in as price returned to key zones. LINK price sits just below the regression boundary, preparing for a potential breakout. Buyers maintain control, and sellers struggle to create new lows.

In case the buyers clear $14.65 level, then the LINK price will shift to 19.05 and then finally $24.00. This bullish setup needs to be sustained in the demand zone.

Chainlink shared information about strong buy flows and confirmed market activity trends. Investors can track these posts for updates on price direction and reserve growth.